Best Stock Brokers In Sydney

Sydney is Australia’s thriving financial hub, home to the nation’s premier banking, investment and stock broking services. Major global banks are headquartered here, as are the Australian Securities Exchange and Reserve Bank of Australia. The Barangaroo district sits at the heart of financial activity.

Major stock brokers also make Sydney their home, drawn to its financial infrastructure and deep talent pool. These brokers play a crucial role in helping local investors access market insights and make well-informed investment decisions.

Among Sydney’s stock brokers, Sharewise stands out. As a full-service broker, Sharewise delivers institutional-grade advice, seamless trade execution and sound risk management. For investors seeking a trusted partner in Australia’s financial hub, Sharewise’s deep expertise and outstanding performance record make it an exceptional choice.

Why Work With Our Team

By partnering with our Sydney-based team, you gain access to local expertise that’s tuned in to market movements and connected to Australia’s leading financial institutions.

Our full-service approach means the investment process is simple, while ensuring every move fits with your broader financial objectives. We don’t just offer advice, we implement it, and that means disciplined stop-loss protection, timely profit-taking and better risk management for you.

What’s more, we’re always here to help, with a dedicated investment manager, timely market updates and brokers who stay connected during and after trading hours.

How Sharewise Helps You Choose the Best Stocks.

Institutional Quality Research

Make informed decisions with confidence.

Dive into comprehensive stock-specific analysis, focused on all companies, from blue-chip to micro-cap. Our extensive research, led by Chief Investment Office Rabbi (Rabih) Ahmed, and support by our team of equity research analysts, ensure you have a deep understanding of the market landscape to invest with clarify and assurance.

Account & Portfolio Management

Your investments, our dedicated attention.

With a dedicated stockbroker, you can rest easy knowing your investments are under expert care. A Sharewise Managed Account allows your advisor to manage your portfolio on your behalf, ensuring strategic decision-making, timely buy and sell actions, and seamless trade execution. We conduct quarterly portfolio reviews and strategy sessions with you so you can enjoy a hands-off investment process.

Dedicated Investment Manager

Your partner in navigating the markets.

Our investment managers are licensed professionals with expert knowledge of the markets. They monitor stocks and market trends daily, managing risk while optimising your portfolio. Focused on maximising returns, they ensure your investments are actively managed and aligned with your objectives.

Timely Stock Recommendations

Never miss an opportunity.

Backed by in-depth research and a clear investment thesis, our buy and sell recommendations go beyond simple tips. Each recommendation is a strategic insight built on real company data, financial fundamentals, and advanced technical analysis. We focus on ensuring you understand exactly what you're investing in and why, delivering actionable trade opportunities with clear rationale.

Professional Risk Management

Stay focused, even in volatile markets.

We take emotions out of investing. Our investment managers use research, data and market signals to guide decisions. By staying disciplined and responsive to market changes, we help investors remain focused when markets move quickly.

