Free Stock Report

Best Silver Stocks ASX

Due to its growing use in the energy sector, there has been a renewed interest in silver. Most people likely know that gold prices are rising, but fewer realise that the price of silver has actually risen more. With this in mind, what are Australian silver stocks then and how does the price of silver translate to the ASX?

In short, silver trading is the practice of speculating on silver prices for profit by accurately predicting changes in their movements. Whereas traditional silver investing involves buying and holding silver bars or coins, trading gives investors market exposure without having physical ownership of the metal.

ASX silver stocks are companies or units of a fund that trade on the Australian Securities Exchange and are exposed to the price of silver. These can be shares in companies involved in silver mining and exploration, or units in an exchange-traded fund (ETF) that tracks the price of silver.

Backed by results

+26.49%

Our ASX return for FY25

vs. Market Return of 10.21%

+24.61%

Our US return for FY25

vs. Market Return of 13.33%

+13.35%

Our ASX return for FY24

vs. Market Return of 7.80%

Download your free silver stocks report now.

Why Invest In Silver Stocks -

Opportunities & Benefits

Due to its use in electronics, tableware and other industries, silver is the most frequently traded precious metal asset behind gold. Silver stock is also more affordable than gold, which drives demand from investors.

Some silver stocks on the ASX give investors a “pure play” on the price of silver. Pure play means business operations are focused exclusively on silver production (in some form) and their share prices are thus linked to the price of silver. Investing in shares of a pure play silver company is often regarded as akin to investing directly in the commodity itself.

Investing in silver stocks can help diversify and add some commodities to your portfolio without buying actual silver. This approach is useful for diversification because commodities often perform differently from the stock market. Precious metals like gold and silver usually hold their value during economic downturns, so adding silver shares to your portfolio might help save you from losses in a bear market.

Performance Matters.

At Sharewise, every stock report is built on the same principles that have driven our portfolios to outperform the market — data, discipline, and depth of research.

Over the past year, our analysts have delivered strong results across the Australian market:

+26.49%

Our ASX return for FY25

vs. Market Return of 10.21%

+24.61%

Our US return for FY25

vs. Market Return of 13.33%

+13.35%

Our ASX return for FY24

vs. Market Return of 7.80%

Past performance is not indicative of future performance.

How these stock reports can help you.

Markets move fast — and new opportunities emerge every day.

Our stock reports cut through the noise, helping you identify quality companies backed by strong fundamentals and credible management.

Each report is curated by the Sharewise analyst and research team, combining data, financial analysis, and clear investment theses — giving you the insights to make confident, well-informed decisions.

Inside the Silver Stock Report

Discover silver stocks operating at the intersection of safe-haven demand and industrial growth.

Each profile includes:

- Investment thesis — crafted by our analysts, outlining why we believe each company could outperform and the key factors driving our view

- Company overview — what they do, their projects, and production outlook

- Fundamentals — valuation metrics, financial health, and operating performance

- Financial statements — revenue, profit trends, and balance sheet strength

- Major shareholders — institutional, insider, and strategic holders to note

Investing in silver stocks and ETFs is a great way to get an introduction to silver’s price. Silver stocks include businesses involved in exploration, mining, and/or the production of silver.

However, deciding which silver stock to buy involves research. Factors such as the company's financial health, production capacity, cost efficiency, and market position should all be researched thoroughly before pulling the trigger. Some of the companies sitting atop the ASX silver stocks list include:

- South32 Ltd (ASX:S32) - Market cap: AU$ 15.86 billion

- Adriatic Metals (ASX:ADT) - Market cap: AU$1.36 billion

- Andean Silver (ASX:ASL) - Market cap: AU$ 158.34 million

- Polymetal International Plc (ASX:POL) - Market cap: AU$173.29 million

- Silver Mines (ASX:SVL) - Market cap: AU$143.26 million

- Sun Silver (ASX:SS1) - Market cap: AU$100.17 million

- Unico Silver (ASX:USL) - Market cap: AU$100.17 million

*This information is for general purposes only and does not constitute financial advice.

Silver Mining Stocks

Silver mining stocks are companies primarily focused on the exploration, mining, and production of silver. Silver Mines (ASX: SVL), Sun Silver (ASX:SS1), and Unico Silver (ASX:USL) are silver mining companies that are focused on silver mining in Australia.

