Free Stock Report

US Growth Stocks

(Top Picks for Investors)

US growth stocks allow Australian investors to access some of the world’s most influential and fast-growing companies. While the ASX is known for reasonable growth and reliable dividends, it represents around 2% of the global share market. By contrast, the US market holds around 45% of global market capital, is home to big players in a broader range of sectors, and experiences periods of significantly higher growth than its Australian counterpart.

Growth stocks are companies with strong potential to expand earnings at a rate faster than the market average. While value stocks focus more on dividend yield, growth companies use innovation and reinvestment to scale quickly and capture market share. The market rewards their rapid growth with higher share prices, making these stocks attractive to long-term investors seeking capital appreciation.

Adding select US growth stocks to your investment portfolio can both increase your potential returns and reduce risks associated with concentrating on the Australian sharemarket.

Backed by results

+26.49%

Our ASX return for FY25

vs. Market Return of 10.21%

+24.61%

Our US return for FY25

vs. Market Return of 13.33%

+13.35%

Our ASX return for FY24

vs. Market Return of 7.80%

Download your free US growth stocks report now.

The Opportunities & Benefits Of Investing in US Growth Stocks

Investing in US growth stocks can help drive long-term portfolio growth for Australian investors. The US share market often experiences higher gains than the Australian market - in the year to May 2025, Australia’s ASX 200 index returned 7.5% (excluding dividends), compared to almost 16% for the US’ NYSE Composite, and close to 30% for the NASDAQ Composite.

While the Australian sharemarket is heavily weighted towards traditional sectors like banking and resources, the US market offers access to a broader range of global market leaders—from technology and healthcare to consumer goods, consulting, business services and clean energy. US growth companies often outperform the market during periods of economic expansion, as their reinvestment strategies and scalability allow them to capture increasing market share.

The US market is home to headlining large-cap stocks like Meta, Microsoft, Amazon and Netflix, along with an abundance of mid-cap and emerging growth companies that are leaders in niche industries or developing breakthrough innovations. This variety makes the US a fertile ground for identifying the next generation of market leaders, offering Australian investors a chance to strengthen their portfolio with future-focused assets.

Performance Matters.

At Sharewise, every stock report is built on the same principles that have driven our portfolios to outperform the market — data, discipline, and depth of research.

Over the past year, our analysts have delivered strong results across the Australian and American market:

+26.49%

Our ASX return for FY25

vs. Market Return of 10.21%

+24.61%

Our US return for FY25

vs. Market Return of 13.33%

+13.35%

Our ASX return for FY24

vs. Market Return of 7.80%

Past performance is not indicative of future performance.

How these stock reports can help you.

Markets move fast — and new opportunities emerge every day.

Our stock reports cut through the noise, helping you identify quality companies backed by strong fundamentals and credible management.

Each report is curated by the Sharewise analyst and research team, combining data, financial analysis, and clear investment theses — giving you the insights to make confident, well-informed decisions.

Inside the US Growth Stocks Report

Dive into in-depth analysis on stocks backed by structural growth trends and execution strength.

Each profile includes:

- Investment thesis — crafted by our analysts, outlining why we believe each company could outperform and the key factors driving our view

- Company overview — what they do, their projects, and production outlook

- Fundamentals — valuation metrics, financial health, and operating performance

- Financial statements — revenue, profit trends, and balance sheet strength

- Major shareholders — institutional, insider, and strategic holders to note

So what are the best US growth stocks to buy now? The answer depends upon individual investment goals and portfolio strategy. When evaluating US growth stocks to buy, investors should consider:

- Long-term industry trends - such as ecommerce, digital payments, sustainable energy, artificial intelligence, automation and ageing health needs.

- Diversification - across various sectors, to reduce industry-specific risks.

- Individual stock analysis - using essential metrics such as market capitalisation, earnings growth rates & revenue projections.

The following popular, large-cap US growth stocks are worth considering for their innovation, growth potential and solid long-term strategies.

Amazon.com Inc. (NASDAQ: AMZN)

- Market Capitalisation: ~ $2.0 trillion (USD).

- Multiline Retail

- E-commerce leader with high-margin cloud computing driving growth, plus continued global expansion and logistics dominance.

Alphabet Inc. (NASDAQ: GOOG)

- Market Capitalisation: ~ $2.0 trillion (USD).

- Multiline Retail

- E-commerce leader with high-margin cloud computing driving growth, plus continued global expansion and logistics dominance.

