Stock Spotlight: ANZ Group Holdings Ltd (ASX:ANZ)

ANZ Group Holdings Ltd (ASX:ANZ), commonly known as ANZ Bank, is one of the largest banks in Australia, and is a leading player in the local and international banking sectors. Headquartered in Melbourne, ANZ serves more than 8.5 million customers across Australia, New Zealand and global markets, with a particularly strong presence in Asia.

ANZ offers a comprehensive suite of financial services across retail, business and institutional banking sectors. It is one of Australia’s biggest banks by both assets and market capitalisation, and holds a significant share of the mortgage, personal loan, and credit card markets.

ASX: ANZ has a large trading volume, and around one-third of ANZ stocks are held by institutional investors, reflecting confidence in the bank’s stability and long-term prospects. As one of Australia’s ‘Big Four’ banks, ANZ shares are considered a core investment for those seeking reliable returns and exposure to the Australian banking sector's sustained growth.

About National Australia Bank Limited

ANZ Group Holdings traces its origins back to 1828, when the Cornwall Bank was founded in Launceston. Over the subsequent two centuries, ANZ merged with fifteen banks to expand across Australia, New Zealand and then globally. Their most recent acquisition, in 2024, is Brisbane-based Suncorp Bank. In 2023, ANZ Group Holdings Limited was established and listed as the new parent company of the ANZ group. ANZ is one of Australia’s ‘Big Four’ banks by total assets, the largest bank in New Zealand, and one of the top ten listed companies on the ASX by market capitalisation.

ANZ Group Holdings operates a diverse business that spans across retail, commercial, and institutional service. The retail division offers products to consumers, including home loans, deposits, credit cards, and personal loans. Its commercial banking arm supports small to large businesses through services such as business lending, asset finance, and high-net-worth banking solutions. In addition, New Zealand’s Business & Agri division supports enterprises in the agricultural and government sectors.

ANZ’s Institutional division has large corporate clients and governments globally, delivering specialised services in transaction banking, corporate finance, foreign exchange, interest rates, credit, commodities, and debt capital markets.

Internationally, the ANZ Bank has an extensive footprint, having a presence in the Pacific, Europe, North America, the Middle East, and in particular Asia. This includes offices in the major Asian markets of Shanghai, Singapore and Hong Kong.

What Makes ANZ Shares A Strong Competitor In The Banking Sector?

ANZ stands out in the Australian banking sector for its diversified business model across retail, commercial, and institutional banking sectors. This broad range of services compares favourably to peers like the Commonwealth Bank (CBA) and Westpac (WBC), which are more domestically focused.

ANZ’s extensive geographic footprint and deep ties across Asia’s key trade corridors also mean it is uniquely positioned to benefit from regional growth. This international footprint helps mitigate domestic market risks, making the ANZ ASX share price less vulnerable to local downturns than Australia-centric competitors.

ANZ stocks are buoyed by the strong overall returns of Australia’s banking sector. Its market capitalisation is the fourth-largest of the ‘big four’ banks behind the Commonwealth Bank of Australia (CBA), Westpac Banking Corporation (WBC) and National Australia Bank (NAB). However, ANZ Bank’s comparatively strong dividend history makes it attractive to income-focused shareholders. reinforcing its reputation as a core portfolio holding.

Even in a potential environment of lower interest rates, ANZ share investing is still anticipated to offer a ‘safe haven’ as part of Australia’s resilient banking sector.

Key Stats

Key Stats

Source: Yahoo Finance, ASX. Data as of 18/11/25.