Lead Silver Stocks

These companies primarily mine and produce lead. Silver often occurs as a byproduct, as silver is often found in lead ores. Polymetal International Plc (ASX:POL) is a mining company developing the high-grade Endeavor silver, lead, and zinc mine within the Cobar Basin of New South Wales. The Cobar Basin is one of Australia's leading polymetallic mineral provinces.

Diversified Silver Stocks

Diversified silver stocks are shares in mining companies that extract and produce various metals. These companies mine silver, as well as other metals like gold, copper, or other minerals.

South32 (ASX: S32) is a major mining and metals company with multifaceted operations. While South32 produces silver, it's primarily a diversified mining company with other metals like aluminium, manganese, and metallurgical coal involved in its portfolio.

What Our Clients Are Saying!

How to Pick the Best Silver Stocks ASX

From diversified companies to physically-backed commodity funds and pure plays, the ASX offers several options for investing in silver shares. Alternatively, investors can get broader exposure into the silver market and incur less risk by using an ETF. ETFs pool investments to track the performance of a specific index, sector, commodity, or asset, and are traded like a regular stock.

Silver trading strategies are based around taking advantage of volatility, economic uncertainty, and stable pricing periods. This includes strategies known as trend trading and range trading.

Trend trading silver involves buying or selling silver based on the direction of its long-term price movement. You’d need to start by determining which direction the market price is moving in.

Range trading silver aims to profit from the repeated movements where silver consistently fluctuates between known support and resistance levels.

Additionally, doing your due diligence and sticking to the basic trading principles will still go a long way. This means analysing market trends and thoroughly researching the company’s fundamentals beforehand.

Our Return vs. The Market

Our performance for the current financial year compared against the market benchmark.

Past performance is not indicative of future performance.

How Sharewise Helps You Choose the Best Silver Stocks.

Institutional Quality Research

Make informed decisions with confidence.

Dive into comprehensive stock-specific analysis, focused on all companies, from blue-chip to micro-cap. Our extensive research, led by Chief Investment Office Rabbi (Rabih) Ahmed, and support by our team of equity research analysts, ensure you have a deep understanding of the market landscape to invest with clarify and assurance.

Account & Portfolio Management

Your investments, our dedicated attention.

With a dedicated stockbroker, you can rest easy knowing your investments are under expert care. A Sharewise Managed Account allows your advisor to manage your portfolio on your behalf, ensuring strategic decision-making, timely buy and sell actions, and seamless trade execution. We conduct quarterly portfolio reviews and strategy sessions with you so you can enjoy a hands-off investment process.

Dedicated Investment Manager

Your partner in navigating the markets.

Our investment managers are licensed professionals with expert knowledge of the markets. They monitor stocks and market trends daily, managing risk while optimising your portfolio. Focused on maximising returns, they ensure your investments are actively managed and aligned with your objectives.

Timely Stock Recommendations

Never miss an opportunity.

Backed by in-depth research and a clear investment thesis, our buy and sell recommendations go beyond simple tips. Each recommendation is a strategic insight built on real company data, financial fundamentals, and advanced technical analysis. We focus on ensuring you understand exactly what you're investing in and why, delivering actionable trade opportunities with clear rationale.

Professional Risk Management

Stay focused, even in volatile markets.

We take emotions out of investing. Our investment managers use research, data and market signals to guide decisions. By staying disciplined and responsive to market changes, we help investors remain focused when markets move quickly.

