Free Stock Report

Best ASX Lithium Stocks in 2026

Through its expert analysis, Sharewise arms you with the knowledge and strategies you need to safely invest in the ASX’s top lithium stocks for 2026. Below we will navigate you through the what, the why, and the how of investing in lithium, from hot market trends to its significance in the technology and renewable energy sectors, to the future of lithium in the market. Download our free lithium stocks ASX report and equip yourself with the ideal starting point to your portfolio creation.

Backed by results

+26.49%

Our ASX return for FY25

vs. Market Return of 10.21%

+24.61%

Our US return for FY25

vs. Market Return of 13.33%

+13.35%

Our ASX return for FY24

vs. Market Return of 7.80%

Download your free lithium stocks report now.

Why Should You Invest In Lithium Stocks?

It’s the billion-dollar question of 2026: are lithium stocks a good investment? After a challenging 12 months for lithium ASX stocks caused by a shifting balance between supply and demand (particularly in China), falling share prices have in turn led to speculation around a potential rebound or longer-term recovery for one of the world’s most valuable mineral commodities.

Amid a crisis, there is always opportunity, and there can be no doubt that lithium remains a key player in the technological and renewable energy revolutions that continue to move at warp speed.

But first, let’s go back a step. Lithium is a soft alkali metal that is an essential component of the rechargeable batteries in mobile phones, laptops, digital cameras and electric vehicles. It is also used in some non-rechargeable batteries for things like heart pacemakers and toys, while it combines with other metals to form alloys and compounds for use in the transport and pharmaceutical industries, and many others. Australia, alongside China, Chile and Argentina, is a leading supplier of lithium to the world.

Lithium and lithium-ion batteries have been in common use since the 1990s but their demand exploded with the rise of the renewable energy sector and the rapidly expanding technology sector. In recent years this has surged again with the proliferation of electric vehicles and energy storage solutions that rely on lithium and lithium-ion batteries.

But back to the share market, and the upshot to all of this is simple: lithium has risen to become one of the most important and high-potential stocks on the ASX.

Performance Matters.

At Sharewise, every stock report is built on the same principles that have driven our portfolios to outperform the market — data, discipline, and depth of research.

Over the past year, our analysts have delivered strong results across the Australian market:

+26.49%

Our ASX return for FY25

vs. Market Return of 10.21%

+24.61%

Our US return for FY25

vs. Market Return of 13.33%

+13.35%

Our ASX return for FY24

vs. Market Return of 7.80%

Past performance is not indicative of future performance.

How these stock reports can help you.

Markets move fast — and new opportunities emerge every day.

Our stock reports cut through the noise, helping you identify quality companies backed by strong fundamentals and credible management.

Each report is curated by the Sharewise analyst and research team, combining data, financial analysis, and clear investment theses — giving you the insights to make confident, well-informed decisions.

Inside the Lithium Stock Report

Get in-depth analysis on high-potential lithium stocks as accelerating demand outpaces global supply.

Each profile includes:

- Investment thesis — crafted by our analysts, outlining why we believe each company could outperform and the key factors driving our view

- Company overview — what they do, their projects, and production outlook

- Fundamentals — valuation metrics, financial health, and operating performance

- Financial statements — revenue, profit trends, and balance sheet strength

- Major shareholders — institutional, insider, and strategic holders to note

Investing in ASX lithium stocks with Sharewise is a straightforward exercise, but equally, it is one that needs careful consideration and an expert guiding hand. The importance of market research, the nous for identifying potential investments, and having an understanding of the need to diversify are just the tip of the iceberg when it comes to investing in Australian lithium stocks. Those entering the market would also be wise to stay informed on trends and regulatory changes, and consider adjusting their portfolio accordingly.

You can begin your investment journey in ASX lithium stocks with Sharewise, where our experts will help you navigate the financial landscape with confidence and established investment strategies.

What Our Clients Are Saying!

