Free Stock Report

Best Stocks To Invest In: Top Picks For High Returns In 2026

What are the best stocks to invest in for 2026? If you want to achieve your full financial potential, you’ll need to adopt the right strategy. Creating wealth through the stock market involves education, proper research, analysis and strategic risk management so that you find the right stocks to invest in. But how do you keep up to date with the latest trends and ongoing opportunities in an ever-changing market?

At Sharewise, we understand the responsibility of guiding investors through the intricate world of stock markets. Which ones have staying power and which ones are flashes in the pan? And, after you’ve bought the right stock, what’s the right time to sell it? Knowing if you should hold onto a stock or let it go helps ensure that your wealth grows sustainably. That’s why our priority is to provide insights and tools for investors looking to make informed decisions and find the

best stocks to invest in right now.

Backed by results

+26.49%

Our ASX return for FY25

vs. Market Return of 10.21%

+24.61%

Our US return for FY25

vs. Market Return of 13.33%

+13.35%

Our ASX return for FY24

vs. Market Return of 7.80%

Download your free stocks report now.

What Makes A Stock The Best To Invest In?

How do you figure out the best stock to invest in right now? One approach is called growth investing, which seeks out companies growing at a faster pace than the market average. Another method is value investing, which locates stocks trading lower than their intrinsic value. Value investing ignores daily movements and short-term market trends and focuses on a company’s fundamentals for long-term growth.

Some of the performance metrics to be considered when assessing a company’s actual value are:

- Debt-to-Equity Ratio: This tells potential investors how much money the company has borrowed to finance its business compared to the total shareholder equity. Some industries require more debt financing than others, so a higher ratio might be acceptable in these cases.

- Price-to-Earnings Ratio: This ratio measures how ‘expensive’ a company’s shares are. It measures the company's current share price against its earnings per share. For example, if the stock trades at $24 per share and its earnings over a 12-month period were $3 per share, the ratio would be 24/3 = 8. Generally, a lower ratio is considered better for investors, although it’s optimum to compare P/E ratios between companies that are of a similar type. Bear in mind that it’s also important to look at a company’s future earnings potential rather than only considering its past earnings.

- Free Cash Flow: In determining the best stocks to invest in, FCF (Free Cash Flow) can be an indicator of a company’s earnings potential into the future. FCF is the amount of money earned by the company minus its expenses (operating expenses and capital expenditures). When this metric increases, it usually means that the company’s earnings are likely to rise. A strong FCF also tends to indicate better longevity for that business.

In summary, an investor should consider a stock’s market potential, financial health, leadership strength and competitive advantages. These economic indicators, industry trends, and company fundamentals all play a role in identifying stocks with high investment potential.

Performance Matters.

At Sharewise, every stock report is built on the same principles that have driven our portfolios to outperform the market — data, discipline, and depth of research.

Over the past year, our analysts have delivered strong results across the Australian market:

+26.49%

Our ASX return for FY25

vs. Market Return of 10.21%

+24.61%

Our US return for FY25

vs. Market Return of 13.33%

+13.35%

Our ASX return for FY24

vs. Market Return of 7.80%

Past performance is not indicative of future performance.

How these stock reports can help you.

Markets move fast — and new opportunities emerge every day.

Our stock reports cut through the noise, helping you identify quality companies backed by strong fundamentals and credible management.

Each report is curated by the Sharewise analyst and research team, combining data, financial analysis, and clear investment theses — giving you the insights to make confident, well-informed decisions.

Inside the Free Stock Picks Report

Get in-depth analysis on a selection of stocks with compelling fundamentals, strong growth potential, and favourable positioning in today’s market.

Each profile includes:

- Investment thesis — crafted by our analysts, outlining why we believe each company could outperform and the key factors driving our view

- Company overview — what they do, their projects, and production outlook

- Fundamentals — valuation metrics, financial health, and operating performance

- Financial statements — revenue, profit trends, and balance sheet strength

- Major shareholders — institutional, insider, and strategic holders to note

If you’re looking for the best stocks to invest in 2025, you can target both the local and global markets, as well as different sectors.