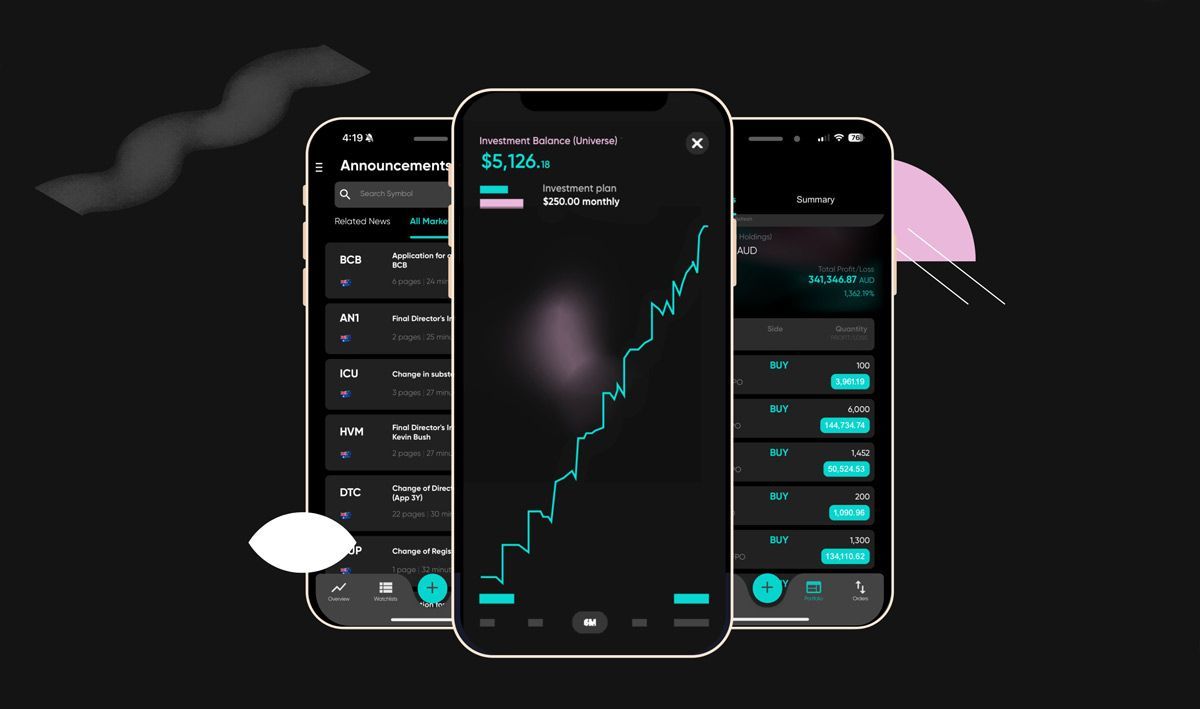

Access to Client Portal

Never miss an opportunity.

Our exclusive client portal gives you 24/7 access to our daily market research, in-depth stock analysis, and buy/sell recommendations. Whether you're at home or on the go, you can stay informed with up-to-date insights and make well-informed decisions. Our user-friendly platform ensures you’re always connected to the latest market trends, putting expert guidance at your fingertips.

Full-Service Share Brokers Sydney

For investors seeking personalised advice and ongoing partnership, a full-service share broker is ideal. This type of broker provides in-depth market research and tailored advice, executes trades, and offers ongoing portfolio and risk management. Full-service brokers are ideally suited to investors seeking comprehensive financial management and help with long-term planning.

Online & Discount Stock Brokers Sydney

Online and discount stock brokers have become a popular choice for investors who favour convenience and affordability. Operating on digital platforms, users can monitor markets in real time and execute trades quickly from anywhere. These brokerage platforms suit self-directed investors who are comfortable using online tools to drive decision-making and have good trading discipline.

Robo-Advisors & Digital Investment Brokers

AI-driven robo-advisors offer investors data-driven, active portfolio management, while benefiting from cost-effective automation. These digital investment brokers rely on algorithms to assess risk tolerance, diversify holdings and rebalance portfolios. They can suit set-and-forget investors and those without deep market knowledge who nevertheless prefer not to engage a full-service broker.

What To Look For In The Best Stock Brokers In Sydney

So, which stock broker in Sydney is going to be the best for you? Several factors should be considered when making your decision.

Brokerage inclusions - What investment options and trading platforms does the stock broker support? What is the extent of their services, and how do these match what you seek?

Reputation and expertise - Do clients rate the broker highly? Is their analysis provided by reputed professionals? Are they regulated by ASIC to ensure high standards are met?

Performance - How has past performance compared to the market? What portfolio and risk management strategies are in place to support future performance?

Fees - What is the fee and commission structure? How does this compare to others offering the same level of service?

The best stock broker for you will be the one who delivers in each of these areas in a way that aligns with your specific needs.

Delivering Consistent, Proven Results For Our Clients

As one of the best-performing stock brokers in Sydney, Sharewise’s results speak for themselves. Our focus on research-backed investment, coupled with sound risk management principles, has delivered returns that consistently outperform the market.

Our return is calculated based on a 1% risk allocation of portfolio value, multiplied by the cumulative risk-to-reward ratio of the positions. In other words, if 1% of your portfolio's value was allocated as risk to each recommended position, this is how your portfolio would have performed across all recommendations provided.

