Stock Brokers Melbourne

Melbourne is one of Australia’s leading financial centres, supported by a strong economy, advanced infrastructure and a vibrant community of professionals. Melbourne, and more broadly Victoria is home to major superannuation funds, financial services firms, fund managers and an expanding fintech industry.

This thriving environment attracts top professional talent, including leading stock brokers in Melbourne. They offer investors market insights, general investment advice and diversified portfolio creation. Among Melbourne brokers, Sharewise stands out as a full-service provider, delivering institutional-grade advice, seamless trade execution, disciplined risk management, and an outstanding performance record. Here’s how Sharewise can help you on your investment journey.

Why Work With Our Team

Sharewise offers a complete, end-to-end service that includes general advice, trade execution and ongoing portfolio management. Unlike many advisors who provide recommendations without follow-through, Sharewise acts on your behalf to protect gains and limit losses while executing your trades.

By working with our team of experienced share brokers, you gain access to local market knowledge, benefit from strong connections to Melbourne’s major financial institutions, and receive notice on a wide range of investment opportunities.

You’ll also have support whenever you need it. With a dedicated investment manager, regular market insights and brokers who stay connected, you’ll be kept up-to-date with the latest market developments.

How Sharewise Helps You Choose the Best Stocks.

Institutional Quality Research

Make informed decisions with confidence.

Dive into comprehensive stock-specific analysis, focused on all companies, from blue-chip to micro-cap. Our extensive research, led by Chief Investment Office Rabbi (Rabih) Ahmed, and support by our team of equity research analysts, ensure you have a deep understanding of the market landscape to invest with clarify and assurance.

Account & Portfolio Management

Your investments, our dedicated attention.

With a dedicated stockbroker, you can rest easy knowing your investments are under expert care. A Sharewise Managed Account allows your advisor to manage your portfolio on your behalf, ensuring strategic decision-making, timely buy and sell actions, and seamless trade execution. We conduct quarterly portfolio reviews and strategy sessions with you so you can enjoy a hands-off investment process.

Dedicated Investment Manager

Your partner in navigating the markets.

Our investment managers are licensed professionals with expert knowledge of the markets. They monitor stocks and market trends daily, managing risk while optimising your portfolio. Focused on maximising returns, they ensure your investments are actively managed and aligned with your objectives.

Timely Stock Recommendations

Never miss an opportunity.

Backed by in-depth research and a clear investment thesis, our buy and sell recommendations go beyond simple tips. Each recommendation is a strategic insight built on real company data, financial fundamentals, and advanced technical analysis. We focus on ensuring you understand exactly what you're investing in and why, delivering actionable trade opportunities with clear rationale.

Professional Risk Management

Stay focused, even in volatile markets.

We take emotions out of investing. Our investment managers use research, data and market signals to guide decisions. By staying disciplined and responsive to market changes, we help investors remain focused when markets move quickly.