Meta Platforms Inc. (NASDAQ: META)

- Market Capitalisation: ~$1.3 trillion (USD).

- Interactive Media and Services

- Owns top social platforms, expanding into AI and the metaverse, with strong ad revenue and user engagement.

Netflix Inc. (NASDAQ: NFLX)

- Market Capitalisation: ~$280 billion (USD).

- Entertainment

- Global streaming leader with strong subscriber growth, rising margins, and content strategy that supports long-term scale.

Shopify Inc. (NYSE: SHOP)

- Market Capitalisation: ~$90 billion (USD).

- IT Services

- Powers the online stores of millions of businesses, benefits from growth in e-commerce growth, payments, logistics, and marketing tools.

Uber Technologies Inc. (NYSE: UBER)

- Market Capitalisation: ~$120 billion (USD).

- Road and Rail

- Leading platform for ride-hailing and food delivery with increasing global scale, and expansion into logistics and autonomous tech.

Block Inc. (NYSE: SQ)

- Market Capitalisation: ~$39 billion (USD).

- Diversified Financial Services

- Offers disruptive digital financial tools for merchants and individuals (Square, Cash App), with strong user growth and long-term potential.

Salesforce Inc. (NYSE: CRM)

- Market Capitalisation: ~$256 billion (USD).

- Software

- World’s largest CRM provider, expanding into AI and data analytics to enhance customer retention.

Investors may also wish to evaluate potentially undervalued small and medium-cap growth stocks, such as the following (from Morningstar’s list of the Best Companies to Own for 2025):

- Rentokil Initial and Copart - speciality business services.

- Coloplast - medical instruments and supplies.

- ServiceNow, Tyler Technologies and Autodesk - software industry.

- Equifax and Experian - consulting services.

What Our Clients Are Saying!

Understanding The Risks & Considerations Of US Growth Stocks

With high potential growth comes high potential risk. US growth stocks often attract rapidly increasing stock prices because the market rewards their innovation, growth to date and perceived growth potential. However, economic shifts and changes to predicted future earnings can impact investor sentiment significantly, making returns volatile.

This is especially the case in fast-moving sectors such as technology, biotech and renewable energy. High growth US stocks can experience significant market fluctuations and may take time to generate substantial returns. Before investing, it is important to assess market conditions, company fundamentals, and industry and economic outlooks. Maintaining a longer-term investment time-frame, and building a diverse portfolio, can help mitigate risk.

Our Return vs. The Market

Our performance for the current financial year compared against the market benchmark.

Past performance is not indicative of future performance.

How Sharewise Helps You Choose the Best US Growth Investments.

Institutional Quality Research

Make informed decisions with confidence.

Dive into comprehensive stock-specific analysis, focused on all companies, from blue-chip to micro-cap. Our extensive research, led by Chief Investment Office Rabbi (Rabih) Ahmed, and support by our team of equity research analysts, ensure you have a deep understanding of the market landscape to invest with clarify and assurance.

Account & Portfolio Management

Your investments, our dedicated attention.

With a dedicated stockbroker, you can rest easy knowing your investments are under expert care. A Sharewise Managed Account allows your advisor to manage your portfolio on your behalf, ensuring strategic decision-making, timely buy and sell actions, and seamless trade execution. We conduct quarterly portfolio reviews and strategy sessions with you so you can enjoy a hands-off investment process.

Dedicated Investment Manager

Your partner in navigating the markets.

Our investment managers are licensed professionals with expert knowledge of the markets. They monitor stocks and market trends daily, managing risk while optimising your portfolio. Focused on maximising returns, they ensure your investments are actively managed and aligned with your objectives.

Timely Stock Recommendations

Never miss an opportunity.

Backed by in-depth research and a clear investment thesis, our buy and sell recommendations go beyond simple tips. Each recommendation is a strategic insight built on real company data, financial fundamentals, and advanced technical analysis. We focus on ensuring you understand exactly what you're investing in and why, delivering actionable trade opportunities with clear rationale.

Professional Risk Management

Stay focused, even in volatile markets.

We take emotions out of investing. Our investment managers use research, data and market signals to guide decisions. By staying disciplined and responsive to market changes, we help investors remain focused when markets move quickly.