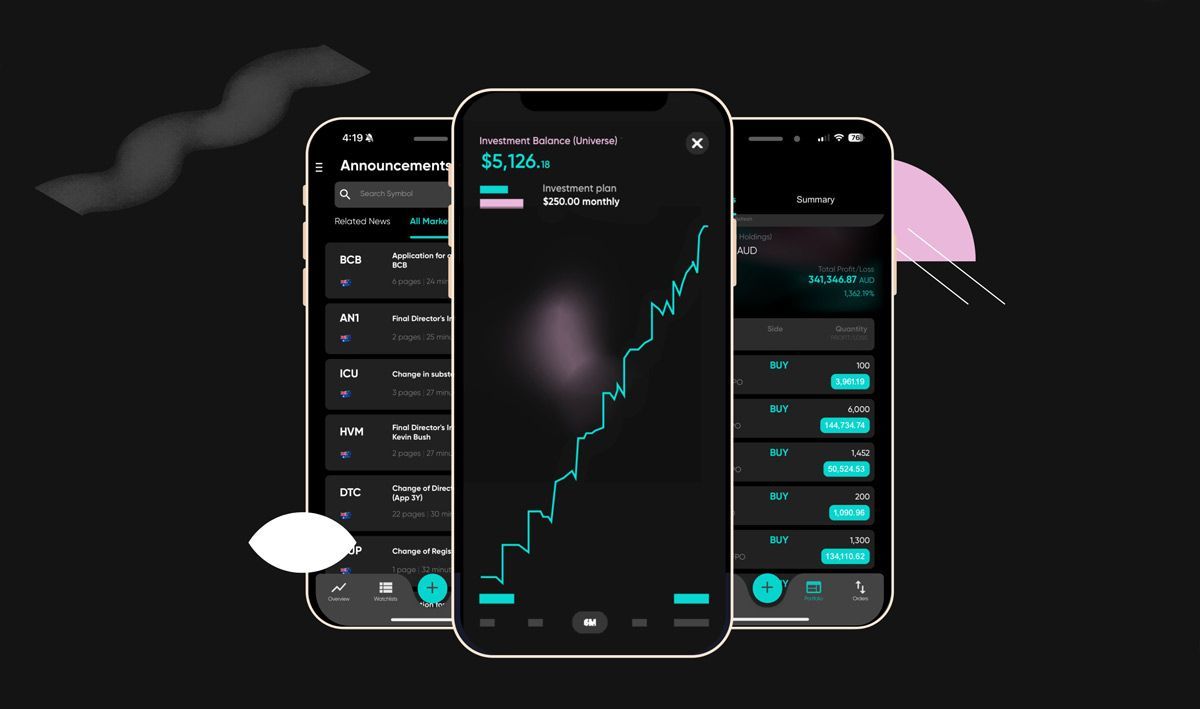

Access to Client Portal

Never miss an opportunity.

Our exclusive client portal gives you 24/7 access to our daily market research, in-depth stock analysis, and buy/sell recommendations. Whether you're at home or on the go, you can stay informed with up-to-date insights and make well-informed decisions. Our user-friendly platform ensures you’re always connected to the latest market trends, putting expert guidance at your fingertips.

Your Investment Journey to Wealth Creation.

Discover how Sharewise helps you build lasting wealth through expert advice, market intelligence, and proactive portfolio support - every step of the way.

Step 1: Start Your Journey with Confidence

Speak with one of our experienced investment managers to understand how we work and how we can support your investment objectives. Whether you’re new to investing or looking to take the next step, we’ll meet you where you are.

Step 2: Navigate the Markets with Clarity

Access our global market updates and institutional-grade research designed to help investors make more informed decisions across all conditions.

Step 3: Act on Research-Backed Ideas

Access timely buy and sell recommendations based on technical and fundamental analysis - helping you act with conviction when opportunities arise.

Step 4: Portfolio Oversight

Stay connected to your investments with ongoing oversight from your Sharewise investment manager. We help you monitor your portfolio, provide general advice based on market conditions, and keep you informed about opportunities that may impact your holdings.

Step 5: Build Resilience Through Risk Management

We support you in identifying and managing risk through research-led insights and regular updates - helping you stay focused, even when markets shift.

Step 6: A Journey of Long-Term Success

Your investment journey doesn’t end with one trade. We’re here for the long haul - providing continuous insights, opportunities, and support to help you stay on track over time.

Investment Tips for Australian Silver Stocks

Silver stocks will usually have a positive correlation with silver’s price. However, you should also watch the demand for other metal assets. A company’s growth and stock returns influence the share price and can even be influenced by news and earnings releases, production costs, and hedging.

You can take advantage of rising and falling silver prices by remembering:

- the more the market moves in your predicted direction, the greater your profit; however,

- the further it moves against you, the larger your losses.

Your success will almost always depend on your risk tolerance, research, and overall investment strategy. It’s no secret that patience usually leads to greater returns, reduced exposure to market volatility, and lower risk from premature decisions.

