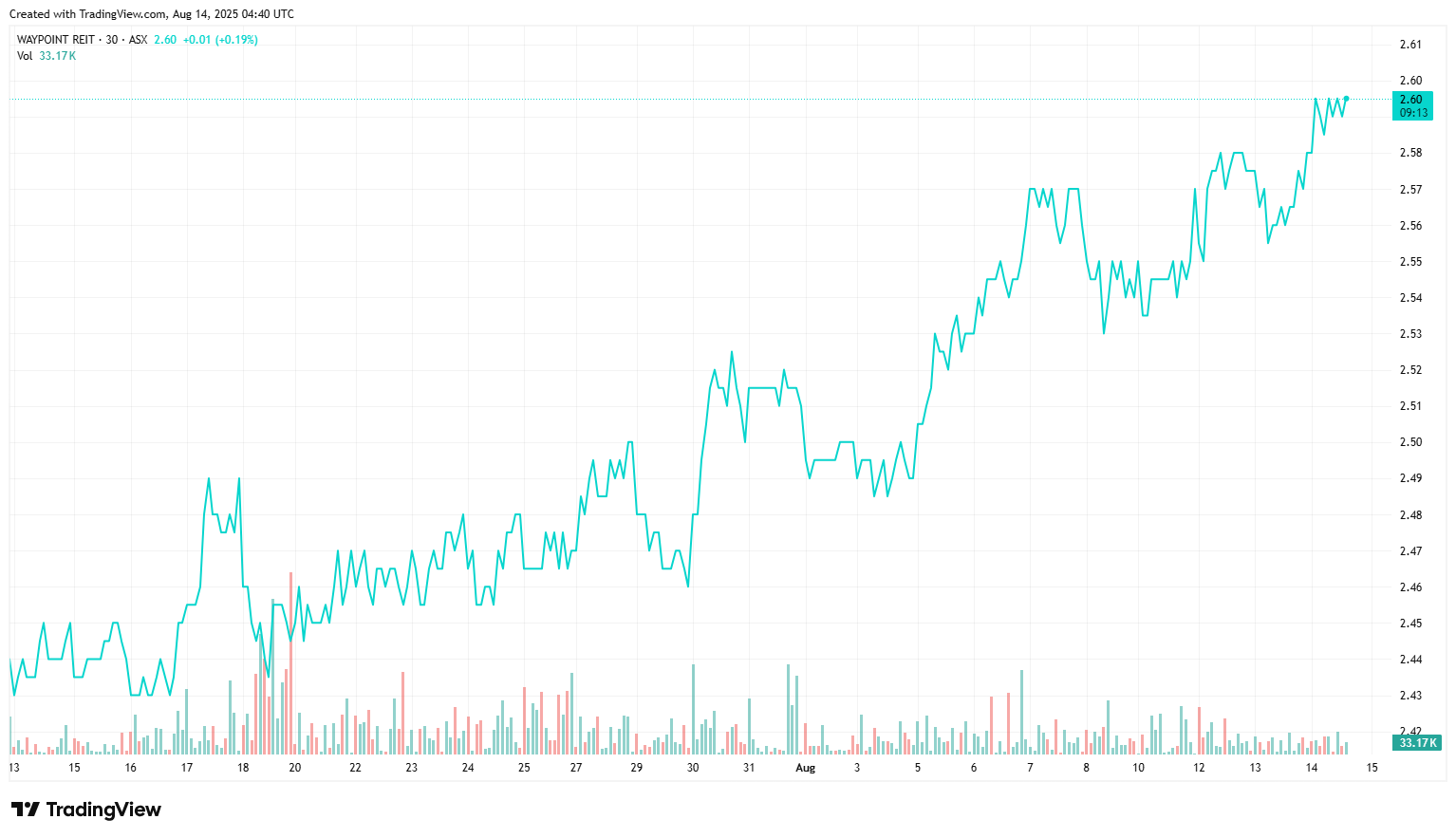

Stock Spotlight: Waypoint REIT Ltd – Neutral (ASX:WPR)

About Waypoint REIT Ltd

Waypoint REIT is Australia's largest listed REIT owning solely fuel and convenience retail properties; it has a high-quality network across all Australian States and mainland Territories. Waypoint REIT's objective is to maximise the long-term returns from the portfolio for the benefit of all securityholders. Waypoint REIT is a stapled entity in which one share in Waypoint REIT Limited (ABN 35 612 986 517) is stapled to one unit in the Waypoint REIT Trust (ARSN 613 146 464). This ASX announcement is prepared for information purposes only and is correct at the time of release to the ASX.

Key Stats

Key Stats

Source: Yahoo Finance. Data as of 14/08/25.