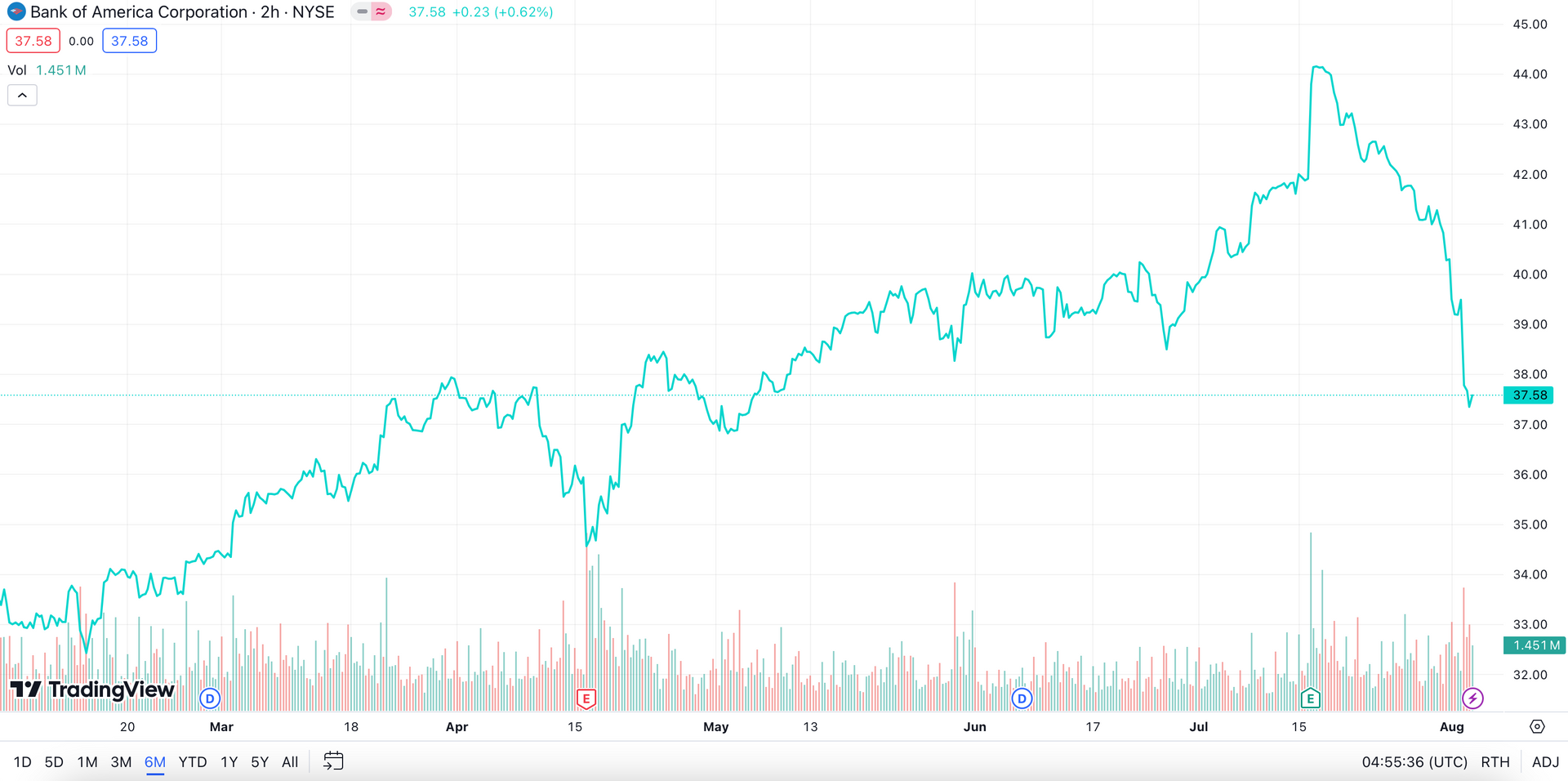

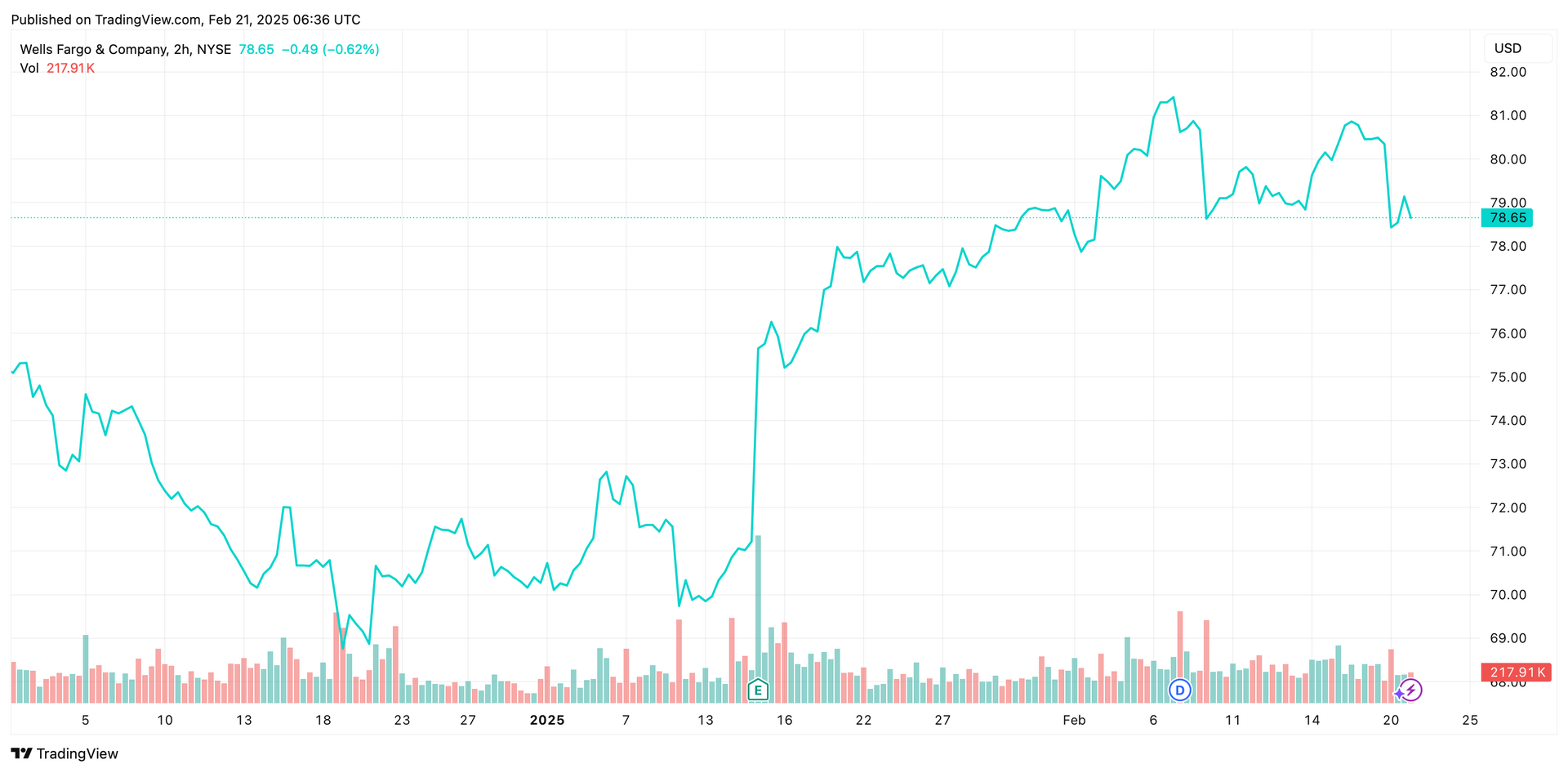

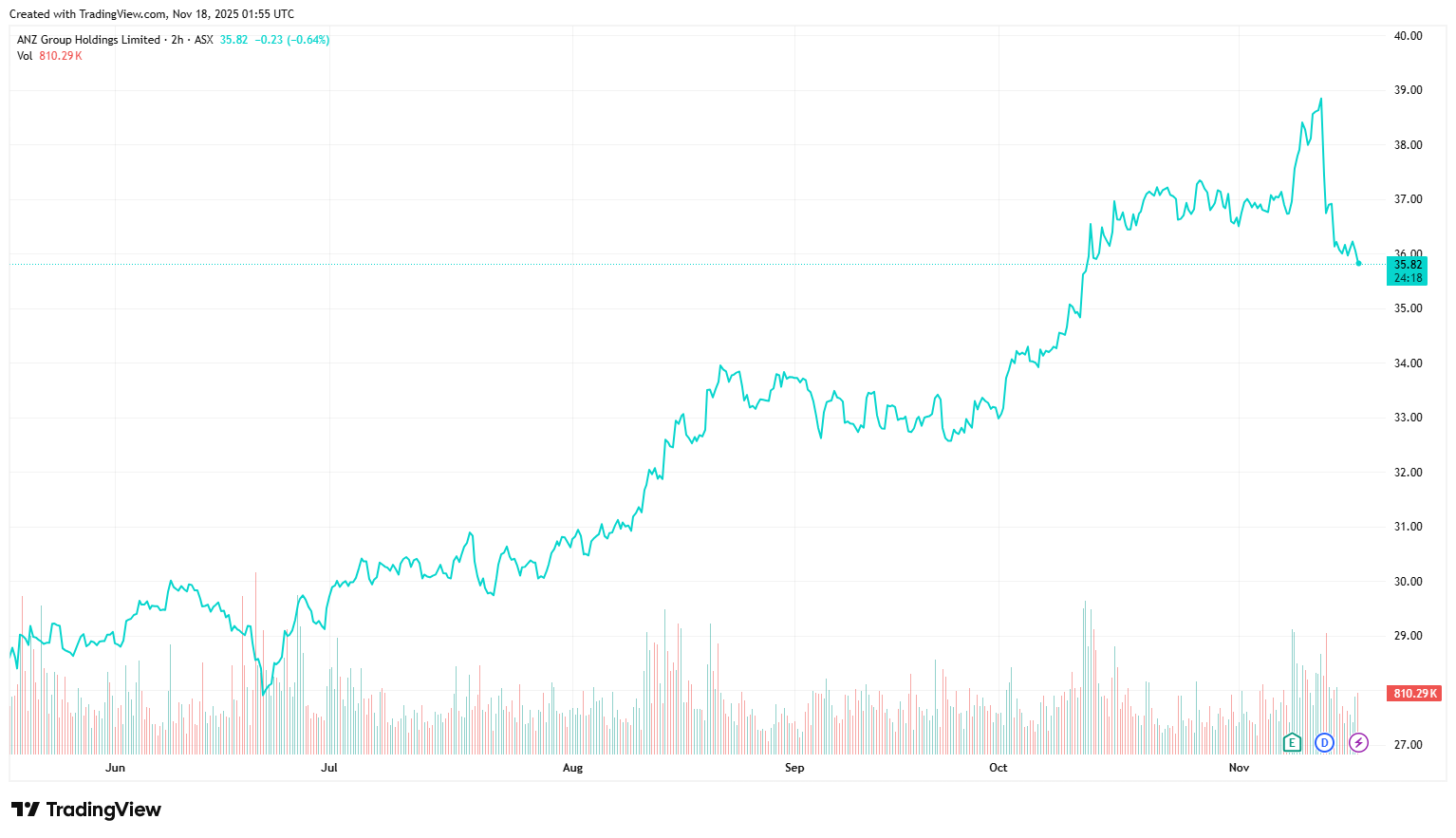

Price Performance

Growth Potential

ANZ’s growth strategy focuses on a number of areas, including strengthening its institutional banking capabilities in Asia to support trade and capital flows across the region. The bank maintains a commitment to service large and growing demand in China, while also positioning itself as a key banking partner for broader Asian markets. This includes having a presence in well established markets such as Japan and India, along with rapidly growing economies like Vietnam and Indonesia.

Another cornerstone of growth is ANZ’s sustainable finance offerings, which support the transition to a low-carbon economy. ANZ Group Holdings offers a suite of sustainable finance products, including green bonds, social and sustainability-linked loans and sustainability-linked derivatives.