Looking at the ASX, some of the best stocks to invest in are blue-chip shares. Options to consider are:

- Coles Group Ltd: As one of Australia’s two largest supermarket chains, Coles has strengths such as the Flybuys loyalty program and its extensive network of Liquorland and Vintage Cellars stores. It has recently upgraded its online business and automation.

- CSL Limited: This biotherapeutics company places a strong emphasis on research and development (R&D), reinvesting about 12% of its sales into this area. It is currently rolling out its new plasma collection technology.

- BHP Group Limited: This perennial mining favourite has a high-quality portfolio of mines worldwide, and its share price is currently at an excellent entry point.

- Commonwealth Bank of Australia: In addition to being Australia’s largest bank, it is also the country’s largest mortgage lender. It delivers a consistently strong financial performance.

What Our Clients Are Saying!

Stock Investment Tips For Long-Term Success

Any company can have short-term gains in the stock market because it can be such a volatile area on a day-to-day basis. That’s why a strategic, long-term view always works best. But which stocks have staying power versus which are flashes in the pan? Sharewise's deep-rooted understanding of fundamental and technical market metrics guides you, ensuring you're not just chasing a trend, but strategically investing in future market leaders.

When you’re considering which

stocks to invest in to implement your long-term investment strategies, here are some tips:

- Diversify your portfolio. Don’t put all your eggs in one basket. Investing in different companies and sectors means that no single stock will have too much of an impact on your overall returns.

- Look at the tax implications. If you invest with a company that provides fully-franked dividends, it means they’ve already paid the tax on the profits. So, you might not have to pay any tax at all on your dividends. Check with your accountant.

- Focus on a long-term strategy and then stick to it. Don’t change your portfolio every time there’s a short-term loss. You’re playing the long game.

- For the long-term, it’s better to invest in a well-performing company with a higher share price than in ‘penny stocks’. Penny stocks are very small companies with low—and volatile—share prices.

Our Return vs. The Market

Our performance for the current financial year compared against the market benchmark.

Past performance is not indicative of future performance.

How Sharewise Helps You Choose the Best Stocks.

Institutional Quality Research

Make informed decisions with confidence.

Dive into comprehensive stock-specific analysis, focused on all companies, from blue-chip to micro-cap. Our extensive research, led by Chief Investment Office Rabbi (Rabih) Ahmed, and support by our team of equity research analysts, ensure you have a deep understanding of the market landscape to invest with clarify and assurance.

Account & Portfolio Management

Your investments, our dedicated attention.

With a dedicated stockbroker, you can rest easy knowing your investments are under expert care. A Sharewise Managed Account allows your advisor to manage your portfolio on your behalf, ensuring strategic decision-making, timely buy and sell actions, and seamless trade execution. We conduct quarterly portfolio reviews and strategy sessions with you so you can enjoy a hands-off investment process.

Dedicated Investment Manager

Your partner in navigating the markets.

Our investment managers are licensed professionals with expert knowledge of the markets. They monitor stocks and market trends daily, managing risk while optimising your portfolio. Focused on maximising returns, they ensure your investments are actively managed and aligned with your objectives.

Timely Stock Recommendations

Never miss an opportunity.

Backed by in-depth research and a clear investment thesis, our buy and sell recommendations go beyond simple tips. Each recommendation is a strategic insight built on real company data, financial fundamentals, and advanced technical analysis. We focus on ensuring you understand exactly what you're investing in and why, delivering actionable trade opportunities with clear rationale.

Professional Risk Management

Stay focused, even in volatile markets.

We take emotions out of investing. Our investment managers use research, data and market signals to guide decisions. By staying disciplined and responsive to market changes, we help investors remain focused when markets move quickly.

