Free Stock Report

Best Uranium Stocks ASX

Investing in uranium stocks on the ASX presents a compelling opportunity for investors seeking exposure to the growing nuclear energy sector. As global demand for clean energy rises, uranium remains a critical component of nuclear power, offering a low-carbon alternative to fossil fuels. The ASX hosts several top-performing uranium stocks, providing a gateway to this burgeoning market. By investing in uranium stocks, investors can potentially benefit from the increasing adoption of nuclear energy as countries strive to meet their zero-carbon targets.

Backed by results

+26.49%

Our ASX return for FY25

vs. Market Return of 10.21%

+24.61%

Our US return for FY25

vs. Market Return of 13.33%

+13.35%

Our ASX return for FY24

vs. Market Return of 7.80%

Download your free uranium stocks report now.

Why Invest In Uranium Stocks - Opportunities & Benefits

Uranium stocks have demonstrated consistent growth and stability, making them an attractive option for investors. The increasing global focus on sustainable and clean energy solutions has driven demand for uranium, which is essential for nuclear power generation. This demand is expected to continue rising as countries seek to reduce carbon emissions and achieve energy security.

The uranium industry offers a variety of investment opportunities, from established mining companies with significant reserves to innovative exploration firms discovering new resources. Investing in

ASX uranium stocks provides exposure to this diverse and resource-rich sector, allowing investors to capitalise on the long-term potential of nuclear energy. With a stable market outlook and promising growth prospects, uranium stocks represent a strategic addition to any investment portfolio.

Performance Matters.

At Sharewise, every stock report is built on the same principles that have driven our portfolios to outperform the market — data, discipline, and depth of research.

Over the past year, our analysts have delivered strong results across the Australian market:

+26.49%

Our ASX return for FY25

vs. Market Return of 10.21%

+24.61%

Our US return for FY25

vs. Market Return of 13.33%

+13.35%

Our ASX return for FY24

vs. Market Return of 7.80%

Past performance is not indicative of future performance.

How these stock reports can help you.

Markets move fast — and new opportunities emerge every day.

Our stock reports cut through the noise, helping you identify quality companies backed by strong fundamentals and credible management.

Each report is curated by the Sharewise analyst and research team, combining data, financial analysis, and clear investment theses — giving you the insights to make confident, well-informed decisions.

Inside the Uranium Stock Report

Dive into the ASX uranium sector as nuclear energy re-emerges as a critical component of the global energy mix. Each profile includes:

- Investment thesis — crafted by our analysts, outlining why we believe each company could outperform and the key factors driving our view

- Company overview — what they do, their projects, and production outlook

- Fundamentals — valuation metrics, financial health, and operating performance

- Financial statements — revenue, profit trends, and balance sheet strength

- Major shareholders — institutional, insider, and strategic holders to note

When looking for the top uranium stocks ASX has to offer, several high-performing options stand out for their significant returns. These stocks showcase the robust potential within the uranium sector, with impressive performance and promising prospects for future growth.

Paladin Uranium Stock

Paladin Uranium Stock stands out among ASX-listed uranium stocks due to its significant potential for future returns. Known for its extensive resource base and efficient production capabilities, Paladin has consistently shown strong performance trends. In recent years, Paladin has seen a steady increase in its stock value, driven by rising uranium prices and strategic operational improvements. With ongoing expansion plans and a focus on sustainable production, the future outlook for Paladin Uranium Stock remains highly promising, making it a compelling choice for investors seeking exposure to the uranium market.

Alligator Uranium Stock

Alligator Uranium Stock is gaining attention on the ASX due to its promising potential for future returns. This company focuses on high-grade uranium exploration and development, positioning itself for substantial growth as demand for uranium increases. Alligator has demonstrated impressive performance trends, with a steady rise in stock value supported by successful exploration results and strategic partnerships. Looking ahead, Alligator's focus on expanding its resource base and advancing its projects suggests a bright future, making it a strong contender among top uranium stocks on the ASX.

Boss Energy Uranium Stock

Boss Energy Uranium Stock stands out on the ASX for its significant potential for future returns. With a strong focus on uranium production and development, Boss Energy has shown consistent growth in its stock value. The company’s flagship Honeymoon project is advancing towards production, driving investor confidence. Recent performance trends highlight a positive trajectory, fueled by strategic acquisitions and favourable market conditions. As global demand for uranium continues to rise, Boss Energy is well-positioned to capitalise on this trend, making it a compelling choice for investors looking out for the best uranium stocks on the ASX.