ANZ’s growth is backed by significant investment in its technical capabilities to provide a more secure and rapid banking experience. This includes investment in the ANZ Plus platform, which continues to attract substantial new customer numbers, along with MyAccounts, which consolidates information from across different financial institutions and rewards programs.

We see growth potential in ANZ for the following reasons:

- ANZ is trading at a material discount to peers - 1.5x Price to Book (P/B) and a dividend yield of 4.6% (before franking). However, we note ANZ measures last on key metrics behind the other 3 major Australian banks (e.g. lending and deposit growth in key segments) and underperformed operationally on some metrics. Therefore, a discount is not without warrant.

- Strong oligopoly position in Australia (along with three other major banks in CBA, NAB, WBC). We are attracted to ANZ’s Institutional bank and its capabilities around the Asia region as a differentiator to the other major banks.

- New CEO, new strategy? ANZ’s new CEO Nuno Matos has now commenced, and the ANZ 2030 strategy is now progressing. He is a very seasoned banking executive and with extensive global experience.

- Improved credit risk – management has spent multiple years de-risking the institutional book’s tail risk.

- Net interest margin (NIM) outlook remains uncertain, but ANZ expects benefits from the replicating portfolio to remain a tailwind over the next 12-18 months.

- Positive progress on Suncorp Bank’s integration and ANZ Plus delivery.

- Solid capital position could lead to ongoing capital management initiatives.

- Continued focus on cost could yield results which come ahead of market expectations.

Upcoming Innovations From ANZ Group Holdings Ltd

ANZ is leaning heavily into technological innovation, streamlining its digital banking services, incorporating AI, and investing in blockchain technology and the fintech sectors.

In 2024, ANZ was ranked #1 in Transaction Banking product development and innovation in Australia by Coalition Greenwich, and was named Best Bank for Payments globally by Global Finance Magazine. Moving forward, the bank will continue consolidating its banking technologies with its two key platforms, ANZ Plus and Transactive Global.

ANZ investment will also be focused on leveraging Generative AI to increase productivity, and the bank recently established the AI Immersion Centre, in partnership with Microsoft.

In the blockchain space, ANZ Bank will be one of the first financial institutions to pilot new technology by Chainlink, which enables secure interactions between existing financial systems and blockchain networks.

ANZ Shareholder Returns & Investor Sentiment

ANZ Group Holdings Ltd (ASX:ANZ) has long been regarded as a reliable dividend payer among Australia's major banks. As of Q1 2025, ANZ’s dividend yield was higher than the banking industry average and in the top quartile of dividend payers in the Australian share market. These relatively high dividend yields help balance out moderate share price gains in recent years, delivering a robust total share price return. ANZ’s focus on consistent dividend yield will be attractive to income-focused investors.

Intense competition in domestic markets has seen ANZ’s profit growth stumble in recent quarters, and the ASX ANZ share price has been impacted by a court-enforceable undertaking with the Australian Prudential Regulation Authority (APRA) to address weaknesses in non-financial risk management practices. However, with a commitment to implementing recommendations, and with digital transformation and emerging market growth opportunities, investor confidence is holding. Overall, ASX:ANZ offers potential for investors looking for long-term growth.

Investment Tips For Buying ANZ Group Holdings Ltd (ASX:ANZ) Stocks

Australia’s ‘Big Four’ bank stocks—including ASX:ANZ—are generally seen as offering consistent rather than rapid growth, along with potentially attractive dividends. These can be a useful addition in an investment portfolio, to counterbalance stocks that come with higher risk (but possibly high reward), such as tech, mining or emerging sector stocks.

Investors looking to buy or hold ANZ stock should look beyond recent share price movements and consider additional metrics when evaluating ANZ share performance. These metrics include:

Earnings Per Share (EPS)

This represents the bank’s profitability on a per share basis. EPS growth over time indicates a solid performance.

Price-to-Earnings (P/E) ratio

P/E ratio = Share Price ÷ Earnings Per Share (EPS).

