Free Stock Report

Cannabis Stocks ASX

In 2016, Australia’s parliament amended the Narcotic Drugs Act 1967 to allow for the cultivation of cannabis for medicinal and research purposes. As an increasing number of countries, including Australia, have legalised marijuana (cannabis) for medicinal use, there has been growing interest in stocks associated with the cultivation, production, and distribution of medicinal cannabis-related products. The extent of the benefits of marijuana (cannabis) in medical applications is still being explored. However, as the use of these products in the medicinal field grows, so too do the investment opportunities for cannabis stocks on the ASX.

In recent years, interest in cannabis stocks has surged as more countries loosen restrictions on cannabis use and production. In Australia, the legal medicinal cannabis market continues to expand, with companies looking to capitalise on growing demand. As public perception shifts and legalisation gains traction, many investors are exploring cannabis stocks for potential long-term growth. The sector's rapid evolution and increasing acceptance have positioned it as an exciting opportunity for those seeking exposure to emerging industries. However, like any market in the share industry, investors must stay informed about which shares are available and the context in which they operate.

Backed by results

+26.49%

Our ASX return for FY25

vs. Market Return of 10.21%

+24.61%

Our US return for FY25

vs. Market Return of 13.33%

+13.35%

Our ASX return for FY24

vs. Market Return of 7.80%

Download your free cannabis stocks report now.

Why Invest In ASX Cannabis Stocks - Opportunities & Benefits

Cannabis cultivation and distribution for medical and research purposes has been legal in Australia since 2016. Recreational use is far more legally restricted in Australia. The landscape for legalisation of the recreational use of cannabis may change over time, with the Greens indicating interest in legalising recreational use on a federal level. However, for now, only the Australian Capital Territory allows for legal recreational use and possession of cannabis.

Significant regulations surround the growth, production, and manufacture of cannabis in Australia. A licence is required for these activities, and an individual must show, amongst other things, that they are a fit and proper person and provide site and security details. There is no limit to the number of licences that can be issued, but not all applications are granted. A decision on a licence takes approximately nine months.

Once a licence has been granted, a permit is required for manufacturing cannabis products, and a separate permit is required for cultivating and producing cannabis. All permit holders must report quarterly to the Office of Drug Control. Despite the regulations surrounding this industry, it has grown by over 100% in the last five years to reach an estimated $350.0m in 2024. This is expected to grow over the next nine years, with a CAGR of 30% between now and 2033.

So, while this market is regulated, and there are several hurdles Australian cannabis companies must overcome on a regulatory basis before a cannabis stock can be listed on the ASX, significant growth is expected in the coming years. The acceptance of cannabis for medical uses, as well as an increasing number of applications for cannabis in medicine, will drive this growth. There is also likely to be significant growth if recreational cannabis use becomes legalised.

Performance Matters.

At Sharewise, every stock report is built on the same principles that have driven our portfolios to outperform the market — data, discipline, and depth of research.

Over the past year, our analysts have delivered strong results across the Australian market:

+26.49%

Our ASX return for FY25

vs. Market Return of 10.21%

+24.61%

Our US return for FY25

vs. Market Return of 13.33%

+13.35%

Our ASX return for FY24

vs. Market Return of 7.80%

Past performance is not indicative of future performance.

How these stock reports can help you.

Markets move fast — and new opportunities emerge every day.

Our stock reports cut through the noise, helping you identify quality companies backed by strong fundamentals and credible management.

Each report is curated by the Sharewise analyst and research team, combining data, financial analysis, and clear investment theses — giving you the insights to make confident, well-informed decisions.

Inside the Cannabis Stock Report

Explore cannabis stocks at the intersection of healthcare, consumer demand, and regulatory change.