What Our Clients Are Saying!

How To Pick The Best Uranium Stocks ASX

Choosing the best uranium stocks requires a thorough analysis of key financial metrics. Investors should focus on company fundamentals, including balance sheets, cash flow, and debt levels, to confirm financial stability and growth potential. Additionally, keeping an eye on market trends, such as uranium demand, geopolitical factors, and industry developments, can provide valuable insights. Evaluating a company's production capacity, exploration projects, and management team also contributes significantly to making informed investment decisions. By considering these factors, investors can identify top-performing uranium stocks on the ASX with strong potential for future returns.

Our Return vs. The Market

Our performance for the current financial year compared against the market benchmark.

Past performance is not indicative of future performance.

How Sharewise Helps You Choose the Best Uranium Stocks.

Institutional Quality Research

Make informed decisions with confidence.

Dive into comprehensive stock-specific analysis, focused on all companies, from blue-chip to micro-cap. Our extensive research, led by Chief Investment Office Rabbi (Rabih) Ahmed, and support by our team of equity research analysts, ensure you have a deep understanding of the market landscape to invest with clarify and assurance.

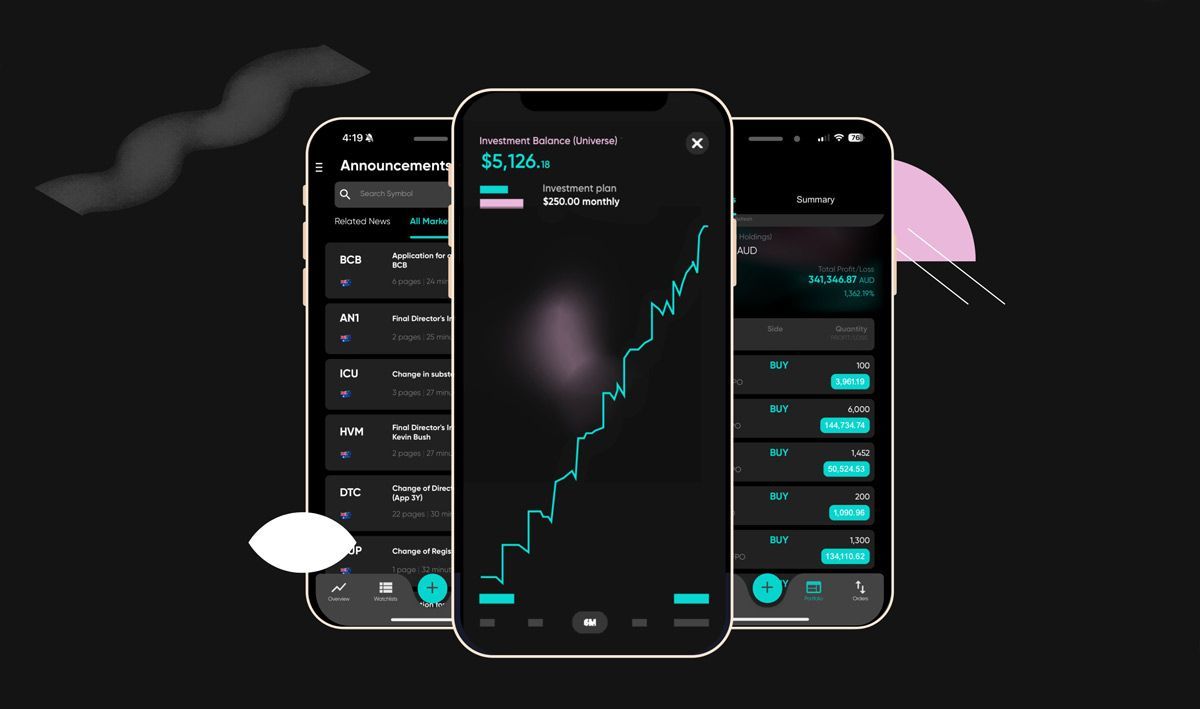

Account & Portfolio Management

Your investments, our dedicated attention.

With a dedicated stockbroker, you can rest easy knowing your investments are under expert care. A Sharewise Managed Account allows your advisor to manage your portfolio on your behalf, ensuring strategic decision-making, timely buy and sell actions, and seamless trade execution. We conduct quarterly portfolio reviews and strategy sessions with you so you can enjoy a hands-off investment process.