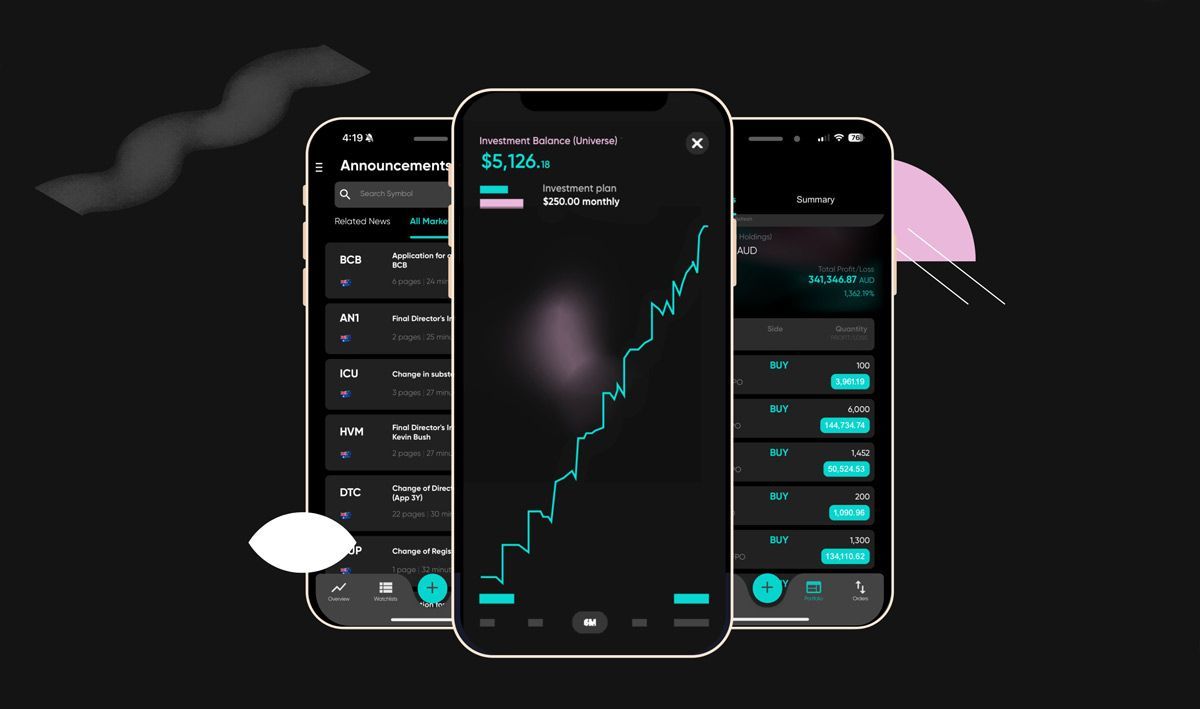

Access to Client Portal

Never miss an opportunity.

Our exclusive client portal gives you 24/7 access to our daily market research, in-depth stock analysis, and buy/sell recommendations. Whether you're at home or on the go, you can stay informed with up-to-date insights and make well-informed decisions. Our user-friendly platform ensures you’re always connected to the latest market trends, putting expert guidance at your fingertips.

Your Investment Journey to Wealth Creation.

Discover how Sharewise helps you build lasting wealth through expert advice, market intelligence, and proactive portfolio support - every step of the way.

Step 1: Start Your Journey with Confidence

Speak with one of our experienced investment managers to understand how we work and how we can support your investment objectives. Whether you’re new to investing or looking to take the next step, we’ll meet you where you are.

Step 2: Navigate the Markets with Clarity

Access our global market updates and institutional-grade research designed to help investors make more informed decisions across all conditions.

Step 3: Act on Research-Backed Ideas

Access timely buy and sell recommendations based on technical and fundamental analysis - helping you act with conviction when opportunities arise.

Step 4: Portfolio Oversight

Stay connected to your investments with ongoing oversight from your Sharewise investment manager. We help you monitor your portfolio, provide general advice based on market conditions, and keep you informed about opportunities that may impact your holdings.

Step 5: Build Resilience Through Risk Management

We support you in identifying and managing risk through research-led insights and regular updates - helping you stay focused, even when markets shift.

Step 6: A Journey of Long-Term Success

Your investment journey doesn’t end with one trade. We’re here for the long haul - providing continuous insights, opportunities, and support to help you stay on track over time.

Your Success in the Market Starts Here.