Best Lithium Stocks To Buy

While it has been a tumultuous time for lithium stocks in Australia, the flipside to a declining share price means it could well be a shrewd time to invest in lithium for strong potential returns. When considering what is the best lithium stock to buy in Australia, consider factors like project timelines, resource quality, management expertise, and market sentiment before making any investment decisions. Remember, Australian lithium stocks can be volatile, so proceed with caution and diversification.

Mineral Resources is made up of four segments (of which lithium is one) and boasts a market capitalisation of more than $12 billion. Its share price fell by around a third in 2023 but has regained strongly in the first half of 2024, with more potential to continue its upward trajectory as the lithium price recovers.

Arcadium meanwhile is one of the largest lithium miners in the world and its diversity of operations has some investment experts predicting a near 50 per cent bounce back in its share price across the coming 12 months.

Sharewise always suggests investors perform their own due diligence ahead of making potential stock purchases, and don’t forget, you can sharpen your expertise by downloading our free lithium report, which is stacked with valuable market analysis and key insights on the lithium industry.

Our Return vs. The Market

Our performance for the current financial year compared against the market benchmark.

Past performance is not indicative of future performance.

How Sharewise Helps You Choose the Best Lithium Stocks.

Institutional Quality Research

Make informed decisions with confidence.

Dive into comprehensive stock-specific analysis, focused on all companies, from blue-chip to micro-cap. Our extensive research, led by Chief Investment Office Rabbi (Rabih) Ahmed, and support by our team of equity research analysts, ensure you have a deep understanding of the market landscape to invest with clarify and assurance.

Account & Portfolio Management

Your investments, our dedicated attention.

With a dedicated stockbroker, you can rest easy knowing your investments are under expert care. A Sharewise Managed Account allows your advisor to manage your portfolio on your behalf, ensuring strategic decision-making, timely buy and sell actions, and seamless trade execution. We conduct quarterly portfolio reviews and strategy sessions with you so you can enjoy a hands-off investment process.

Dedicated Investment Manager

Your partner in navigating the markets.

Our investment managers are licensed professionals with expert knowledge of the markets. They monitor stocks and market trends daily, managing risk while optimising your portfolio. Focused on maximising returns, they ensure your investments are actively managed and aligned with your objectives.

Timely Stock Recommendations

Never miss an opportunity.

Backed by in-depth research and a clear investment thesis, our buy and sell recommendations go beyond simple tips. Each recommendation is a strategic insight built on real company data, financial fundamentals, and advanced technical analysis. We focus on ensuring you understand exactly what you're investing in and why, delivering actionable trade opportunities with clear rationale.

Professional Risk Management

Stay focused, even in volatile markets.

We take emotions out of investing. Our investment managers use research, data and market signals to guide decisions. By staying disciplined and responsive to market changes, we help investors remain focused when markets move quickly.