Each profile includes:

- Investment thesis — crafted by our analysts, outlining why we believe each company could outperform and the key factors driving our view

- Company overview — what they do, their projects, and production outlook

- Fundamentals — valuation metrics, financial health, and operating performance

- Financial statements — revenue, profit trends, and balance sheet strength

- Major shareholders — institutional, insider, and strategic holders to note

There are a range of Australian cannabis stocks on the ASX. Some of these stocks include:

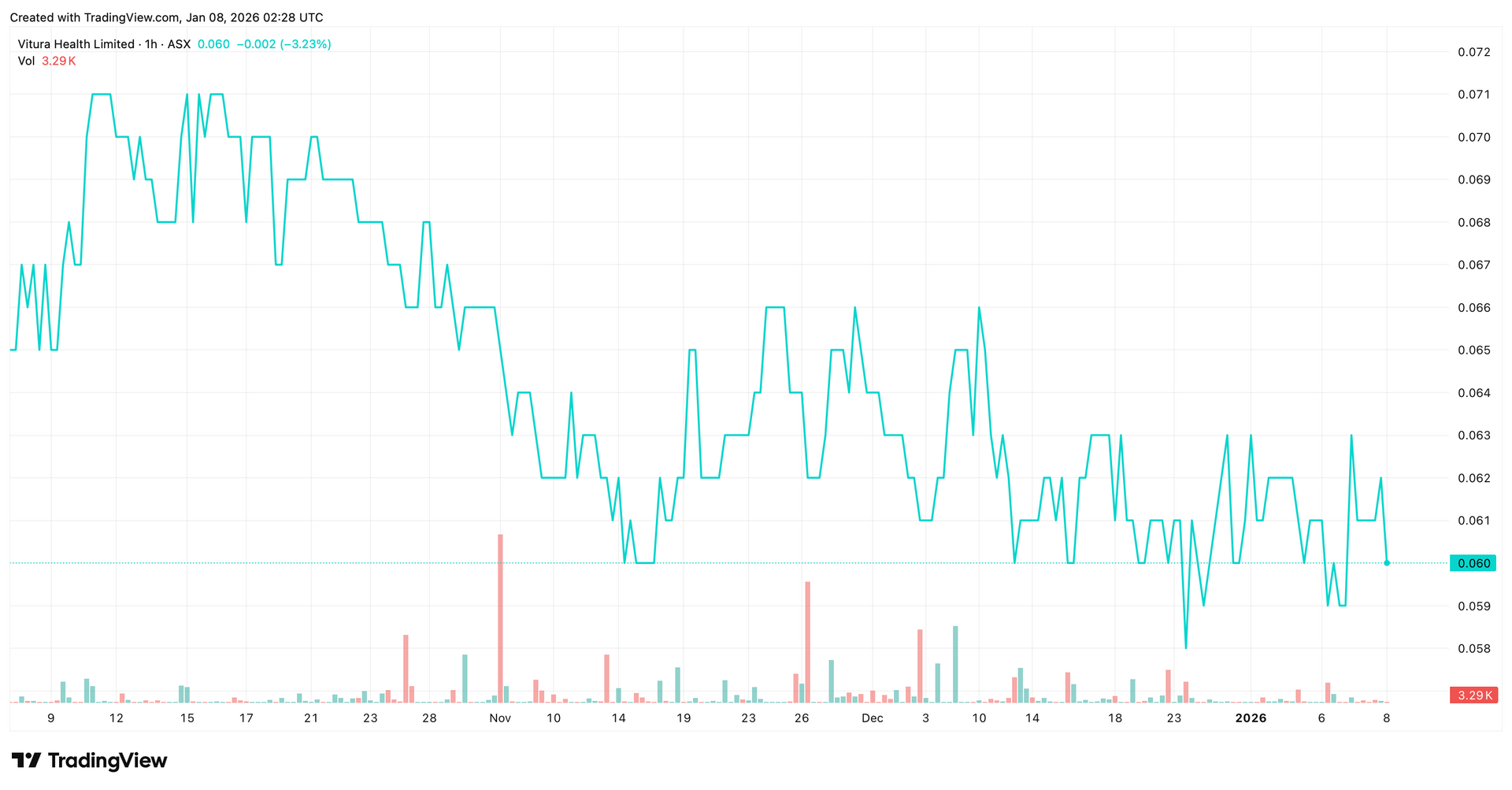

- Vitura Health Limited (ASX:VIT)

