Unwrapping the Santa Claus Rally: Lessons, Outlook, and Market Moves

Every December, investors start talking about the “Santa Claus Rally” — a term that sounds more like a festive myth than a market event. Yet this short seasonal window has been observed for decades, often delivering above-average returns at a time when most traders are winding down for the holidays. With the year drawing to a close and market volatility still a central theme, many are wondering whether Santa will make an appearance this year, particularly after last year’s underwhelming finish.

What Drives the Rally and Why It Matters

Holiday sentiment can lift investor mood, while lighter trading volumes during the festive season amplify even modest buying pressure. Year-end portfolio adjustments also play a role: tax-loss selling usually subsides by this point, and fund managers often “window-dress” holdings to present stronger year-end results. Year-end bonuses and holiday cash flows can translate into incremental equity purchases, further boosting markets. Together, these forces often create a small but noticeable seasonal lift in U.S. equities.

Even modest gains during the Santa Rally can carry meaningful implications. A positive rally can set the tone for the new year, influencing sector rotations and investor risk appetite in January. It also acts as a sentiment barometer: a strong rally typically signals cautious optimism, while a weak or absent rally may indicate defensive positioning or broader macro uncertainty. For both fund managers and individual investors, the Santa Rally period provides a natural window for tactical adjustments or portfolio rebalancing ahead of year-end.

Last Year’s Miss and What 2025 Could Bring

In 2024, the Santa Claus Rally largely failed to materialize. The S&P 500 declined through most of the traditional seven-day period, and major indices ended the window in negative territory, marking one of the weaker year-end performances of the past decade. While select sectors such as megacap technology fared better, the broader market slipped, challenging long-term averages and underscoring that seasonality is never guaranteed. That absence added to a cautious tone heading into 2025 and highlighted how modern markets — influenced by algorithmic trading, global capital flows, and rapid macroeconomic shifts — can diverge from traditional patterns.

Looking ahead to 2025, the outlook for a Santa Rally is mixed. On the positive side, the recent U.S. Federal Reserve rate cut has improved liquidity conditions and lifted market sentiment, while mild consolidation earlier in December could provide a base for a late-month rebound. Yet global macro uncertainty, geopolitical tensions, and sector-specific volatility remain potential headwinds that could limit gains or disrupt the rally entirely. In short, a Santa Claus Rally this year is possible but far from guaranteed, and its magnitude will likely depend on sentiment, liquidity, and broader market developments in the final weeks of December.