This ratio indicates investor sentiment: a higher P/E ratio may suggest that investors expect higher earnings growth in the future, while a lower ratio could indicate the stock is undervalued or that the company is experiencing difficulties.

Dividend Yield & Payout Ratio

These show how much of earnings are being paid out to shareholders.

Return on Equity (ROE)

This ratio assesses how efficiently the bank is using shareholder equity to generate profit, with a higher ROE suggests stronger profitability.

Additional metrics are useful in comparing the valuation and market positioning of ANZ, when compared to other large banking institutions. Such metrics include:

Cost-to-Income Ratio

Compares operating expenses to operating income, with a lower ratio indicating better operational efficiency.

Loan Impairment/Provisioning

Measures how much is being set aside for bad loans, to help assess credit risk.

Liquidity Coverage Ratio (LCR)

Measures the bank’s ability to meet short-term obligations with liquid assets, ensuring continued viability in times of financial stress.

ASX: ANZ is a high-volume trading stock generally supported by robust demand, including significant holdings by institutions. This means that, while its performance can be suited to long-term investors, it is liquid enough to be considered by short-term traders.

Key Risks

- Intense competition for credit growth.

- Increase in bad and doubtful debts or increase in provisioning especially any Australian and institutional single exposure loan losses.

- New strategy fails to yield the desired results and disappoints relative to expectations.

- Funding pressure for deposits.

- Credit risk with potential default of mortgages, personal and business loans and credit cards.

- Potential changes to Australian Banking legislation.

- Significant exposure to the Australian property market

- Operating costs come in below market expectations

ANZ’s Commitment To Environmental, Social & Governance (ESG) Factors

ANZ has committed to facilitating at least $100 billion in social and environmental activities by 2030, through customer transactions and direct investments. In 2024, ANZ announced it would cease funding new or expanded oil and gas extraction projects, and it also has no significant involvement in alcohol, adult entertainment, gambling, tobacco, controversial weapons or military contracting.

By aligning its business strategy with global sustainability goals, the ANZ ASX share price is well placed to benefit from growing institutional and individual demand for ESG-focused investments.

Frequently Asked Questions.

How has the ANZ share price historically reacted to changes in interest rates & global market conditions?

ANZ’s share price tends to rise with higher interest rates due to improved lending margins, but this effect may be counterbalanced to an extent by reduced demand for loans. ANZ share prices can be negatively affected by global market volatility.

What are the key drivers of fluctuations in ANZ’s share price & how can investors anticipate these trends?

Key drivers include interest rate changes, housing market trends, regulatory developments, earnings reports, and macroeconomic trends. Tracking movements in these indicators can help investors anticipate ANZ share price movements.

How does ANZ’s dividend yield compare to other ASX banks & what can it tell investors about the bank’s financial health?

ANZ typically offers competitive dividend yields, often above that offered by other banks. These yields increase the total shareholder return, but should be considered alongside other financial health indicators.

How is ANZ leveraging its presence in Asia to enhance its market position & stock value?

ANZ is actively focusing on trade finance and institutional banking in Asia, in order to tap into high-growth markets, diversify income, and build resilience against domestic market slowdowns.

What are the main opportunities for growth that ANZ is exploring & how could these affect its stock price in the future?

ANZ is investing in digital banking, green finance, and expanding institutional services in Asia, all of which could drive long-term earnings growth, support buoyant investor sentiment, and have a positive effect on stock prices.

How can investors assess the stability & potential risks of ANZ shares before making investment decisions?

Investors should review key metrics like Return on Equity, P/E and Cost-to-Earnings ratios, explore industry risk factors and consider their own personal financial position and investment goals, when making investment decisions.

Subscribe to our newsletter

Disclaimer: This article does not constitute financial advice nor a recommendation to invest in the securities listed. The information presented is intended to be of a factual nature only. Past performance is not a reliable indicator of future performance. As always, do your own research and consider seeking financial, legal and taxation advice before investing.