Past performance is not indicative of future performance.

You can feel confident knowing your investment portfolio is guided by experienced professionals and a team committed to your financial success.

Your Investment Journey to Wealth Creation.

Discover how Sharewise helps you build lasting wealth through expert advice, market intelligence, and proactive portfolio support - every step of the way.

Step 1: Start Your Journey with Confidence

Speak with one of our experienced investment managers to understand how we work and how we can support your investment objectives. Whether you’re new to investing or looking to take the next step, we’ll meet you where you are.

Step 2: Navigate the Markets with Clarity

Access our global market updates and institutional-grade research designed to help investors make more informed decisions across all conditions.

Step 3: Act on Research-Backed Ideas

Access timely buy and sell recommendations based on technical and fundamental analysis - helping you act with conviction when opportunities arise.

Step 4: Portfolio Oversight

Stay connected to your investments with ongoing oversight from your Sharewise investment manager. We help you monitor your portfolio, provide general advice based on market conditions, and keep you informed about opportunities that may impact your holdings.

Step 5: Build Resilience Through Risk Management

We support you in identifying and managing risk through research-led insights and regular updates - helping you stay focused, even when markets shift.

Step 6: A Journey of Long-Term Success

Your investment journey doesn’t end with one trade. We’re here for the long haul - providing continuous insights, opportunities, and support to help you stay on track over time.

What Our Clients Are Saying!

Your Success in the Market Starts Here.

At Sharewise, our approach to investing is built on clarity, precision, and strategy. By combining technical and fundamental analysis, we uncover opportunities and manage risk with a data-driven mindset. Our diversified approach ensures portfolios remain balanced, resilient, and adaptive to global market shifts.

Whether you’re navigating volatility or pursuing growth, our insights are designed to simplify complexity and empower informed decisions.

Data-Driven Decisions

Our investment philosophy combines technical and fundamentalanalysis to uncover opportunities and manage risk with precision. Every recommendation is backed by data, research, and professional expertise — ensuring each move is informed and strategic.

Superior Strategy

We take a diversified, multi-asset approach to investing, balancing risk and reward across global markets. This strategy is designed to enhance returns, manage volatility, and protect your portfolio through all market cycles.

Resilient and Adaptable

Markets evolve — and so do we. Our team proactively adjusts strategies in response to global economic and political shifts, positioning portfolios to capture growth during bullish phases and remain resilient during downturns.

Effortless Portfolio Oversight

Your dedicated advisor manages the day-to-day performance of your portfolio while you remain in control of all trading decisions through our non-discretionary structure. This balance of professional management and client approval provides transparency, accountability, and confidence.

Strategic Risk Management

We carefully balance position sizes, correlations, and volatility to safeguard your investments. Through ongoing, proactive risk assessment, we maintain portfolio resilience and stability across changing market conditions.

Curated Market Insights

Our in-house analysts deliver institutional-grade research and stock recommendations, giving you access to the same calibre of insight used by professional investors.

How To Start Investing With A Share Broker

We’re all about simplifying your share investing journey, maintaining a focus on long-term growth and keeping you well informed along the way. Here’s how Sharewise’s Sydney stock brokers can help you start investing.

Step 1: Choose your membership

Select the Sharewise membership that best suits your investing needs. Whether you’re looking for ASX insights, global market exposure, or a bundled solution, you’ll have clarity on what’s included and how we support your investment journey from the outset.

Step 2: Explore the client portal

Once you’re onboarded, you’ll gain access to our exclusive client portal — your central hub for smarter investing. Here, you can access research, market updates, and portfolio insights designed to keep you informed 24/7.

Step 3: Strategy session

Your journey continues with a dedicated strategy session with your share advisor. We take the time to understand your investment objectives, risk profile, and time horizon, and explain how our services align with your goals.

Step 4: Portfolio review

Our analysts conduct a detailed review of your existing portfolio (if applicable), providing clear, research-backed guidance on your holdings and outlining next steps based on fundamental and technical analysis.

Step 5: Managed account

For clients seeking a more hands-on approach, we open a managed (non-discretionary) account. Your advisor actively implements strategies, manages risk, and monitors your portfolio — with all trades executed only with your approval, ensuring full transparency and control.