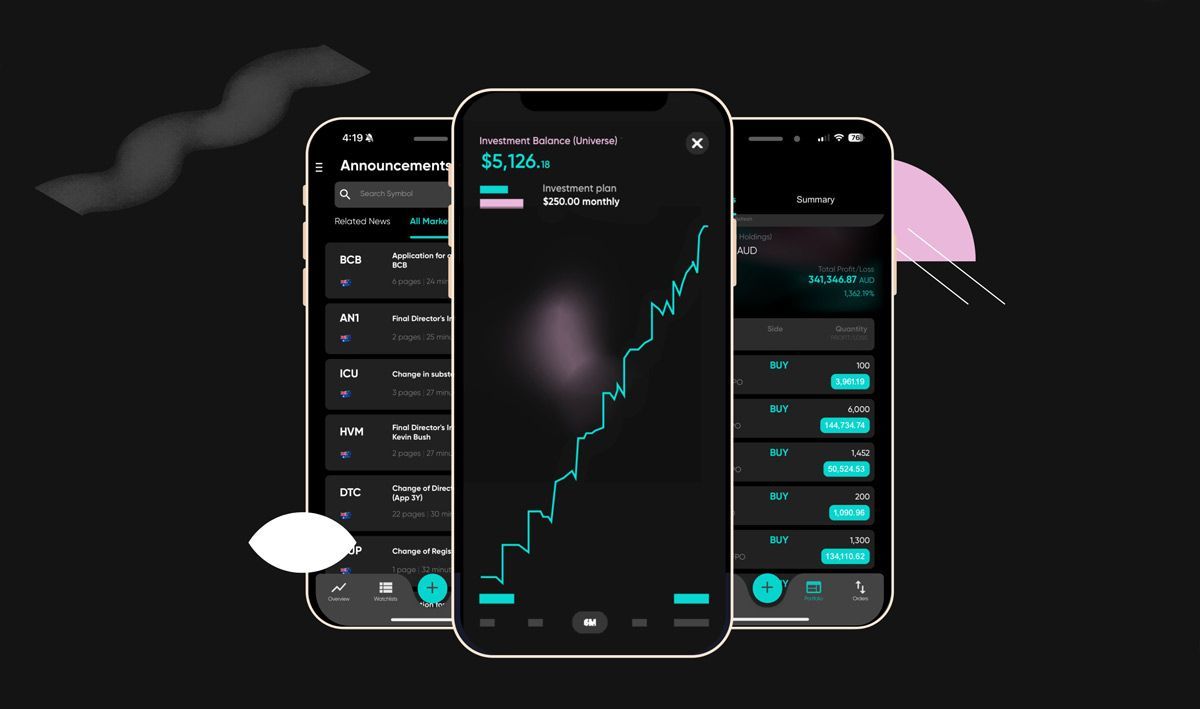

Access to Client Portal

Never miss an opportunity.

Our exclusive client portal gives you 24/7 access to our daily market research, in-depth stock analysis, and buy/sell recommendations. Whether you're at home or on the go, you can stay informed with up-to-date insights and make well-informed decisions. Our user-friendly platform ensures you’re always connected to the latest market trends, putting expert guidance at your fingertips.

Full-Service Share Brokers Melbourne

Full-service stockbrokers in Melbourne offer comprehensive support, from detailed market research and personalised advice to trade execution and ongoing portfolio and risk management. They are well-suited to investors looking for hands-on guidance, long-term planning, and management of their investments from start to finish.

Online & Discount Stock Brokers Melbourne

Online and discount brokers offer a convenient, low-cost way to invest. Using digital platforms, investors can track markets in real time and make trades from any location. These brokers suit self-directed investors who are comfortable with online tools and who are confident sticking to their strategy amidst market moves.

Robo-Advisors & Digital Investment Brokers

Robo-advisors and digital platforms use AI and algorithms to manage portfolios automatically. They handle risk assessment, diversification and portfolio rebalancing cost-effectively. These options can appeal to investors who are not confident in reading the market, or who prefer a set-and-forget style of investing.

What To Look For In The Best Stock Brokers In Melbourne

So, who is going to be the best stock broker in Melbourne for you? The answer depends upon a number of factors, which should be measured against your preferred investment approach and long-term goals.

Services Offered - What services, trading platforms and investment options does the broker provide? Do their capabilities align with your goals, and do they support the way you want to manage your investments?

Experience & Reputation - How is the broker regarded by clients and peers? Is their market analysis produced by knowledgeable professionals? Are they regulated by ASIC and compliant with industry standards?

Track Record - How has the broker performed historically, relative to the market? What portfolio management and risk strategies are in place to help support future results?

Costs

- What fees or commissions apply, and how do these compare to other brokers offering similar services? Are the costs justified by the value provided?

Delivering Consistent, Proven Results For Our Clients

As a leading Melbourne broker, Sharewise boasts an impressive performance history. By combining research-driven investment strategies with disciplined risk management, our clients benefit from returns that consistently outperform the market.

Our return is calculated based on a 1% risk allocation of portfolio value, multiplied by the cumulative risk-to-reward ratio of the positions. In other words, if 1% of your portfolio's value was allocated as risk to each recommended position, this is how your portfolio would have performed across all recommendations provided.

Past performance is not indicative of future performance.

When you partner with Sharewise, you’ll know your portfolio is managed by high-performing professionals who are committed to your long-term financial goals.

Your Investment Journey to Wealth Creation.

Discover how Sharewise helps you build lasting wealth through expert advice, market intelligence, and proactive portfolio support - every step of the way.

Step 1: Start Your Journey with Confidence

Speak with one of our experienced investment managers to understand how we work and how we can support your investment objectives. Whether you’re new to investing or looking to take the next step, we’ll meet you where you are.

Step 2: Navigate the Markets with Clarity

Access our global market updates and institutional-grade research designed to help investors make more informed decisions across all conditions.

Step 3: Act on Research-Backed Ideas

Access timely buy and sell recommendations based on technical and fundamental analysis - helping you act with conviction when opportunities arise.

Step 4: Portfolio Oversight

Stay connected to your investments with ongoing oversight from your Sharewise investment manager. We help you monitor your portfolio, provide general advice based on market conditions, and keep you informed about opportunities that may impact your holdings.

Step 5: Build Resilience Through Risk Management

We support you in identifying and managing risk through research-led insights and regular updates - helping you stay focused, even when markets shift.

