Stock Spotlight: Wesfarmers Limited (ASX:WES)

Wesfarmers Limited (ASX: WES) is one of Australia’s most diversified and influential conglomerates, with operations spanning retail, industrial, chemical, energy, health and digital sectors. Starting over a century ago as a West Australian farmer’s cooperative, Wesfarmers is now one of Australia’s most significant employers, and the home of powerhouse brands such as Bunnings, Kmart, Officeworks and Priceline. Now moving into digital, health and lithium production spaces, Wesfarmers’ diverse business model provides resilience during changing economic circumstances.

WES is one of the ASX’s top 10 ‘blue-chip’ stocks, with over $93 billion in market capitalisation. Its diversified revenue base, commitment to long-term value creation and regular, fully-franked dividends make it a core holding for both institutional and individual investors. Wesfarmers shares offer steady, anticipated growth for long-term investors and consistent dividend returns to income-seekers. It also provides exposure to a broad range of industries through a single investment for those looking for diversification in their portfolios.

About Wesfarmers Limited

Wesfarmers began in 1914 as a farmer’s cooperative in Western Australia, with the aim of supporting rural producers through collective buying and selling. Over the decades, Wesfarmers steadily expanded into an ever-increasing range of industries, including dairy, fertilisers, transport and grain. Wesfarmers was listed on the Australian Stock Exchange in 1984, and continued to pursue a growth strategy through acquisitions including Bunnings, Coles Group, the Kmart Group and Australian Pharmaceutical Industries. It also moved into industrial, chemical, gas and insurance industries, and reconfigured through a number of divestments.

Today, Wesfarmers is structured into eight groups: Bunnings Group; Kmart Group; Chemicals, Energy & Fertilisers; Officeworks; Industrial & Safety; Wesfarmers Health; Wesfarmers OneDigital and Other Activities. Wesfarmers remains headquartered in Perth and operates across all Australian states and territories. With around 120,000 workers, Wesfarmers has become one of Australia's largest employers and most significant companies.

Today, ASX: WES is one of Australia’s top 10 listings, with a market capitalisation of over $93 billion. It is the number one stock in the Consumer Cyclical sector, and is considered a blue-chip investment, with stocks being owned by more than 500,000 investors.

What Makes WES Stocks A Strong Investment Choice?

ASX: WES is regarded as a high-quality defensive stock, resilient in the face of changing economic circumstances, thanks to its diversified portfolio of businesses. With a spread across retail, health, industrial and resource sectors, it is cushioned against downturns in any one area, and more able to generate consistent cash flow.

Wesfarmers’ market-leading brands—including Bunnings, Kmart, Officeworks and Priceline—give it a competitive edge in multiple retail spheres. The management team is known for retaining focus on long-term value creation, supported by disciplined capital management and operational excellence.

Wesfarmers stock is held by a large base of institutional investors, is highly liquid, and has a consistent record for fully-franked dividend payouts. As such, ASX: WES is considered a core holding for investors seeking income as well as long-term gains through a steadily rising WES ASX share price.

Key Stats

Key Stats

Source: Yahoo Finance, ASX. Data as of 06/08/25.

