January 21, 2026

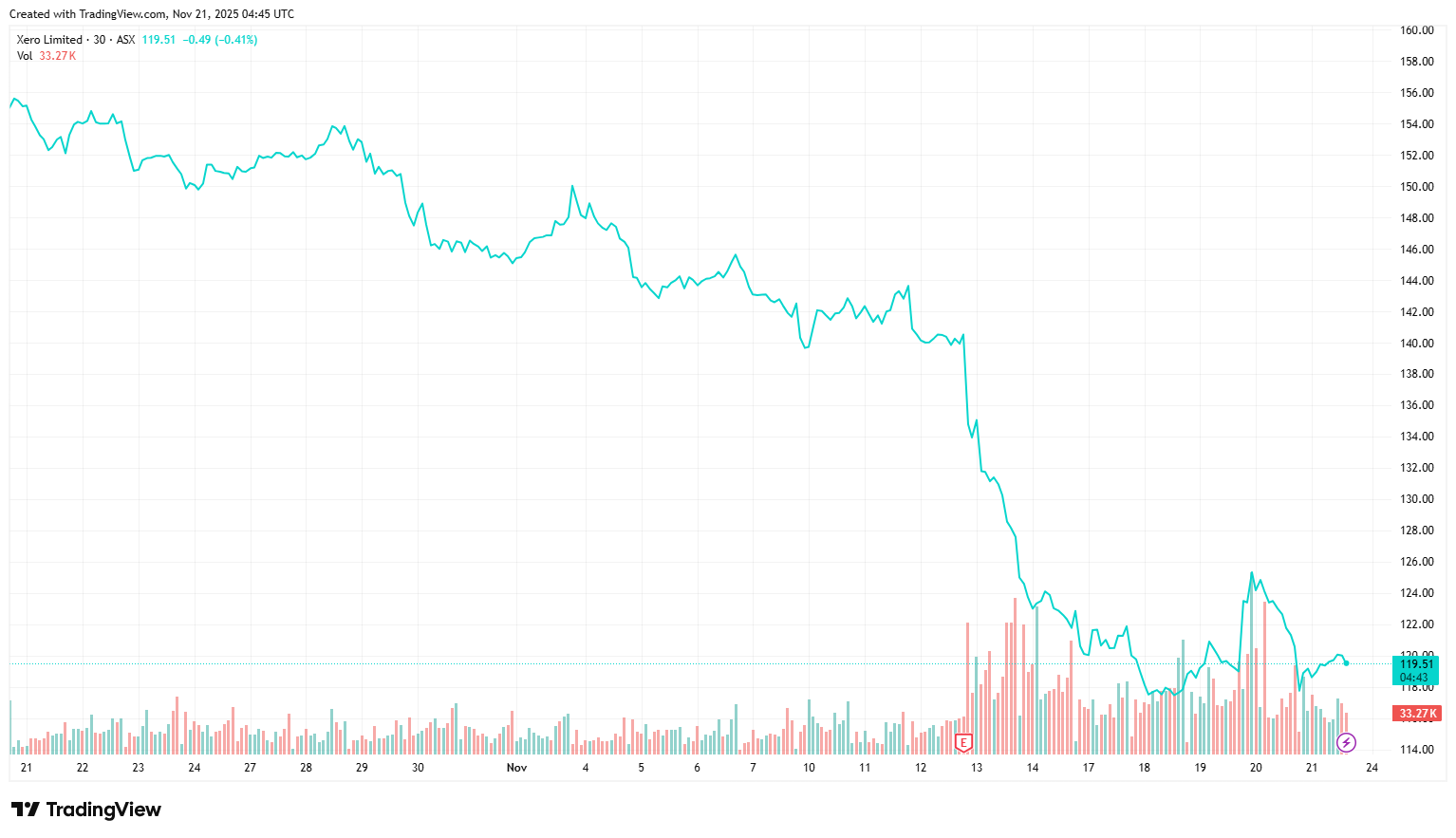

Inflation is currently eroding the purchasing power of cash at a rate that demands action. Sitting on $100,000 in a standard savings account feels safe, yet the real value of that capital decreases every single day that it remains idle. Holding six figures in investable assets places you at a critical juncture. You have moved beyond the accumulation phase of the early saver and entered the territory of the sophisticated investor. The decisions you make now regarding asset allocation, risk management, and professional oversight will dictate whether this capital compounds into a comfortable retirement or stagnates against the rising cost of living. This guide explores the evidence-based strategies for deploying $100,000 in the current Australian market, comparing asset classes and examining the structural advantages of managed equities. I have $100k to invest: What should I do? The "best" place to put $100k depends entirely on your timeline and risk tolerance. While the allure of a "safe" bank account is strong, safety is relative. The Australian Bureau of Statistics (ABS) reported a 3.8% rise in the Consumer Price Index (CPI) over the twelve months to the June 2024 quarter. If your post-tax return on cash does not exceed this figure, you are technically losing wealth. Investors typically face three primary pathways for this sum: Defensive Assets: Term deposits and bonds. Growth Assets: Equities (Shares) and Property. Speculative Assets: Crypto and Venture Capital. For high-income earners and self-directed investors, the stock market often provides the optimal balance of liquidity and growth potential compared to the high entry costs of real estate. Best way to invest $100k for monthly income Retirees and income-focused investors often ask about the best way to invest $100k for monthly income. While term deposits offer certainty, they rarely offer inflation-beating growth. The Australian share market (ASX) is unique globally due to the imputation credit system. When you invest in high-quality, dividend-paying companies (often referred to as "blue chips"), you receive a share of the profits. Because the company has already paid corporate tax, the Australian Taxation Office (ATO) grants you a "franking credit" for that tax. This can significantly boost the effective yield of your portfolio. Comparing Income Vehicles: Term Deposits: Safe capital, low growth, fully taxable interest. Investment Grade Bonds: Lower risk than shares, generally lower returns than equities over the long term. Dividend Equities: Potential for capital growth plus income. A portfolio yielding 4% to 5% plus franking credits can outperform cash rates, though the capital value fluctuates. Our share advisors provide general advice to help investors understand how to maximise these franking credits within a model portfolio, supporting a strategy focused on consistent yield and transparency. Investing $100,000 in the stock market vs real estate The Australian property obsession is well-documented, but investing $100k in real estate presents immediate logistical hurdles. In major markets like Sydney or Melbourne, $100,000 barely covers the stamp duty and deposit for a median-priced investment property. You become highly leveraged, meaning you owe significantly more than you own, and your asset is illiquid. You cannot sell a bedroom if you need cash flow. Investing $100,000 in the stock market offers distinct advantages: Liquidity: You can convert shares to cash in T+2 days. Diversification: Instead of one address, you own pieces of Australia’s largest banks, miners, and retailers. Yield: Australian shares often pay fully franked dividends, which can be more tax-effective than rental income. Entry Barriers: You can start deploying capital immediately without waiting for loan approval or settlement. For many investors, the stock market provides a more agile vehicle for wealth creation, particularly when the goal is to achieve market outperformance. For example, in FY25, Sharewise’s ASX model portfolio delivered a +26.49% return compared to the market’s 10.21%. Investing $100k in ETFs vs Managed Accounts Many self-directed investors default to investing $100k in ETFs (Exchange Traded Funds) or index funds. The argument is usually low