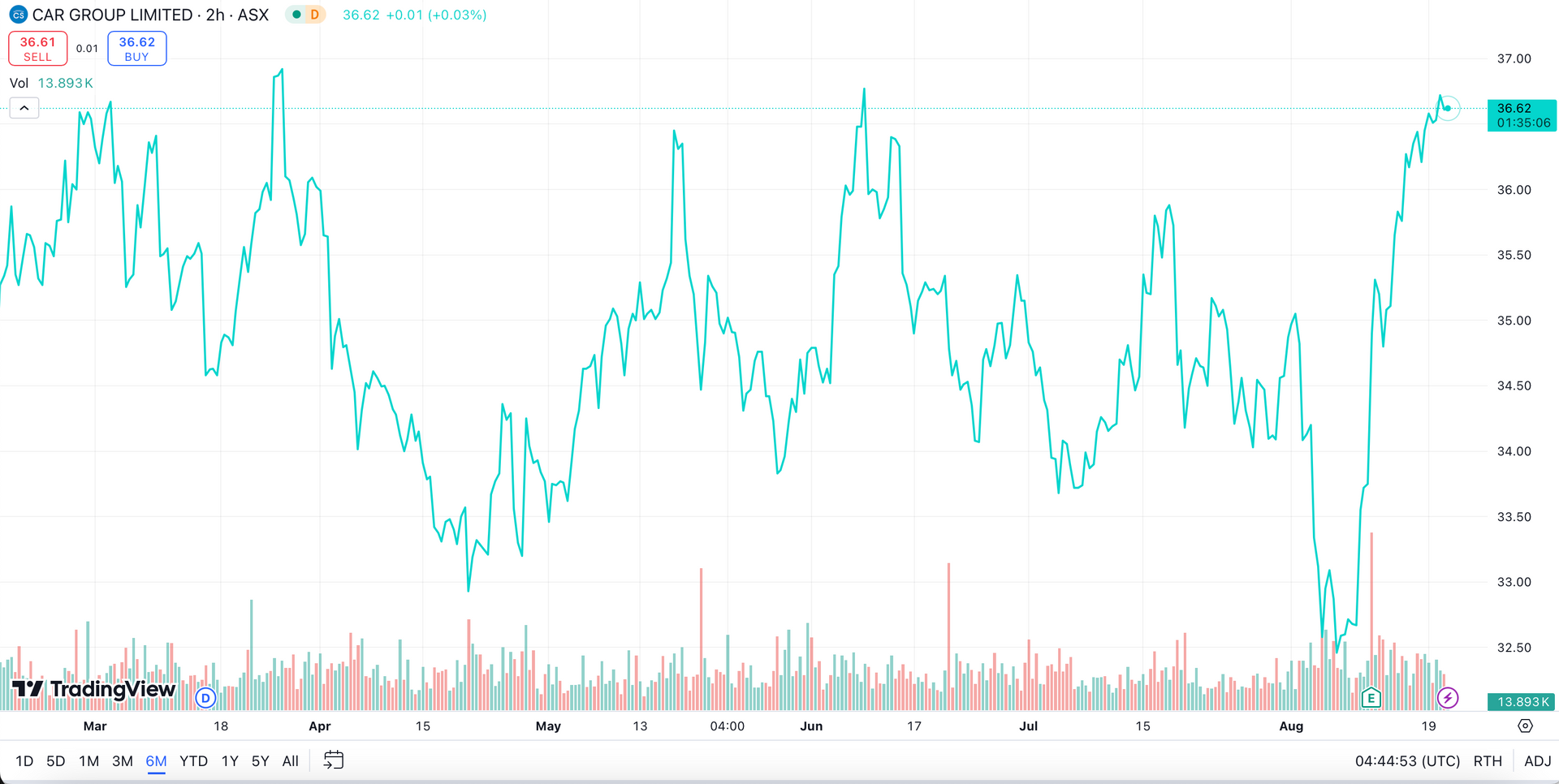

The Santa Effect Down Under

Although primarily a U.S. phenomenon, the Santa Claus Rally can influence other markets, including the ASX. Australian investors often monitor the pattern for cues on market sentiment, which can support confidence in large-cap, growth, and small-cap stocks that are sensitive to global trends. Historically, the ASX 200 has experienced modest gains during this period, helped by lighter trading and year-end portfolio adjustments. Certain sectors, including technology, consumer discretionary, and materials, may respond more strongly to these flows. With global risk appetite potentially lifted by the recent Fed rate cut, the ASX could benefit if U.S. markets participate in a Santa Rally, although domestic factors such as company earnings, commodity prices, and economic data will continue to be key drivers of performance.

Key Takeaways for Investors

Investors should treat the Santa Claus Rally as a lens for understanding market sentiment rather than as a standalone trading signal. Gains during this period are typically modest and vary from year to year. Maintaining diversification and disciplined risk management is prudent, avoiding overconcentration in anticipation of a seasonal move. Each year is different, as 2024 demonstrated, and structural shifts or unexpected events can easily override historical tendencies.

The Santa Claus Rally remains one of the most talked-about seasonal patterns in equity markets, offering a brief window where history, sentiment, and market flows often align. Yet even long-standing traditions like this are not guaranteed. As markets navigate shifting monetary policy, global uncertainty, and sector-specific volatility, the 2025 year-end period may present more of an opportunity to observe than a certainty to profit. Investors would be wise to understand what Santa represents while maintaining a disciplined and measured approach to portfolio management.

Subscribe to our newsletter

Disclaimer: This article does not constitute financial advice nor a recommendation to invest in the securities listed. The information presented is intended to be of a factual nature only. Past performance is not a reliable indicator of future performance. As always, do your own research and consider seeking financial, legal and taxation advice before investing.