At Sharewise, our approach to investing is built on clarity, precision, and strategy. By combining technical and fundamental analysis, we uncover opportunities and manage risk with a data-driven mindset. Our diversified approach ensures portfolios remain balanced, resilient, and adaptive to global market shifts.

Whether you’re navigating volatility or pursuing growth, our insights are designed to simplify complexity and empower informed decisions.

Data-Driven Decisions

Our investment philosophy combines technical and fundamentalanalysis to uncover opportunities and manage risk with precision. Every recommendation is backed by data, research, and professional expertise — ensuring each move is informed and strategic.

Superior Strategy

We take a diversified, multi-asset approach to investing, balancing risk and reward across global markets. This strategy is designed to enhance returns, manage volatility, and protect your portfolio through all market cycles.

Resilient and Adaptable

Markets evolve — and so do we. Our team proactively adjusts strategies in response to global economic and political shifts, positioning portfolios to capture growth during bullish phases and remain resilient during downturns.

Effortless Portfolio Oversight

Your dedicated advisor manages the day-to-day performance of your portfolio while you remain in control of all trading decisions through our non-discretionary structure. This balance of professional management and client approval provides transparency, accountability, and confidence.

Strategic Risk Management

We carefully balance position sizes, correlations, and volatility to safeguard your investments. Through ongoing, proactive risk assessment, we maintain portfolio resilience and stability across changing market conditions.

Curated Market Insights

Our in-house analysts deliver institutional-grade research and stock recommendations, giving you access to the same calibre of insight used by professional investors.

Hear From More Clients!

Frequently Asked Questions.

What are the best stocks to invest in right now?

At Sharewise, our analysts have done the research and identified high-potential stocks that could boost your portfolio. Because the market is constantly evolving, there are always new opportunities for investors. The key is being able to analyse the underlying reasons for a stock's performance and determine if it is undervalued or overvalued. We then issue our latest buy and sell recommendations for you to take advantage of. Our free ASX stock reports provide you with valuable insights and knowledge so you can arrive at data-driven decisions to expand your portfolio.

To get the very latest information and insights into the best stocks to invest in right now, download your free stock report.

What makes a good investment in stocks?

A good stock investment should suit your tolerance for risk and provide you with the result you’re looking for, especially in the long term. This is why it’s essential to know the importance of trends in the market. And have the know-how to evaluate balance sheets and other financial metrics. This determines whether a company is in good health with growth potential. To get real value out of your investment, it’s best to ignore daily movements and short-term market trends and focus on a company’s fundamentals for long-term growth and performance.

How do you know what a good stock is?

There are certain steps you can take to determine the best stocks to invest in:

- Research what the company produces. How does it make its money? Companies often provide information for investors, and you can also check their website and other sources about their business activities.

- Study their financial reports to determine the underlying health and growth potential of the company. If you don’t like to look over financials, don’t stress. At Sharewise, we’ve already done this legwork for you with our free report.

- Monitor the stock and spot important trends. This can help you see whether the stock is currently undervalued (which is worth buying) or overvalued.

- Listen to expert opinion. Our team of experts regularly update our free stock report containing new and emerging investment opportunities for your portfolio.

How do I buy stocks to invest in?

To invest in stocks, you can open a brokerage account and start buying shares of companies listed on the ASX. Diversifying your portfolio across various sectors can help spread risk. Besides shares, you can also explore Exchange-Traded Funds (ETFs) that offer a diverse range of investment options for building your portfolio.

How often should I review my stock investments?

It depends on how much your investments mean to you. At a bare minimum, you should review them annually or semi-annually, and this should include a review of the best stocks to invest in. A good way to regularly monitor your shares is to set up a ‘watch list’ for the shares you own using your online broker account. This keeps you in the loop on share prices, dividends and price-sensitive announcements.

What is the risk of investing in stocks?

No stocks are entirely safe. When you are looking for stocks to invest in, it has a lot to do with your tolerance for risk. You might prefer to buy stocks in very stable companies with a consistent track record of paying regular dividends. This is considered much safer than investing in companies that might be experiencing rapid growth but are often high-risk. The important thing is to assemble an investment portfolio that meets your needs and preferences.