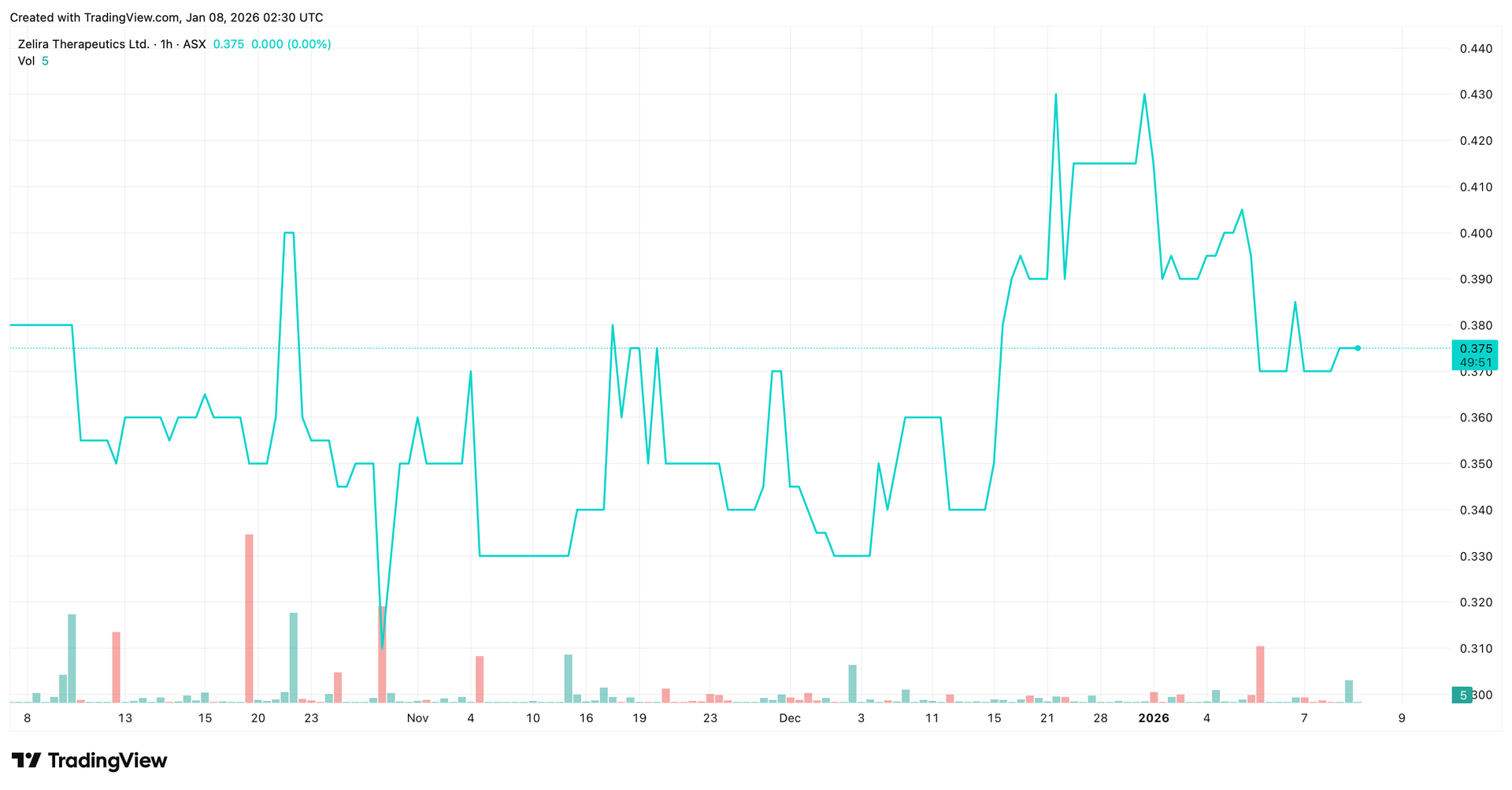

- Zelira Therapeutics (ASX:ZLD)