Dedicated Investment Manager

Your partner in navigating the markets.

Our investment managers are licensed professionals with expert knowledge of the markets. They monitor stocks and market trends daily, managing risk while optimising your portfolio. Focused on maximising returns, they ensure your investments are actively managed and aligned with your objectives.

Timely Stock Recommendations

Never miss an opportunity.

Backed by in-depth research and a clear investment thesis, our buy and sell recommendations go beyond simple tips. Each recommendation is a strategic insight built on real company data, financial fundamentals, and advanced technical analysis. We focus on ensuring you understand exactly what you're investing in and why, delivering actionable trade opportunities with clear rationale.

Professional Risk Management

Stay focused, even in volatile markets.

We take emotions out of investing. Our investment managers use research, data and market signals to guide decisions. By staying disciplined and responsive to market changes, we help investors remain focused when markets move quickly.

Access to Client Portal

Never miss an opportunity.

Our exclusive client portal gives you 24/7 access to our daily market research, in-depth stock analysis, and buy/sell recommendations. Whether you're at home or on the go, you can stay informed with up-to-date insights and make well-informed decisions. Our user-friendly platform ensures you’re always connected to the latest market trends, putting expert guidance at your fingertips.

Your Investment Journey to Wealth Creation.

Discover how Sharewise helps you build lasting wealth through expert advice, market intelligence, and proactive portfolio support - every step of the way.

Step 1: Start Your Journey with Confidence

Speak with one of our experienced investment managers to understand how we work and how we can support your investment objectives. Whether you’re new to investing or looking to take the next step, we’ll meet you where you are.

Step 2: Navigate the Markets with Clarity

Access our global market updates and institutional-grade research designed to help investors make more informed decisions across all conditions.

Step 3: Act on Research-Backed Ideas

Access timely buy and sell recommendations based on technical and fundamental analysis - helping you act with conviction when opportunities arise.

Step 4: Portfolio Oversight

Stay connected to your investments with ongoing oversight from your Sharewise investment manager. We help you monitor your portfolio, provide general advice based on market conditions, and keep you informed about opportunities that may impact your holdings.

Step 5: Build Resilience Through Risk Management

We support you in identifying and managing risk through research-led insights and regular updates - helping you stay focused, even when markets shift.

Step 6: A Journey of Long-Term Success

Your investment journey doesn’t end with one trade. We’re here for the long haul - providing continuous insights, opportunities, and support to help you stay on track over time.

Investment Tips For Australian Uranium Stocks

Diversification is key to managing risk and maximising potential returns when investing in Australian uranium stocks. Spread your investments across different sectors and asset types, including various uranium companies with distinct projects and market positions. This approach can help balance the inherent volatility in the uranium market and protect your portfolio from sector-specific downturns.

Regularly reviewing your portfolio is essential. Assess performance in light of changing market conditions and adjust your investments according to your financial goals and risk tolerance. Staying informed about industry trends and economic factors can help you make timely adjustments to improve your returns.

Adopting a long-term investment strategy is also beneficial. Patience can yield better returns by allowing investments to mature and reducing the impact of short-term market fluctuations. A well-considered, long-term approach helps capitalise on the growth potential of uranium stocks while navigating through market volatility.

Your Success in the Market Starts Here.

At Sharewise, our approach to investing is built on clarity, precision, and strategy. By combining technical and fundamental analysis, we uncover opportunities and manage risk with a data-driven mindset. Our diversified approach ensures portfolios remain balanced, resilient, and adaptive to global market shifts.

Whether you’re navigating volatility or pursuing growth, our insights are designed to simplify complexity and empower informed decisions.

Data-Driven Decisions

Our investment philosophy combines technical and fundamentalanalysis to uncover opportunities and manage risk with precision. Every recommendation is backed by data, research, and professional expertise — ensuring each move is informed and strategic.

Superior Strategy

We take a diversified, multi-asset approach to investing, balancing risk and reward across global markets. This strategy is designed to enhance returns, manage volatility, and protect your portfolio through all market cycles.

Resilient and Adaptable

Markets evolve — and so do we. Our team proactively adjusts strategies in response to global economic and political shifts, positioning portfolios to capture growth during bullish phases and remain resilient during downturns.

Effortless Portfolio Oversight

Your dedicated advisor manages the day-to-day performance of your portfolio while you remain in control of all trading decisions through our non-discretionary structure. This balance of professional management and client approval provides transparency, accountability, and confidence.