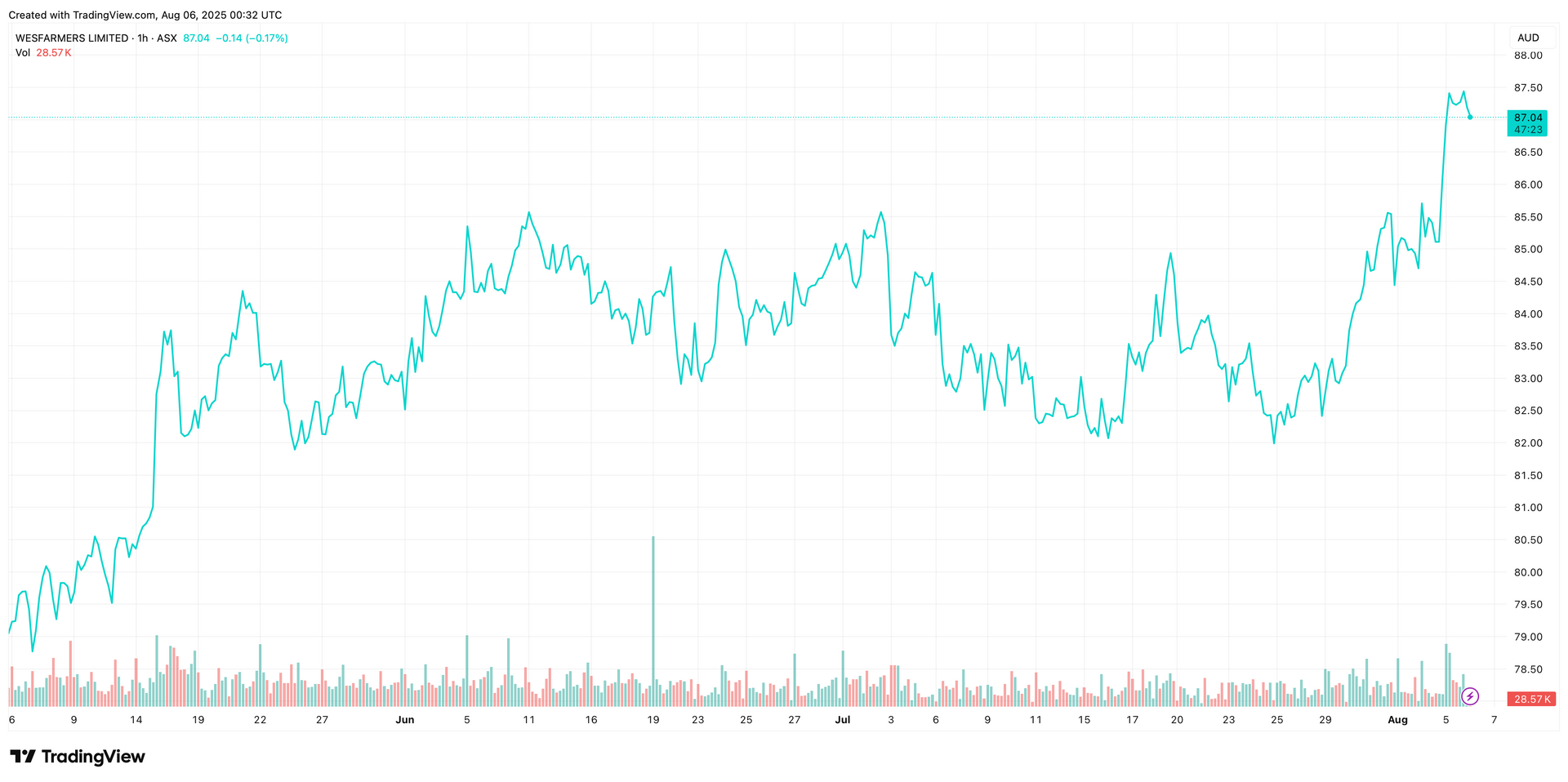

Price Performance

Growth Potential

Wesfarmers’ primary objective is to deliver satisfactory returns to shareholders through operational excellence, entrepreneurial initiative, more value-added transactions and responsible long-term management. Wesfarmers’ diversified portfolio positions it well to capture growth opportunities in various sectors. Growth potential is supported in the following ways:

- Healthy profit contributions from businesses such as Bunnings, Kmart, Officeworks, Health and Industrial & Safety, may offset weaker returns, as experienced in Chemicals & Fertilisers.

- Popular retail brands, including Bunnings and Kmart, enjoy strong market positioning and are well placed to succeed in a changing retail environment.

- Wesfarmers stands to benefit from expansion in Australia’s mining and agricultural industries, as it manufactures key industrial products for these sectors.

- With health and pharmaceutical brands such as Priceline Pharmacies, InstantScripts and SILK Laser, the group will benefit from high anticipated growth in the health, beauty and wellness sectors.

- Wesfarmers periodically renews its portfolio of businesses through acquisitions and divestments to align with future growth opportunities.

- Investments in technical innovation, such as OneDigital and the OnePass loyalty program, support the increasing demand for an integrated, omnichannel retail experience and broader customer engagement.

- Wesfarmers is actively pursuing decarbonisation targets across its businesses, appealing to an investor market that increasingly favours sustainability-focused businesses.

- Wesfarmers’ joint venture with Covalent Lithium is expected to reach full commercial production of battery-grade lithium hydroxide by 2026. This is expected to become a significant growth driver.

- Diversified asset base with core assets continuing to grow (Bunnings; Kmart and WesCEF).

- Expect improving performance from Officeworks.

- On-going focus on shareholder return including solid yield.

- Strong management team.

- Strong balance provides flexibility to take advantage of opportunities as they arise.

- Potential capital management initiatives.

Upcoming Innovations From Wesfarmers Limited

Wesfarmers has made significant investments in technology to effect digital transformation across its portfolio of businesses. The OneDigital platform is driving multi-channel experiences in its retail brands, with over 220 million customer interactions each month. The OnePass loyalty program has also expanded with new partnerships and benefits.

Automation, radio-frequency identification of stock, digitised sourcing and supply chain analytics are also improving efficiencies in the retail and health businesses. These support lower costs, improved inventory management and an ability to meet customer demand more precisely.

Wesfarmers is also making gains in cutting emissions and retains a clear focus on sustainability targets across its businesses. Its joint venture in lithium production also means Wesfarmers will benefit from global decarbonisation efforts and rising battery demand. These initiatives position Wesfarmers as a digital, data-led group that is capable of adapting to significantly changing business environments.