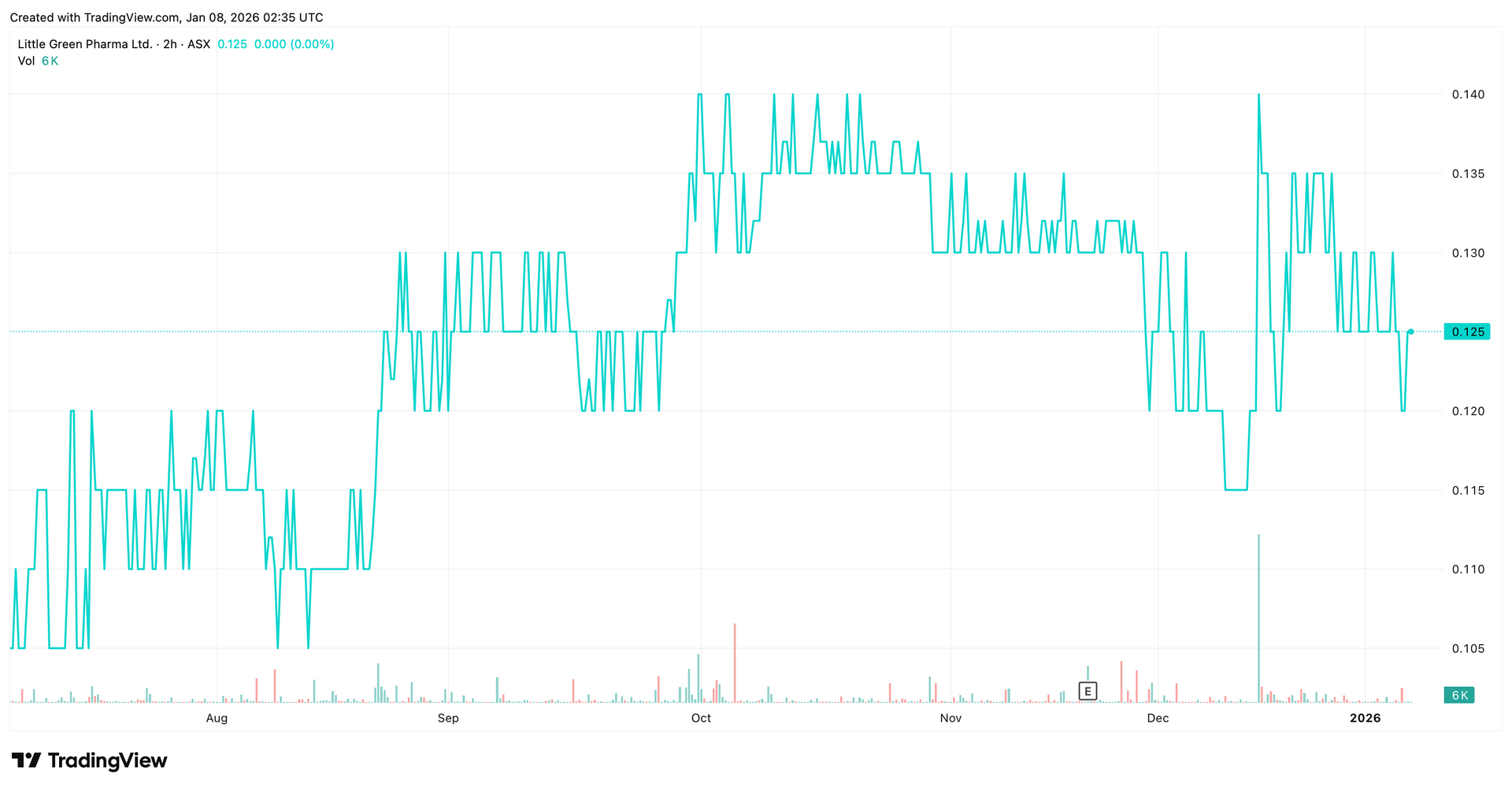

- Little Green Pharma (ASX:LGP)

- Cann Group (ASX: CAN)