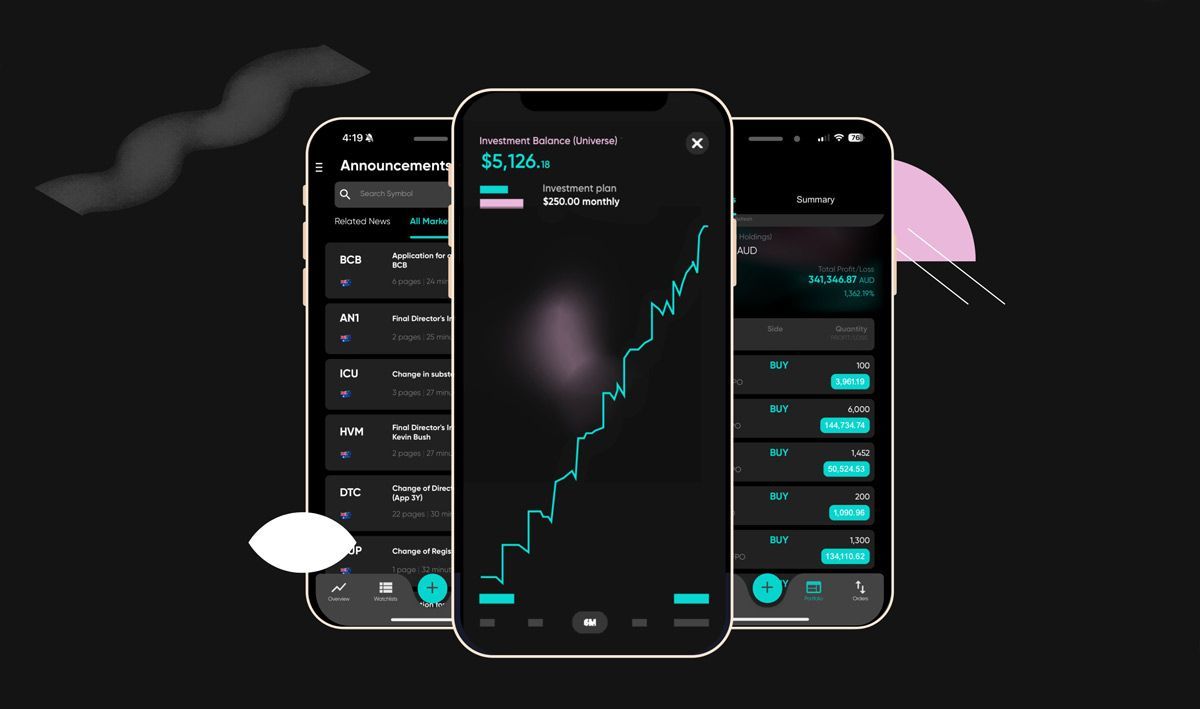

Access to Client Portal

Never miss an opportunity.

Our exclusive client portal gives you 24/7 access to our daily market research, in-depth stock analysis, and buy/sell recommendations. Whether you're at home or on the go, you can stay informed with up-to-date insights and make well-informed decisions. Our user-friendly platform ensures you’re always connected to the latest market trends, putting expert guidance at your fingertips.

Your Investment Journey to Wealth Creation.

Discover how Sharewise helps you build lasting wealth through expert advice, market intelligence, and proactive portfolio support - every step of the way.

Step 1: Start Your Journey with Confidence

Speak with one of our experienced investment managers to understand how we work and how we can support your investment objectives. Whether you’re new to investing or looking to take the next step, we’ll meet you where you are.

Step 2: Navigate the Markets with Clarity

Access our global market updates and institutional-grade research designed to help investors make more informed decisions across all conditions.

Step 3: Act on Research-Backed Ideas

Access timely buy and sell recommendations based on technical and fundamental analysis - helping you act with conviction when opportunities arise.

Step 4: Portfolio Oversight

Stay connected to your investments with ongoing oversight from your Sharewise investment manager. We help you monitor your portfolio, provide general advice based on market conditions, and keep you informed about opportunities that may impact your holdings.

Step 5: Build Resilience Through Risk Management

We support you in identifying and managing risk through research-led insights and regular updates - helping you stay focused, even when markets shift.

Step 6: A Journey of Long-Term Success

Your investment journey doesn’t end with one trade. We’re here for the long haul - providing continuous insights, opportunities, and support to help you stay on track over time.

Your Success in the Market Starts Here.

At Sharewise, our approach to investing is built on clarity, precision, and strategy. By combining technical and fundamental analysis, we uncover opportunities and manage risk with a data-driven mindset. Our diversified approach ensures portfolios remain balanced, resilient, and adaptive to global market shifts.

Whether you’re navigating volatility or pursuing growth, our insights are designed to simplify complexity and empower informed decisions.

Data-Driven Decisions

Our investment philosophy combines technical and fundamentalanalysis to uncover opportunities and manage risk with precision. Every recommendation is backed by data, research, and professional expertise — ensuring each move is informed and strategic.

Superior Strategy

We take a diversified, multi-asset approach to investing, balancing risk and reward across global markets. This strategy is designed to enhance returns, manage volatility, and protect your portfolio through all market cycles.