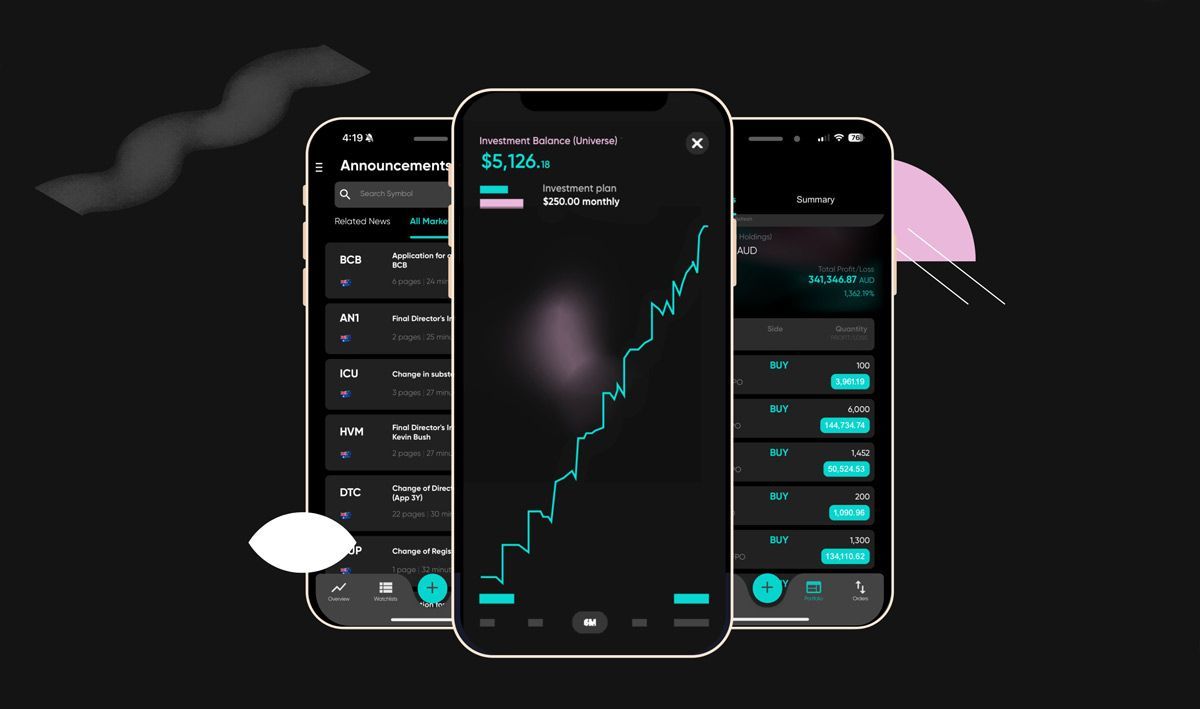

Access to Client Portal

Never miss an opportunity.

Our exclusive client portal gives you 24/7 access to our daily market research, in-depth stock analysis, and buy/sell recommendations. Whether you're at home or on the go, you can stay informed with up-to-date insights and make well-informed decisions. Our user-friendly platform ensures you’re always connected to the latest market trends, putting expert guidance at your fingertips.

Your Investment Journey to Wealth Creation.

Discover how Sharewise helps you build lasting wealth through expert advice, market intelligence, and proactive portfolio support - every step of the way.

Step 1: Start Your Journey with Confidence

Speak with one of our experienced investment managers to understand how we work and how we can support your investment objectives. Whether you’re new to investing or looking to take the next step, we’ll meet you where you are.

Step 2: Navigate the Markets with Clarity

Access our global market updates and institutional-grade research designed to help investors make more informed decisions across all conditions.

Step 3: Act on Research-Backed Ideas

Access timely buy and sell recommendations based on technical and fundamental analysis - helping you act with conviction when opportunities arise.

Step 4: Portfolio Oversight

Stay connected to your investments with ongoing oversight from your Sharewise investment manager. We help you monitor your portfolio, provide general advice based on market conditions, and keep you informed about opportunities that may impact your holdings.

Step 5: Build Resilience Through Risk Management

We support you in identifying and managing risk through research-led insights and regular updates - helping you stay focused, even when markets shift.

Step 6: A Journey of Long-Term Success

Your investment journey doesn’t end with one trade. We’re here for the long haul - providing continuous insights, opportunities, and support to help you stay on track over time.

Tracking US Growth Stocks & Market Performance

To stay on top of your investments, it’s important to regularly review earnings reports, revenue growth, stock price trends and broader market movements.

Stock screeners like Yahoo Finance and MarketWatch provide up-to-the-minute stock prices and financial indicators. Financial news sites such as Bloomberg, CNBC, and Seeking Alpha offer timely updates and deeper market insights, while investment apps let Australian investors monitor holdings in real-time.