Are you an active investor or simply curious?

Attend one of our free investor events at our Milsons Point office in Sydney.

List of Services

-

Stocks and Sips - Rural Funds Group (ASX:RFF) Our Stocks and Sips evening with Rural Funds Group (ASX:RFF) featured a live Q&A with Chief Operating Officer Tim Sheridan and General Manager James Powell, who shared insights into RFF’s portfolio strategy, growth drivers, and the role of emerging agri-tech in modern agriculture. The discussion explored market trends, climate considerations, and the key indicators investors should watch over the next 12–18 months, followed by drinks, gourmet food, and networking at the Sharewise office.Stocks and Sips - Rural Funds Group (ASX:RFF)

-

Stocks and Sips - Imugene (ASX:IMU) Our Stocks and Sips evening with Imugene (ASX:IMU) featured a live Q&A and presentation with CEO and Managing Director Leslie Chong, who shared insights into Imugene’s allogeneic CAR T platform, azer-cel - an “off-the-shelf” therapy reshaping cancer treatment. The discussion explored clinical progress, investment potential, and Imugene’s role in the future of oncology, followed by drinks, gourmet food, and networking at the Sharewise office.Stocks and Sips - Imugene (ASX:IMU)

-

Stocks and Sips - Calix (ASX:CXL) On Thursday 4 September, we hosted an exclusive Stocks and Sips event with Calix (ASX:CXL) CEO Phil Hodgson. Guests heard how Calix is scaling its patented technology to decarbonise cement, lime, batteries, and green iron — including insights into its $44.9 million ARENA-backed ZESTY project. The evening included live Q&A, drinks, and networking at the Sharewise office.Stocks and Sips - Calix (ASX:CXL)

-

Stocks and Sips – Decidr Ai Industries (ASX:DAI) We were joined by Decidr AI Executive Director David Brudenell for an insightful conversation on building in AI, the future of decision-making technology, and what it takes to grow a listed tech company — all part of our latest Stocks and Sips event.Stocks and Sips – Decidr Ai Industries (ASX:DAI)

-

Stocks & Sips – Lunchtime Q&A with Sankar Narayan, CEO of SiteMinder SiteMinder CEO Sankar Narayan joined us for a candid Q&A on leadership, resilience, and navigating the ASX — at our first-ever Stocks & Sips event.Stocks & Sips – Lunchtime Q&A with Sankar Narayan, CEO of SiteMinder

Frequently Asked Questions.

What does a Sydney stock broker do & how can they help you invest?

A Sydney stock broker will help you buy and sell shares in local and international markets. Depending on the level of service offered, they may also provide market insights, guidance in picking stocks, and help manage your portfolio over the longer term.

How do you choose the best stock broker in Sydney?

To find the best stock broker for you, look at reputation, fees, trading platforms, research quality, customer support and the range of services offered, and consider how well they align with your investment style and goals.

What are the typical brokerage fees?

Fees can vary by broker as well as by brokerage type - online and discount brokers often charge a flat fee or low percentage per trade, while full-service brokers may charge commissions or advisory fees. When comparing fees across stock brokers, be sure you are doing so for the same level of service. You can see Sharewise fees here.

Can beginners start investing with a Sydney stock broker or online platforms?

Beginners can start investing with both full-service brokers and online platforms. Full-service stock brokers will suit Sydney investors seeking guidance, personalised recommendations, and help executing trades. Online platforms will appeal to investors keen to learn to do things themselves or who are more budget-focused.

Is it better to use a full-service broker or an online share trading platform?

Your ideal stock broking platform will depend on your investment and decision-making style. Full-service brokers offer personalised advice, trade execution and broader portfolio management, streamlining the whole investment process. Online platforms provide low-cost, self-directed trading for investors who want to be more hands-on and independent in their decision-making.

How does Sharewise help Sydney investors make smarter stock market decisions?

Sharewise partners with Sydney investors who are looking to build stock market wealth over the long term. As a full-service stock broker, Sharewise provides expert research, trade recommendations, portfolio and risk management, along with trade execution.