Step 6: A Journey of Long-Term Success

Your investment journey doesn’t end with one trade. We’re here for the long haul - providing continuous insights, opportunities, and support to help you stay on track over time.

What Our Clients Are Saying!

Your Success in the Market Starts Here.

At Sharewise, our approach to investing is built on clarity, precision, and strategy. By combining technical and fundamental analysis, we uncover opportunities and manage risk with a data-driven mindset. Our diversified approach ensures portfolios remain balanced, resilient, and adaptive to global market shifts.

Whether you’re navigating volatility or pursuing growth, our insights are designed to simplify complexity and empower informed decisions.

Data-Driven Decisions

Our investment philosophy combines technical and fundamentalanalysis to uncover opportunities and manage risk with precision. Every recommendation is backed by data, research, and professional expertise — ensuring each move is informed and strategic.

Superior Strategy

We take a diversified, multi-asset approach to investing, balancing risk and reward across global markets. This strategy is designed to enhance returns, manage volatility, and protect your portfolio through all market cycles.

Resilient and Adaptable

Markets evolve — and so do we. Our team proactively adjusts strategies in response to global economic and political shifts, positioning portfolios to capture growth during bullish phases and remain resilient during downturns.

Effortless Portfolio Oversight

Your dedicated advisor manages the day-to-day performance of your portfolio while you remain in control of all trading decisions through our non-discretionary structure. This balance of professional management and client approval provides transparency, accountability, and confidence.

Strategic Risk Management

We carefully balance position sizes, correlations, and volatility to safeguard your investments. Through ongoing, proactive risk assessment, we maintain portfolio resilience and stability across changing market conditions.

Curated Market Insights

Our in-house analysts deliver institutional-grade research and stock recommendations, giving you access to the same calibre of insight used by professional investors.

How To Start Investing With A Share Broker

We promise you a straightforward investment journey, where you always feel well-informed and remain focused on long-term growth. Here’s how it works:

Step 1: Start your investment journey with confidence

Connect with one of our stock brokers in Melbourne to explore how we can support your financial goals. Whether you’re new to investing or seeking a more advanced strategy, we’ll tailor a strategy to fit your needs.

Step 2: Choose your membership

Select the Sharewise membership that best suits your investing needs. Whether you’re looking for ASX insights, global market exposure, or a bundled solution, you’ll have clarity on what’s included and how we support your investment journey from the outset.

Step 3: Explore the client portal

Once you’re onboarded, you’ll gain access to our exclusive client portal — your central hub for smarter investing. Here, you can access research, market updates, and portfolio insights designed to keep you informed 24/7.

Step 4: Strategy session

Your journey continues with a dedicated strategy session with your share advisor. We take the time to understand your investment objectives, risk profile, and time horizon, and explain how our services align with your goals.

Step 5: Portfolio review

Our analysts conduct a detailed review of your existing portfolio (if applicable), providing clear, research-backed guidance on your holdings and outlining next steps based on fundamental and technical analysis.

Step 6: Managed account

For clients seeking a more hands-on approach, we open a managed (non-discretionary) account. Your advisor actively implements strategies, manages risk, and monitors your portfolio — with all trades executed only with your approval, ensuring full transparency and control.

Frequently Asked Questions.

What services do Melbourne stock brokers provide, and how can they support my investment goals?

Melbourne stock brokers assist with buying and selling shares in both Australian and international markets. They may also offer market analysis, guidance on selecting stocks, trade execution, and ongoing support to help you manage your portfolio over time.

How do you find and choose the best stock broker in Melbourne?

When selecting a stock broker, look at reputation, fees, trading tools, quality of research, customer service and range of offerings. Make sure these factors align with your investment style, goals, and how actively you want to manage your portfolio.

What fees should you expect when working with a stock broker?

Brokerage fees vary depending on the broker and account type. Online and discount brokers often charge a fixed or low-percentage fee per trade, while full-service brokers may charge commissions or advisory fees. Always compare costs for the same level of service to make an informed choice.

Can first-time investors get started with a Melbourne stock broker or through online trading platforms?

Full-service brokers are suitable for new investors seeking personalised guidance, trade support and portfolio management. Online platforms appeal to beginners who want to learn independently, manage costs, and take a more hands-on approach.

Should I choose a full-service stock broker or an online trading platform for investing?

It depends on your investing style and how much support you want. Full-service brokers provide tailored advice, trade execution and portfolio oversight, streamlining the investment process. Online platforms offer lower-cost, self-directed trading for those who prefer control and independence.

How does Sharewise help Melbourne investors to make smarter stock market decisions?

Sharewise is a full-service stock broker that delivers professional-grade research to Melbourne investors, along with timely trade recommendations, portfolio oversight, risk management and trade execution.