The U.S. Federal Reserve delivered today its third consecutive rate cut of 2025, lowering the federal funds rate by 25 basis points to 3.50%–3.75%. While markets had largely anticipated the move, the tone of this meeting signals a meaningful recalibration in the Fed’s policy stance. After a year marked by persistent services inflation, uneven job growth, and tighter financial conditions, policymakers are signalling a more deliberate effort to support a cooling labour market while remaining vigilant against the risk of sticky inflation.

The macro backdrop is increasingly nuanced. Hiring momentum is softening, unemployment has edged higher, and wage growth is normalising. Yet inflation, while easing from last year’s peak, has not yet firmly aligned with the Fed’s 2% target. This divergence between a gradually weakening labour market and persistent inflation pressures places the Fed in a narrow policy corridor, requiring both action and communication to be carefully calibrated.

This easing cycle differs from previous ones. Unlike the rapid, liquidity-driven cuts of 2020 or the prolonged post-GFC easing phase, today’s environment is shaped by structurally higher inflation, tighter fiscal constraints, and a Treasury market that has become central to financial stability. These dynamics mean each incremental rate decision carries broader implications for global liquidity, asset valuations, and portfolio construction heading into 2026.

A notable feature of this meeting was the presence of three dissenting votes, an unusually high level of disagreement for an FOMC decision. Those dissenters preferred to hold rates steady, arguing that easing too early could undermine progress on inflation. Their opposition underscores internal uncertainty and the broader debate over the pace at which policy should adjust in a late-cycle environment.

The Fed also confirmed its intention to restart Treasury buyback operations in 2026 to improve liquidity and functioning in the government bond market. Although not a return to quantitative easing, the program will allow the Fed to retire older, less liquid securities in exchange for newer ones. Treasury-market depth has emerged as a macro issue in its own right, with instability in 2024 and 2025 demonstrating that smooth market functioning is now essential for effective monetary transmission.

Why the Fed Cut Rates: The Economic Backdrop

Labour-market cooling has become increasingly evident. Job creation has slowed, unemployment has edged up from cycle lows, and wage pressures have moderated. Participation is stabilising, but job vacancies have retreated sharply from post-pandemic highs, signalling a gradual rebalancing. The Fed remains mindful that weaker consumption or corporate layoffs could tip the economy toward a more pronounced slowdown.

Inflation, however, remains the complicating factor. Goods inflation continues to ease as supply chains normalise, but services inflation, particularly in housing and wage-sensitive categories, remains elevated. While the overall trajectory is encouraging, the pace of disinflation is not yet sufficient to provide full confidence that inflation will converge smoothly to target.

The dissenting votes reflect this tension. Cutting rates in an environment where inflation remains above target risks undoing progress made over the past two years. Their opposition underscores the atypical inflation dynamics the Fed is navigating and signals that further cuts should not be taken for granted. The committee is executing a delicate balancing act, supporting a gradually weakening labour market while avoiding a renewed surge in inflation.

Market Reaction: Impact on US, Global and ASX Markets

Equity markets rallied strongly following the announcement, driven by expectations of a more accommodative rate environment extending into 2026. Technology stocks led the gains as investors rotated toward long-duration assets benefiting from lower discount rates. Cyclical sectors also advanced on hopes of stabilising demand, while defensive sectors lagged amid reduced hedging demand. Financials were mixed, with banks benefiting from a steeper yield curve but facing pressure from potential credit-quality deterioration.

In fixed income, short-dated Treasury yields fell sharply, reflecting confidence in further cuts, while longer-dated yields declined more modestly, steepening the curve. Credit spreads tightened as risk appetite improved, although high-yield spreads remain sensitive to recession concerns.

The USD weakened against major peers, benefiting Asian and emerging-market currencies. A softer dollar improves global liquidity, supports commodity prices, and encourages capital inflows into Asia’s rate-sensitive sectors. Gold and industrial metals also rose, reflecting expectations of a more accommodative global policy backdrop.

Global markets broadly responded positively. European equities and bonds gained on prospects of synchronised easing across major central banks. Asian markets, particularly South Korea, Taiwan, and Indonesia, saw strong inflows into technology, financials, and consumer-driven sectors. Emerging-market debt rallied on lower yields and improved risk sentiment. Corporates are likely to accelerate refinancing and reassess capex plans as lower borrowing costs improve debt sustainability.