Resilient and Adaptable

Markets evolve — and so do we. Our team proactively adjusts strategies in response to global economic and political shifts, positioning portfolios to capture growth during bullish phases and remain resilient during downturns.

Effortless Portfolio Oversight

Your dedicated advisor manages the day-to-day performance of your portfolio while you remain in control of all trading decisions through our non-discretionary structure. This balance of professional management and client approval provides transparency, accountability, and confidence.

Strategic Risk Management

We carefully balance position sizes, correlations, and volatility to safeguard your investments. Through ongoing, proactive risk assessment, we maintain portfolio resilience and stability across changing market conditions.

Curated Market Insights

Our in-house analysts deliver institutional-grade research and stock recommendations, giving you access to the same calibre of insight used by professional investors.

Hear From More Clients!

Frequently Asked Questions.

Are lithium stocks a good investment?

Lithium stock has dropped significantly on the ASX in the past 12 months due largely to an increasing supply of the metal from China. It means ASX lithium stocks now sit in a more attractive price range for potential purchase, while the technology and renewable energy booms of recent times are at an interesting point given the sluggishness of the Chinese economy. Right now, most forecasts are positioning lithium stocks as a potentially sound long-term investment as opposed to trumpeting any expectations of overnight profitability.

What is the best lithium stock to buy in Australia?

There are multiple factors to take into account when considering investing in ASX lithium stocks, and it pays to do your own due diligence while also learning from Sharewise’s experts along the way. When it comes to lithium companies, consider factors like project timelines, resource quality, management expertise, and market sentiment before making any investment decisions. The lithium space is volatile, so proceed with caution and diversification. Sharewise is currently eyeing Mineral Resources Ltd (ASX:MIN) and Arcadium Limited PLC (ASX: LTM) but remember, rapid fluctuations can happen so ensure you are monitoring the market and the latest ASX lithium stock news before you finalise your decisions.

What factors influence lithium stock prices?

The behemoth that is China remains influential in dictating the direction of lithium stock prices. A symptom of the sluggish Chinese economy overall has been a slowing of electric car sales, which has tilted the supply versus demand balance of lithium unfavourably for investors. And while inflation rates and currency fluctuations also influence lithium prices considerably, it is that oversupply, driven also by a significant increase in global production of lithium, that has been most decisive.

What are the risks associated with investing in lithium stocks?

There are two key risks associated with investing in lithium stocks on the ASX. The first is directly related to what we have seen playing out in the market across the past 12 months; an ongoing imbalance between supply and demand would likely continue to drive prices downward. The second is a technological factor: just as lithium-ion batteries were once the hot new renewable energy alternative, so could a more desirable alternative emerge as we continue exploring reliable and cost-efficient clean energy solutions.

How can I start investing in lithium stocks?

Invest in lithium stocks with Sharewise, where our stated mission is to help our clients achieve their financial goals by providing safe and reliable share advice through expert market analysis and established investment strategies. Open your free trading account and begin building your portfolio.

What are some leading companies in the lithium industry?

Let’s begin in our own backyard. Pilbara Minerals (ASX: PLS) operates its 100 per cent owned Pilgangoora lithium-tantalum asset in Western Australia, and in 2021 the company purchased Altura Lithium. Last year Pilbara announced commissioning activities at its lithium hydroxide processing plant in South Korea, which is a joint venture with one of its many partners, POSCO. With more expansion projects underway, Pilbara is a giant of the lithium industry that is only growing.

American behemoth Albemarle is the world’s top lithium producer, with one of its two business units exclusively focused on the lithium-ion battery and energy transition markets. Albemarle has a diverse portfolio of lithium mines and facilities in Australia, Chile and the United States. The company’s interests in Australia come through joint ventures with Mineral Resources (ASX: MIN) and IGO (ASX: IGO), the latter also involving Chinese giant Tianqi Lithium.

Other global leaders in the lithium industry include Chile-headquartered SQM, Chinese-operated Ganfeng Lithium and the aforementioned Arcadium Lithium (ASX: LTM).