fees and broad exposure. You buy the haystack to find the needle. While investing $100k in an S&P 500 ETF or an ASX 200 index fund guarantees you the market return, it also guarantees you catch every downturn. Passive funds do not discern between a good company and a bad one; they buy everything based on market cap. If a sector is overvalued, the ETF buys more of it. The Sharewise Managed Account difference: We believe in active risk management. A managed account provides the best of both worlds. You retain beneficial ownership of the shares (HIN based), meaning you see exactly what you own, but professional investment managers handle the day-to-day decisions including timely buy or sell actions pending your approval. Risk-Aware: We can move to cash to protect capital during volatility. ETFs stay fully invested while the market falls. Transparency: You are not just a number in a unit trust. You see every trade. Institutional-Grade Access: We utilise data and research typically reserved for institutional desks to identify opportunities before the broader market reacts. This approach suits the time-poor professional who wants the "investor" status without the administrative burden of researching individual stocks or rebalancing portfolios. Diversification: 100k investment in ASX vs NASDAQ and NYSE A common mistake for Australian investors is "home bias". The ASX represents less than 2% of the global equity market and is heavily skewed towards financials and materials. If you limit your $100k investment to the ASX, you miss out on the growth engines of the global economy: technology and healthcare. Investing 100k in S&P 500 vs ASX: ASX: High yield, lower growth, value-oriented. US Markets (Nasdaq/NYSE): Lower yield, higher capital growth, tech-heavy. A robust portfolio should not choose one or the other. It should integrate both. Gaining exposure to global giants (like Apple, Microsoft, or Nvidia) balances the cyclical nature of Australian miners and banks. Our advisors assist clients in constructing a blended portfolio that captures the defensive income of Australia and the aggressive growth of the US. The key investment strategies to consider Best way to invest $100k in the short term vs long term Time horizon is the single most important factor in your strategy. Short to Medium Term (3 years): For growth-focused investors, three years is ample time to target returns significantly higher than a term deposit. While passive funds can be risky in the short term because they are fully exposed to market dips, Sharewise’s active management is designed to solve this problem. Because we actively manage risk, moving to cash to protect capital during volatility rather than riding the market down, we can pursue high-growth outcomes over a medium timeframe. You do not need to settle for inflation-matching cash rates; you need a professional strategy that actively navigates the market to capture upside. Long Term (5 years+): History shows that equities outperform almost every other asset class over extended periods. The Vanguard Index Chart (2023) highlights that over 30 years, Australian shares have returned an average of roughly 9.2% per annum. While past performance is not a reliable indicator of future performance, the data suggests that time in the market is superior to timing the market. Making Your Decision Deciding how to invest $100,000 is a pivotal financial moment. It is the step up from saving to wealth building. You can leave it in the bank to slowly lose purchasing power, lock it away in an illiquid property, or deploy it into a liquid, diversified portfolio of high-quality companies. At Sharewise, we don't believe in the 'silent broker' model. We provide proactive, one-on-one communication and active oversight. You won't have to wonder how your portfolio is performing; your dedicated advisor is accessible via call, text, or email to ensure your strategy remains responsive to the market. Ready to see how professional oversight can transform your $100k investment? We understand that trust is earned through results, not promises. To ensure you are comfortable with our professional investment management, Sharewise offers a 30-day non-committal period . This allows you to evaluate our performance and advisors risk-free before making a long-term commitment.