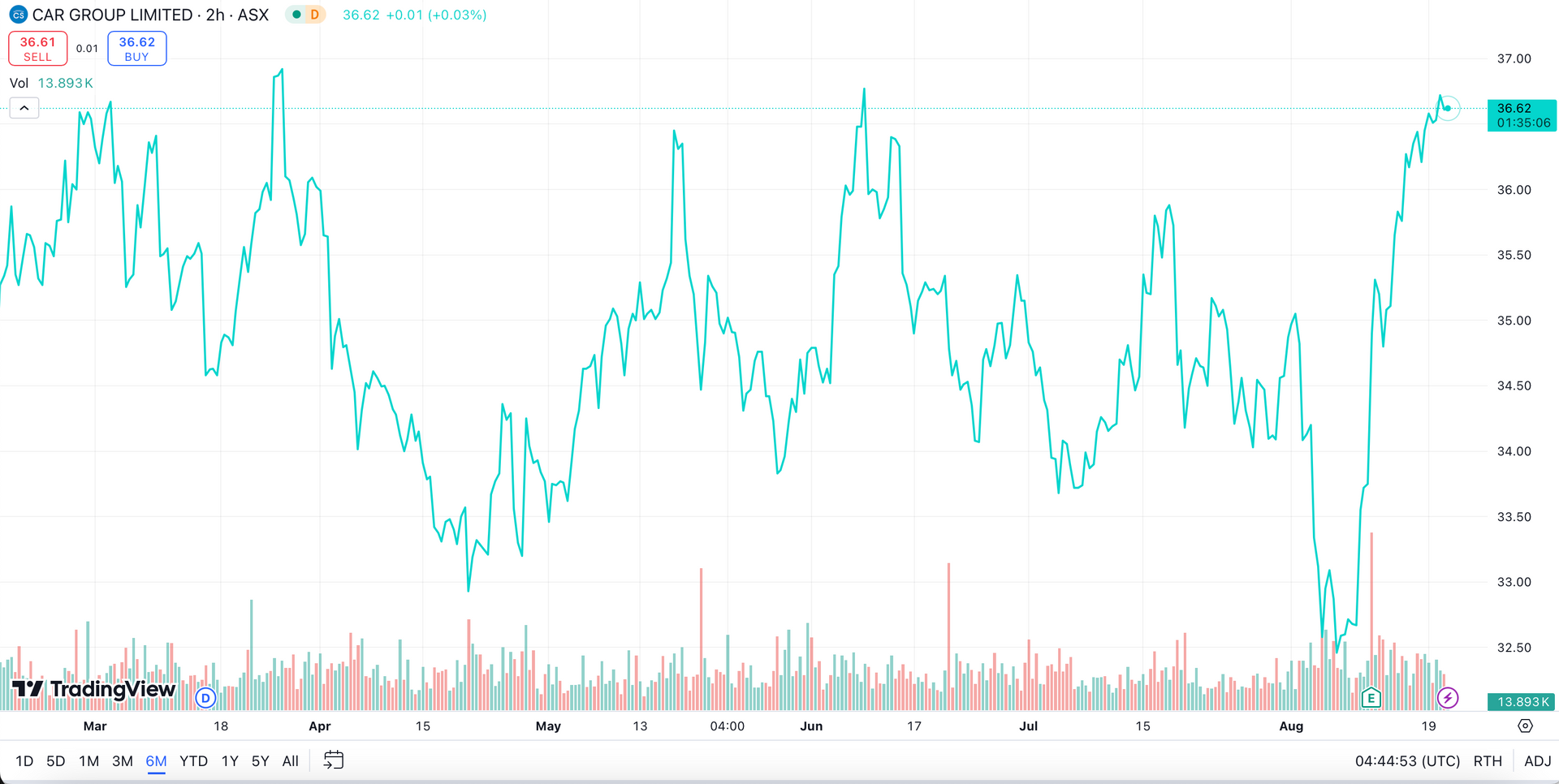

The Fed’s rate cut is expected to influence the ASX through both sentiment and sector-specific channels. A softer U.S. rate environment tends to support global risk appetite, which can boost Australian equities. Resource and energy stocks may benefit from stronger commodity prices under a weaker USD, while technology and industrial companies with global exposure could gain from improved funding conditions and stabilised demand. Financials may see mixed outcomes, as lower rates can compress bank margins but also support lending growth. Currency movements remain a key factor, with the AUD’s relative strength or weakness affecting exporters and importers differently. Domestic monetary policy, including RBA settings, will continue to interact with these global influences, shaping sector performance. While the ASX often tracks U.S. market trends, sector composition and local economic conditions remain decisive.

Potential Risks and Divergent Scenarios

Despite improved sentiment, risks remain two-sided. Premature easing could reignite inflation, particularly if demand rebounds or supply-side pressures return, forcing the Fed back into a hawkish stance. Conversely, delaying easing for too long could leave the economy vulnerable if labour-market deterioration accelerates or corporate earnings weaken, potentially necessitating more aggressive cuts later.

Geopolitical volatility further complicates the outlook. Supply-chain disruptions, commodity-market instability, or heightened geopolitical tensions could either lift inflation or suppress global demand, challenging policymakers and markets simultaneously. Liquidity risks also persist. While the planned Treasury buyback program aims to mitigate structural fragilities, execution must avoid unintended market distortions.

Investment Positioning in a Lower-Rate Environment

A lower-rate environment reshapes the investment setting. In equities, investors may favour quality growth names with strong balance sheets, structural earnings drivers, and pricing power. Duration-sensitive assets, including technology and communication services, are likely to benefit most from falling yields. Cyclicals could gain if growth stabilises, though selection remains key.

In fixed income, extending duration to capture capital gains from further cuts while maintaining exposure to high-quality credit is likely to be beneficial. Steepening curves favour barbell strategies that combine short-dated liquidity with longer-dated Treasuries or investment-grade corporates.

Currency markets present opportunities as a softer USD supports Asia and emerging markets. Commodities may benefit from improved liquidity, although demand-side risks remain tied to global growth. Across asset classes, beneficiaries include firms with high funding needs or leveraged balance sheets, provided conditions stabilise. Yet labour-market fragility and inflation uncertainty require caution, with selective positioning and disciplined risk management remaining essential.

As the easing cycle progresses, investors should monitor inflation momentum, labour-market dynamics, and Fed communication for confirmation that the soft-landing narrative remains intact. For now, the Fed’s shift is supportive but is not a blanket endorsement for indiscriminate exposure to risk assets.

Conclusion

The Fed’s third consecutive rate cut marks an important inflection point for global markets, signalling a shift toward gradual easing while acknowledging the continued complexity of the inflation and labour-market environment. The presence of dissenting votes, the reintroduction of Treasury buybacks and the Fed’s insistence on data dependency all underline that this is not a conventional easing cycle, nor one without significant risks. While the decision provides a degree of support for growth heading into 2026, it also highlights the delicate balance the Fed must strike to avoid reigniting inflation or tightening financial conditions inadvertently. For investors, the evolving policy mix suggests a period of opportunity tempered by the need for selectivity, disciplined positioning and close monitoring of macro signals as the easing cycle unfolds.