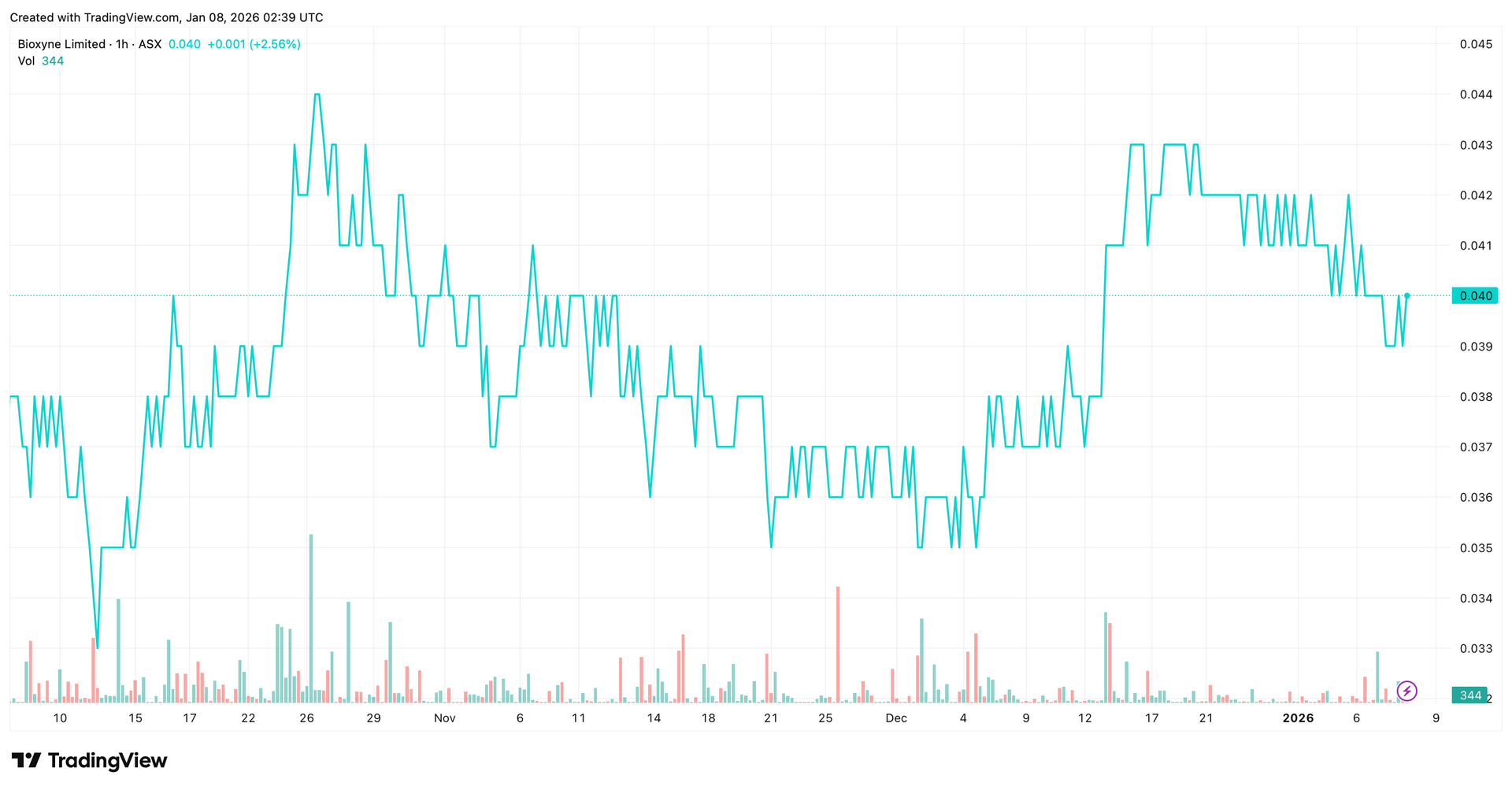

- Bioxyne (ASX:BXN)

- Neurotech International (ASX:NTI)

Virtua Health Limited (ASX:VIT)

Virtua Health Limited, formerly Cronos Australia, manufactures medical marijuana products. It has also developed a comprehensive national distribution network for the sale and distribution of medicinal cannabis and other products, which forms a digital health platform.

Zelira Therapetics (ASX:ZLD)

Zelira Therapeutics Limited is a global biopharmaceutical company focused on researching, developing, and commercialising clinically validated cannabinoid-based medicines. It targets fast-growing medical cannabis markets and has several treatments in the pipeline for rollout in several countries.

Little Green Pharma (ASX:LGP)

Little Green Pharma is a global medicinal cannabis company focused on the cultivation, production and distribution of pharmaceutical-grade products. The company operates under Australian and international licenses, supplying regulated medical markets across Australia, Europe and the UK.

Watch our webinar with their Executive Director Fleta Solomon.