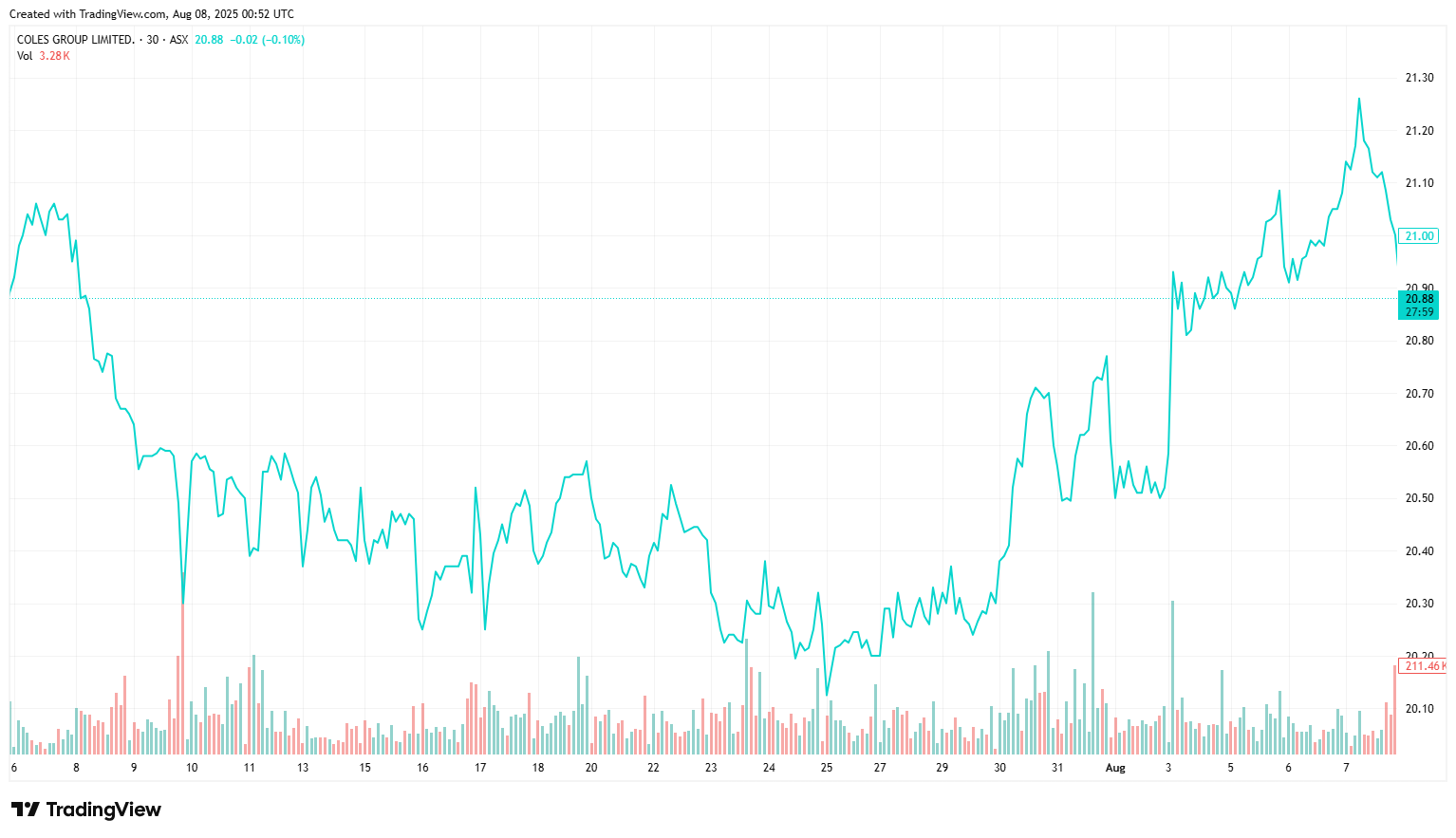

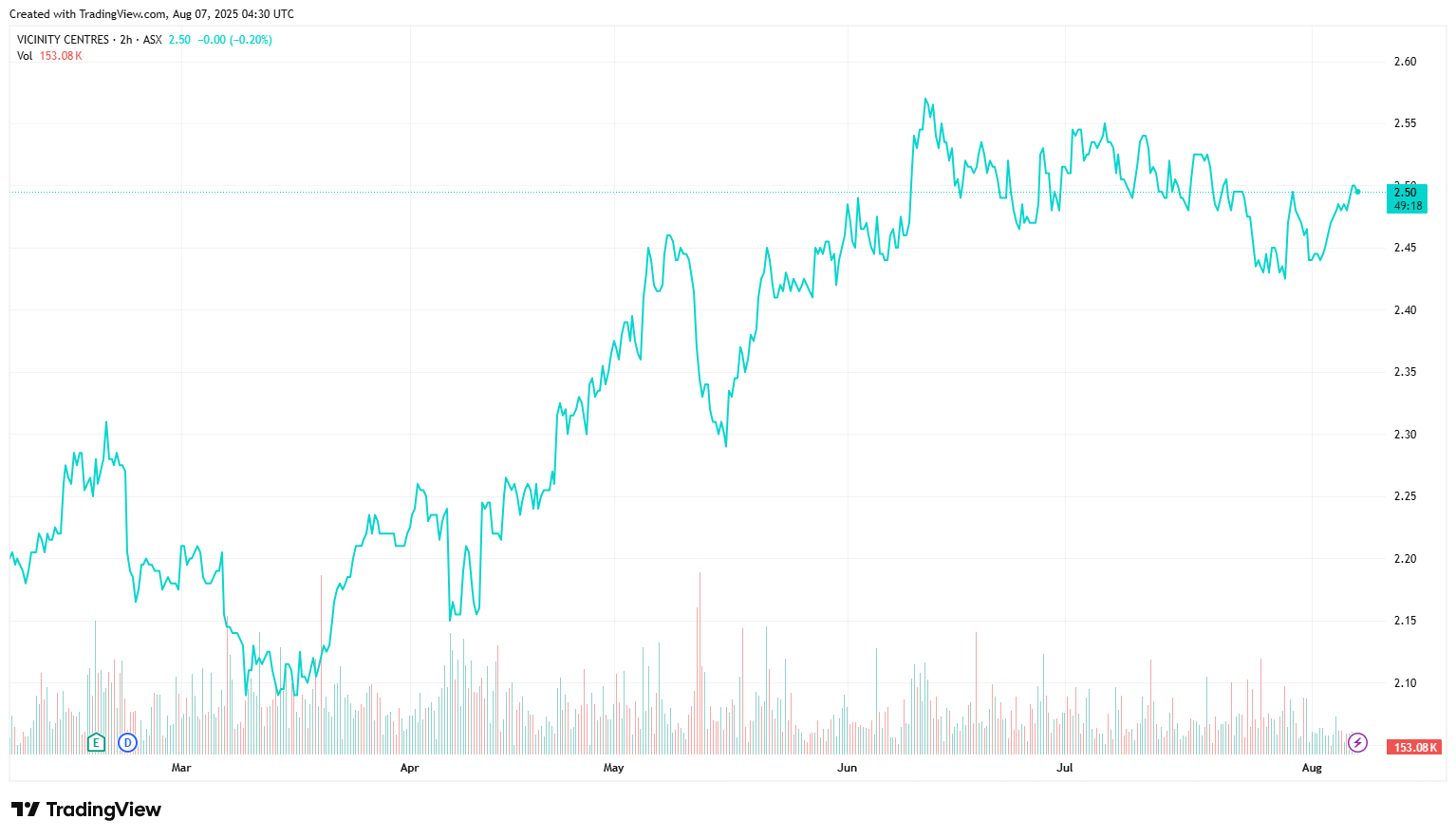

Price Performance

Growth Potential

- Strong momentum in cloud with Azure’s growth flywheel (growth fueled by demand for AI workloads, hybrid cloud and mission-critical enterprise migration) driving market share gains (took share in Azure infrastructure in every quarter in FY25 as the company has more data center regions than competitors and is scaling data center capacity faster than competitors).

- AI driving multi-decade growth with the company not only having first-mover advantage in AI commercialization (early and exclusive partnership with OpenAI has embedded GPT models into Office 365/Copilot, Azure, GitHub Copilot and Dynamics 365) but also owning both the infrastructure (Azure) and application layer.

- Solid free cash flow generation and strong balance sheet enables aggressive reinvestment in AI infrastructure, strategic acquisitions and consistent shareholder returns ($57.3bn remaining under current buyback authorization).

- Recurring and resilient revenue base with >70% of revenue being subscription-based (enterprise contracts are multi-year with high renewal rates, creating visibility and stability in cash flows, even during economic slowdowns) spanning Office 365, Azure, LinkedIn and Game Pass.

- Expanding ecosystem with ability to cross-sell cloud, AI, cybersecurity, productivity, and developer tools to the same customer.

Key Risks

- Competitive & macro pressures in key markets – if the growth rate for Azure slows the market would view this as a negative.

- New product releases or updates fail to resonate with customers.

- Value destructive acquisition(s).

- Adverse movements in currency (USD).

- Intellectual property theft and piracy.

Subscribe to our newsletter

Disclaimer: This article does not constitute financial advice nor a recommendation to invest in the securities listed. The information presented is intended to be of a factual nature only. Past performance is not a reliable indicator of future performance. As always, do your own research and consider seeking financial, legal and taxation advice before investing.