Joining a platform like Sharewise connects you with a community of trading experts and resources to use at your disposal. Regardless of your trading decisions, remember to regularly assess your portfolio and make periodic adjustments based on the latest market conditions and trends.

Your Success in the Market Starts Here.

At Sharewise, our approach to investing is built on clarity, precision, and strategy. By combining technical and fundamental analysis, we uncover opportunities and manage risk with a data-driven mindset. Our diversified approach ensures portfolios remain balanced, resilient, and adaptive to global market shifts.

Whether you’re navigating volatility or pursuing growth, our insights are designed to simplify complexity and empower informed decisions.

Data-Driven Decisions

Our investment philosophy combines technical and fundamentalanalysis to uncover opportunities and manage risk with precision. Every recommendation is backed by data, research, and professional expertise — ensuring each move is informed and strategic.

Superior Strategy

We take a diversified, multi-asset approach to investing, balancing risk and reward across global markets. This strategy is designed to enhance returns, manage volatility, and protect your portfolio through all market cycles.

Resilient and Adaptable

Markets evolve — and so do we. Our team proactively adjusts strategies in response to global economic and political shifts, positioning portfolios to capture growth during bullish phases and remain resilient during downturns.

Effortless Portfolio Oversight

Your dedicated advisor manages the day-to-day performance of your portfolio while you remain in control of all trading decisions through our non-discretionary structure. This balance of professional management and client approval provides transparency, accountability, and confidence.

Strategic Risk Management

We carefully balance position sizes, correlations, and volatility to safeguard your investments. Through ongoing, proactive risk assessment, we maintain portfolio resilience and stability across changing market conditions.

Curated Market Insights

Our in-house analysts deliver institutional-grade research and stock recommendations, giving you access to the same calibre of insight used by professional investors.

Hear From More Clients!

Frequently Asked Questions.

Are silver stocks a good investment?

While historical returns are no guarantee of future gains, silver’s characteristics do suggest that it can be a beneficial investment. For example, rising demand for silver in low-carbon energy is expected to enable mining companies to produce more silver and help drive the price of silver higher.

Investing in silver stocks can also be an excellent way to diversify your portfolio. Silver returns have historically shown little correlation with stock market returns so holding silver shares could potentially protect you in the event of a recession.

What are the best silver stocks ASX to buy in Australia?

Some ASX-listed silver producers and explorers to consider include:

- South32 Ltd (ASX:S32)

- Silver Mines Limited (ASX:SVL)

- Global X Physical Silver (ASX:ETPMAG)

- Adriatic Metals CDI (ASX:ADT)

Remember, you should always do thorough research yourself before investing. What we regard as the best silver stocks on the ASX may not be what’s best for your portfolio.

What is the outlook for the silver industry in Australia & globally?

The long-term outlook for the silver industry is generally favourable due to technological advancements and the growing renewable energy sectors. Global demand for silver is driven by industrial uses (electronics, solar panels, etc.) and investment demand.

Australia is a significant producer of silver, and the industry's future depends on factors like exploration success, production costs, and government policies. Australia has the third-largest silver reserves in the world, trailing only Peru and Poland.

How risky are silver stocks?

Silver stocks can be risky because of price volatility and economic conditions, among other factors. While they provide a dependable preservation of value over time, precious metals don't typically surge in price. So, silver stocks may not offer the same growth potential as companies in other sectors of the economy.

Depending on the type of investment, not all silver shares will give you full exposure to the price of silver. Companies have their own risks that will also play into the valuation that investors place on their shares.

What factors should I consider before investing in silver stocks?

Consider your risk tolerance, how long you plan to hold onto the investment, and current market conditions. Above all else, remember that the price of silver can be volatile, like all commodities and several factors can impact its value.

How can I start investing in silver stocks?

Start your journey with expert guidance. Our share advisory services provides buy and sell recommendations and exclusive insights to help you invest in silver stocks with confidence.

1. Consult with an expert

Connect with our experienced investment managers for tailored advice and actionable strategies that align with your financial goals.

2. Sign up to Share Advisory Services

Discover the silver stocks we're actively buying for clients. Our team will craft a risk-managed investment strategy to help you achieve your objectives.

3. Invest with confidence

Rely on our expertise to navigate the silver market securely. With professional insights and ongoing support, you can make well-informed decisions every step of the way.