Cann Group (ASX:CAN)

Cann Group breeds, cultivates, and produces cannabis products. It is an agricultural technology company that has built a state-of-the-art, end-to-end breeding, cultivating and production facility in Mildura. Cann Group also owns a patent-protected capsule technology through Satipharm. Watch our webinar with Cann Group CEO Peter Crock.

Bioxyne (ASX:BXN)

Bioxyne Ltd is an Australian life science and health products company. It develops, manufactures, and distributes consumer dietary supplements, including cannabis products. Bioxyne is listed as a stock to watch as it recently produced the first Australian cannabis gummies.

Neurotech International (ASX: NTI)

Neutotech International is a clinical-stage biopharmaceutical development company focusing on developing treatments for neurological disorders in children. Neurotech has developed a novel compound, NTI164, for the treatment of Autism Spectrum Disorder in children.

What Our Clients Are Saying!

Understanding The Risks & Considerations Of ASX Cannabis Stocks

Several financial metrics should be used as the basis for considering investing in an ASX cannabis stock. These include company fundamentals, market trends, regulatory status and potential changes, and developments in research on the effectiveness and applications of medical cannabis.

Company fundamentals that should be considered include revenue, debt-to-equity ratio, profitability, and cash flow. These fundamentals can change over time, so it is important to research them regularly if you are considering buying into, holding, or selling cannabis stocks.

The information presented on this site is valid when writing; as with any stocks, the position of cannabis stocks can change. This is especially the case in a highly regulated market. If recreational cannabis use were legalised in Australia, this would likely have a positive effect on cannabis stocks, as would evidence of wider medical applications of cannabis. If there were to be a tightening of regulations for cannabis cultivation, production and distribution, or negative evidence were produced on the the effectiveness of cannabis in medical applications, this would negatively affect the price.

Therefore, it is important to stay informed and conduct thorough research on cannabis stocks before deciding to buy or hold them.

Our Return vs. The Market

Our performance for the current financial year compared against the market benchmark.

Past performance is not indicative of future performance.

How Sharewise Helps You Choose the Best Cannabis Stocks.

Institutional Quality Research

Make informed decisions with confidence.

Dive into comprehensive stock-specific analysis, focused on all companies, from blue-chip to micro-cap. Our extensive research, led by Chief Investment Office Rabbi (Rabih) Ahmed, and support by our team of equity research analysts, ensure you have a deep understanding of the market landscape to invest with clarify and assurance.

Account & Portfolio Management

Your investments, our dedicated attention.

With a dedicated stockbroker, you can rest easy knowing your investments are under expert care. A Sharewise Managed Account allows your advisor to manage your portfolio on your behalf, ensuring strategic decision-making, timely buy and sell actions, and seamless trade execution. We conduct quarterly portfolio reviews and strategy sessions with you so you can enjoy a hands-off investment process.

Dedicated Investment Manager

Your partner in navigating the markets.

Our investment managers are licensed professionals with expert knowledge of the markets. They monitor stocks and market trends daily, managing risk while optimising your portfolio. Focused on maximising returns, they ensure your investments are actively managed and aligned with your objectives.

Timely Stock Recommendations

Never miss an opportunity.

Backed by in-depth research and a clear investment thesis, our buy and sell recommendations go beyond simple tips. Each recommendation is a strategic insight built on real company data, financial fundamentals, and advanced technical analysis. We focus on ensuring you understand exactly what you're investing in and why, delivering actionable trade opportunities with clear rationale.

Professional Risk Management

Stay focused, even in volatile markets.

We take emotions out of investing. Our investment managers use research, data and market signals to guide decisions. By staying disciplined and responsive to market changes, we help investors remain focused when markets move quickly.