Strategic Risk Management

We carefully balance position sizes, correlations, and volatility to safeguard your investments. Through ongoing, proactive risk assessment, we maintain portfolio resilience and stability across changing market conditions.

Curated Market Insights

Our in-house analysts deliver institutional-grade research and stock recommendations, giving you access to the same calibre of insight used by professional investors.

Hear From More Clients!

Frequently Asked Questions.

Are uranium stocks a good investment?

Uranium stocks can be a good investment, particularly if you believe in the future growth of nuclear energy. They offer the potential for significant returns due to increasing global demand for clean energy and supply constraints. However, they also come with risks, including market volatility and regulatory changes. Researching individual companies, assessing their financial health, and considering the broader uranium market trends is vital. Diversification and a long-term investment approach can help manage risks. Consulting with financial experts can also provide tailored advice based on your investment goals and risk tolerance.

What is the outlook for the uranium industry in Australia & globally?

The outlook for the uranium industry is promising both in Australia and globally. As the world increasingly shifts toward cleaner energy sources, demand for uranium, which fuels nuclear power plants, is expected to rise. The industry benefits from robust mining and exploration activities in Australia, which is known for its significant uranium reserves. Globally, the push for low-carbon energy solutions and geopolitical factors will likely drive growth. This positive trend suggests potential investment opportunities for those interested in uranium stocks in Australia. However, staying informed about market developments and regulatory changes is essential for making sound investment decisions.

How risky are uranium stocks?

Uranium stocks can be relatively high risk due to several factors. The volatility in uranium prices, driven by fluctuating global demand and supply, can impact stock performance. Regulatory changes, such as stricter environmental policies or shifts in energy policy, also add to the risk. Additionally, the uranium industry is heavily influenced by geopolitical factors, which can affect market stability. Investing in uranium stocks requires careful consideration of these risks, as well as the financial health of the companies involved and broader market trends. Diversification and a thorough understanding of the sector can help manage these risks.

What factors should I consider before investing in uranium stocks?

Before investing in uranium stocks on the ASX, consider the following factors:

- Market Conditions: Understand the current and projected uranium prices, supply-demand dynamics, and global energy trends.

- Company Fundamentals: Evaluate the financial health, management team, and operational efficiency of uranium companies. Review their exploration projects, production capacity, and reserves.

- Regulatory Environment: Be aware of environmental regulations, licensing requirements, and government policies related to uranium mining and nuclear energy.

- Geopolitical Risks: Assess geopolitical factors that might impact uranium supply or market stability, including trade policies and international relations.

- Investment Horizon: Consider your long-term investment goals and risk tolerance. Uranium stocks can be volatile and may require a longer investment horizon to realise significant returns.

- Diversification: Avoid putting all your investments into uranium stocks. Diversify across different sectors and asset types to mitigate risk.

- Technical & Fundamental Analysis: Perform thorough research, including technical analysis of stock trends and fundamental analysis of the industry and specific companies.

What are the best uranium stocks to buy in Australia?

As of now, some of the best uranium stocks to consider in Australia include:

- Paladin Energy Ltd (PDN): Known for its significant uranium resources and projects, Paladin has shown strong performance and potential for future growth. Its focus on advancing its projects and managing operational efficiency makes it a prominent player.

- Boss Energy Ltd (BOE): Boss Energy is notable for its development of the Honeymoon Uranium Project. The company's strategic positioning and progress in project development offer promising prospects for investors.

- Alligator Energy Ltd (AGE): Alligator Energy is engaged in uranium exploration and development, with projects like the Samphire Uranium Project. The company's exploration success and strategic developments contribute to its potential.

These stocks represent some of the top uranium companies in Australia, each with its strengths and growth opportunities in the uranium market. Always conduct thorough research and consider your investment goals before purchasing stocks.

How can I start investing in uranium stocks?

To start investing in uranium stocks on the ASX, follow these steps:

- Research: Begin by researching uranium companies and understanding the market. Look for companies with strong financials and promising projects.

- Open a Brokerage Account: Choose a reputable brokerage firm that provides access to the ASX and allows trading of uranium stocks.

- Develop a Strategy: Decide on your investment goals and risk tolerance. Diversify your portfolio to mitigate risks.

- Monitor Investments: Regularly review your investments and stay updated on market trends and company news.

- Consult Experts: Consider seeking advice from financial advisors or industry experts to make informed decisions.