Creating a custom portfolio of your selected US growth stocks allows you to track your overall investment performance, rebalance as needed, and respond to changes in market sentiment or company fundamentals. For guidance on building a robust, well-balanced US growth stock portfolio, start by

speaking with an experienced advisor.

Your Success in the Market Starts Here.

At Sharewise, our approach to investing is built on clarity, precision, and strategy. By combining technical and fundamental analysis, we uncover opportunities and manage risk with a data-driven mindset. Our diversified approach ensures portfolios remain balanced, resilient, and adaptive to global market shifts.

Whether you’re navigating volatility or pursuing growth, our insights are designed to simplify complexity and empower informed decisions.

Data-Driven Decisions

Our investment philosophy combines technical and fundamentalanalysis to uncover opportunities and manage risk with precision. Every recommendation is backed by data, research, and professional expertise — ensuring each move is informed and strategic.

Superior Strategy

We take a diversified, multi-asset approach to investing, balancing risk and reward across global markets. This strategy is designed to enhance returns, manage volatility, and protect your portfolio through all market cycles.

Resilient and Adaptable

Markets evolve — and so do we. Our team proactively adjusts strategies in response to global economic and political shifts, positioning portfolios to capture growth during bullish phases and remain resilient during downturns.

Effortless Portfolio Oversight

Your dedicated advisor manages the day-to-day performance of your portfolio while you remain in control of all trading decisions through our non-discretionary structure. This balance of professional management and client approval provides transparency, accountability, and confidence.

Strategic Risk Management

We carefully balance position sizes, correlations, and volatility to safeguard your investments. Through ongoing, proactive risk assessment, we maintain portfolio resilience and stability across changing market conditions.

Curated Market Insights

Our in-house analysts deliver institutional-grade research and stock recommendations, giving you access to the same calibre of insight used by professional investors.

How To Build A Portfolio With US Growth Stocks

Diversification is the key to building a resilient investment portfolio. If one area of your investments is hit by a downturn, diversification increases the chance that other areas of your portfolio will continue to grow. This is particularly important when investing in US growth stocks, as they can experience sizeable short-term volatility.

Within the class of high growth US stocks, you can diversify across various sectors and across more established versus undervalued, high-potential stocks. At a portfolio level, diversification can occur across geographic regions, and across asset types—including bonds and high dividend-yielding value stocks.

Hear From More Clients!

Frequently Asked Questions.

What factors contribute to the rapid growth of US growth stocks & how can investors identify them early?

US growth stocks are driven by innovative technology, scalable business models, and identifying and moving into developing markets early. Investors can spot growth stock opportunities early by keeping up-to-date with disruptive sectors, reading analyst forecasts, and reviewing the key indicators and company fundamentals of potential growth stocks.

What are the key indicators to evaluate when assessing the growth potential of US stocks in high-growth industries?

Key company indicators include revenue growth, profit margins, market share, growth strategy and investment into R&D. Important financial indicators include the Price-to-Earnings (P/E) ratio. Price-to-Earnings Growth (PEG), Return of Equity (ROE) and Free Cash Flow (FCF) Margin.

How do interest rate changes & inflation impact the performance of US growth stocks, particularly in tech & biotech sectors?

Higher interest rates and inflation can make it more expensive for companies to borrow money to fund future growth, as well as reducing the present value of future earnings. This can make investors less willing to pay high stock prices for companies that rely on funding now, with the promise of big profits in the future - such as those in the tech and biotech sector.

How do market trends, such as ESG investing or the rise of green energy, shape the future of US growth stocks & affect their stock prices?

Trends like ESG (environmental, social and governance) and green energy boost the demand for companies aligned with sustainability and innovation, often leading to stronger investor interest, premium valuations, and long-term up-trends for stock performance.

How do emerging technologies, such as AI & renewable energy, influence the performance of US growth stocks?

Emerging technologies create new markets and revenue streams, enabling companies at the forefront of these developments to scale rapidly and become long-term leaders. This future potential can be rewarded in an enhanced stock price today.

What are the long-term investment strategies for balancing risk & reward when investing in US growth stocks?

Diversifying across sectors, dollar-cost averaging, and holding for the long term while monitoring company fundamentals can help investors manage volatility and capture sustained growth.

How can US growth stocks diversify an investment portfolio & what are the advantages of holding these stocks over the long term?

US growth stocks offer Australian investors risk-reduction through geographic diversification, as well as potential reward through exposure to global innovation and long-term capital appreciation, in sectors underrepresented in the Australian market.