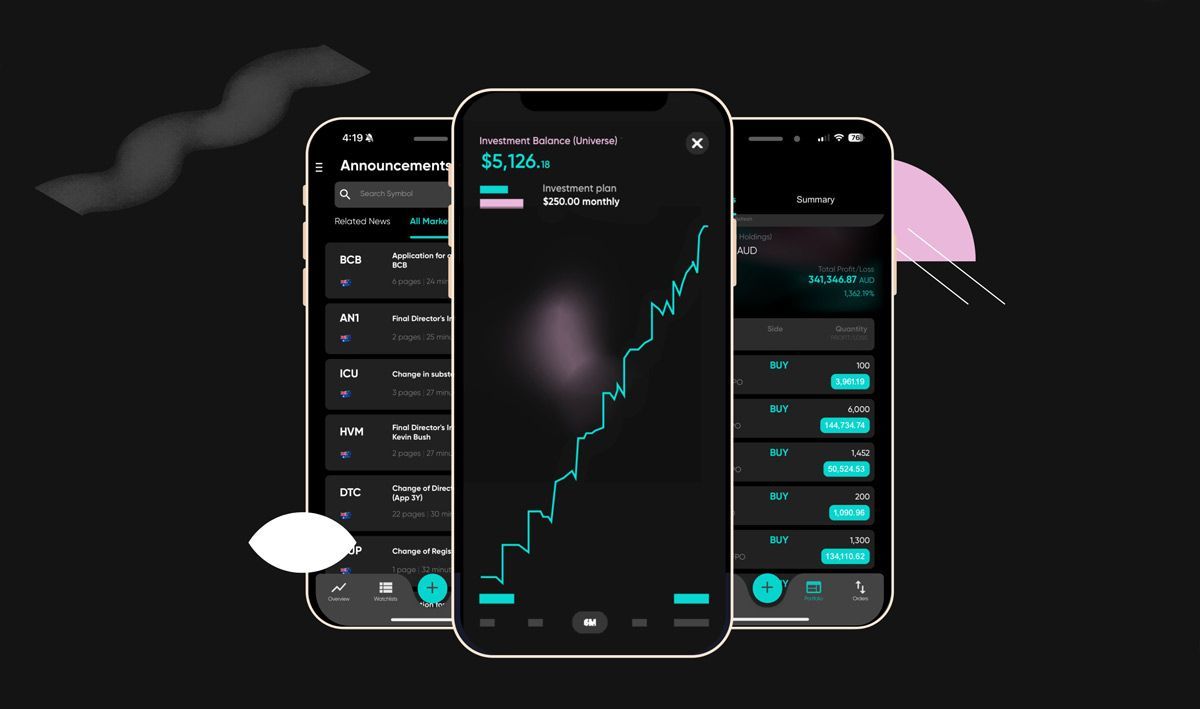

Access to Client Portal

Never miss an opportunity.

Our exclusive client portal gives you 24/7 access to our daily market research, in-depth stock analysis, and buy/sell recommendations. Whether you're at home or on the go, you can stay informed with up-to-date insights and make well-informed decisions. Our user-friendly platform ensures you’re always connected to the latest market trends, putting expert guidance at your fingertips.

Your Investment Journey to Wealth Creation.

Discover how Sharewise helps you build lasting wealth through expert advice, market intelligence, and proactive portfolio support - every step of the way.

Step 1: Start Your Journey with Confidence

Speak with one of our experienced investment managers to understand how we work and how we can support your investment objectives. Whether you’re new to investing or looking to take the next step, we’ll meet you where you are.

Step 2: Navigate the Markets with Clarity

Access our global market updates and institutional-grade research designed to help investors make more informed decisions across all conditions.

Step 3: Act on Research-Backed Ideas

Access timely buy and sell recommendations based on technical and fundamental analysis - helping you act with conviction when opportunities arise.

Step 4: Portfolio Oversight

Stay connected to your investments with ongoing oversight from your Sharewise investment manager. We help you monitor your portfolio, provide general advice based on market conditions, and keep you informed about opportunities that may impact your holdings.

Step 5: Build Resilience Through Risk Management

We support you in identifying and managing risk through research-led insights and regular updates - helping you stay focused, even when markets shift.

Step 6: A Journey of Long-Term Success

Your investment journey doesn’t end with one trade. We’re here for the long haul - providing continuous insights, opportunities, and support to help you stay on track over time.

Investment Tips For Cannabis Stocks

Diversifying your investments across different sectors and asset types can minimise risk and enhance potential returns. Cannabis stocks, a relatively new and growing type of stock, can add another measure of diversity to your stock portfolio. As with any stock, it is important to consider which cannabis stocks make the best addition to your portfolio and how they fit into the distribution of stocks across your portfolio.

Investors should regularly review their portfolios in the context of the changing market conditions and individual market goals. As things change, buying or selling stocks to keep your portfolio balanced and shaped to meet your financial goals may be best.