WES Shares Returns & Investor Sentiment

ASX: WES provides a strong history of delivering sound total shareholder returns (TSR) through consistent dividends and share price performance. The WES dividend yield for the year to Feb 2025 was $2.02 or 2.45%, putting it solidly in the mid-range compared to other large-cap stocks (BHP - $2.48, CBA - $4.75) and sector competitors (Myer - $3.03, Harvey Norman $0.24). This reliable dividend performance has helped sustain investor confidence while broader market conditions have fluctuated.

Investor sentiment towards Wesfarmers remains positive overall. The stock is supported by a large base of institutional investors, who value its defensive characteristics and high liquidity. While there are some concerns over whether the WES ASX valuation ratio is high, some analysts have recently upgraded their view of the stock, recognising growth drivers like Bunnings, lithium and health.

Overall, sentiment towards the ASX WES share price appears to be bullish, due to Wesfarmers’ strategic capital allocation, consistent dividends, and capacity to perform across economic cycles.

Investment Tips For Buying Wesfarmers Limited (ASX:WES)

When looking to buy WES ASX stocks, investors should consider more than the current share price. Reviewing key indicators such as Earnings Per Share (EPS), Return On Invested Capital (ROIC) and Dividends Per Share (DPS) can provide insight into the company’s efficiency and long-term value prospects. The price-to-earnings (P/E) ratio can also be compared to other listed companies to help evaluate whether ASX: WES is trading at a fair value.

WES is generally considered a defensive, blue-chip stock and can provide a balance against higher-risk stocks within an investment portfolio. Consistent dividend payouts can make the stock attractive to investors seeking a reliable, moderate income. For investors with a focus on long-term growth, participating in the company’s dividend reinvestment plan will help compound long-term gains.

To monitor the performance of WES on the ASX, investors can track updates on sites such as the ASX and MarketIndex websites, or via online broker apps. These platforms provide real-time share prices, track key indicators, and provide market analysis, announcements and a record of dividend payouts.

Key Risks

- Wesfarmers has significant exposure to retail sector cycles, making it vulnerable to consumer spending slowdowns and changing consumer behaviour. This is somewhat mitigated by its holdings in non-retail sectors.

- Increases to supply costs—including wages, fuel, raw materials, consumer products and supply chain factors—will place downward pressure on profitability, especially in areas where competition makes increasing prices to the consumer difficult.

- Wesfarmers faces strong competition in some of its retail, health and industrial markets, necessitating constant innovation and improved operational efficiencies.

- Earnings from the chemical, energy and fertiliser businesses can be volatile due to fluctuations in commodity prices and demand.

- Long-term plays and developing sectors—including health, digital and lithium—face execution risk, and may be impacted by emerging technologies and competitors.

- Macroeconomic and geopolitical trends have the ability to impact both demand and global supply chains.

- Expect ongoing issues with Catch.

- Margin erosion due to competitive pressures.

- Disappointing earnings performance in Bunnings.

- Deterioration in the macro picture leading to lower retail sales activity and volumes.

- Deterioration in balance sheet metrics.

- Adverse movements in AUD/USD.

Frequently Asked Questions.

How has Wesfarmers’ dividend policy evolved over the past decade?

Wesfarmers holds a policy of distributing a high proportion of profits (typically 70–90% ) via dividend payouts. The WES dividend yield fluctuates slightly with earnings, but in recent years has remained between $0.88 and $1.07 biannually.

What impact do Wesfarmers’ acquisitions & divestments have on its share price?

Wesfarmers has made many acquisitions and several divestments in its history. When these are strategic, aligned to changing market conditions and opportunities, the WES ASX share price will typically rise, reflecting perceived long-term value creation.

How does WES compare to other ASX blue-chip stocks in terms of risk & return?

ASX: WES is generally considered a lower-risk, defensive, blue-chip stock, due to its diversification and strong cash flow. The stock offers steady capital appreciation and ongoing dividend income, rather than the shorter-term high-growth prospects that more dynamic sectors like mining or technology may offer.

What ESG (Environmental, Social, Governance) initiatives are driving Wesfarmers’ long-term strategy?

Wesfarmers is pursuing ambitious emissions and decarbonisation targets across its businesses and has recently invested in lithium production to help deliver more sustainable energy. In addition, the group is paying increasing attention to supply transparency, along with workforce safety and inclusion.

How exposed is Wesfarmers to changes in consumer spending trends?

With retail sectors a large part of its business holdings, Wesfarmers has significant exposure to trends in consumer sentiment and spending. Investment in new technology, updated retail strategies, and shifts into growing sectors such as health and digital help to mitigate this risk.

How can investors use Wesfarmers shares for dividend reinvestment strategies?

Wesfarmer’s Dividend Investment Plan allows investors to reinvest part or all of their ASX: WES dividend payments into the company, at a discount and without brokerage fees. This supports long-term investment growth for participating shareholders.

Subscribe to our newsletter

Disclaimer: This article does not constitute financial advice nor a recommendation to invest in the securities listed. The information presented is intended to be of a factual nature only. Past performance is not a reliable indicator of future performance. As always, do your own research and consider seeking financial, legal and taxation advice before investing.