However, your portfolio evaluation must use a long-term investment approach. Some market volatility can impact your overall portfolio more significantly if you are overly reactive to that volatility. Being patient and waiting for the long-term outcomes of stocks to be realised is important when you are confident in a stock's company fundamentals and long-term prospects.

At Sharewise, we understand the doing all the research and keeping on top of all the information on the stock market is a challenge. We take this work out of it by doing this research for you. This enables us to guide you on how to minimise your investment risk and maximise your returns. You can join Sharewise by contacting us through our website.

Your Success in the Market Starts Here.

At Sharewise, our approach to investing is built on clarity, precision, and strategy. By combining technical and fundamental analysis, we uncover opportunities and manage risk with a data-driven mindset. Our diversified approach ensures portfolios remain balanced, resilient, and adaptive to global market shifts.

Whether you’re navigating volatility or pursuing growth, our insights are designed to simplify complexity and empower informed decisions.

Data-Driven Decisions

Our investment philosophy combines technical and fundamentalanalysis to uncover opportunities and manage risk with precision. Every recommendation is backed by data, research, and professional expertise — ensuring each move is informed and strategic.

Superior Strategy

We take a diversified, multi-asset approach to investing, balancing risk and reward across global markets. This strategy is designed to enhance returns, manage volatility, and protect your portfolio through all market cycles.

Resilient and Adaptable

Markets evolve — and so do we. Our team proactively adjusts strategies in response to global economic and political shifts, positioning portfolios to capture growth during bullish phases and remain resilient during downturns.

Effortless Portfolio Oversight

Your dedicated advisor manages the day-to-day performance of your portfolio while you remain in control of all trading decisions through our non-discretionary structure. This balance of professional management and client approval provides transparency, accountability, and confidence.

Strategic Risk Management

We carefully balance position sizes, correlations, and volatility to safeguard your investments. Through ongoing, proactive risk assessment, we maintain portfolio resilience and stability across changing market conditions.

Curated Market Insights

Our in-house analysts deliver institutional-grade research and stock recommendations, giving you access to the same calibre of insight used by professional investors.

Hear From More Clients!

Frequently Asked Questions.

Are Cannabis stocks a good investment?

Cannabis stocks are a growing and dynamic area that could make a good investment. While the future of cannabis stocks looks strong, individual stock results may vary, and the market may change, so it is important to keep current on what is happening in this market.

How risky & stable are Cannabis stocks?

While no stocks are risk-free, the growing medical applications of cannabis and the potential for recreational legalisation point to a stable future for cannabis stocks.

What are the top Cannabis stocks to buy?

There are a range of ASX listed cannabis stocks. Some of the best ASX cannabis stocks include:

- Vitura Health Limited (ASX: VIT)

- Zelira Therapeutics (ASX: ZLD)

- Neurotech International (ASX:NTI)

- Little Green Pharma (ASX: LGP)

- Cann Group (ASX: CAN)

- Bioxyne (ASX: BXN)

What is the outlook for the Cannabis stock industry in Australia & globally?

There is currently a growing number of medical applications for cannabis and increasing acceptance of the use of cannabis for medical purposes. This provides a positive outlook for this market to continue to grow. If more countries legalise cannabis for recreational uses, this will also drive the market to stronger growth.

What factors should I consider when investing in medical Marijuana stocks?

Before you invest in a medical marijuana stock, you should consider the overall market trends, the regulation infrastructure the market operates within, individual company performance, your overall stock portfolio profile, and your individual financial goals.

Considering the above factors, you can assess whether medical marijuana Australian stocks are a good investment for your portfolio.

How can I start investing in Cannabis stocks?

Suppose you have researched and decided to invest in cannabis stocks. In that case, the next step is to open a brokerage account with an Australian financial institution such as Sharewise. Once your account is open, you need to deposit funds into it before you start trading.

To invest in ASX cannabis stocks on the Sharewise platform, you need to:

- Open your free trading account

- Securely transfer funds into your trading account

- Trade with expert advice.

With a Sharewise membership, you are not on your own. With a Sharewise membership, you can benefit from our stock market recommendations and market research to guide your investing decisions.

Are you unsure where to start, or do you have questions? We are here to help - book a call with an advisor.