Staying Invested: The Role of Dollar-Cost Averaging in Market Uncertainty

The Instinct to Retreat

Market volatility has a way of making inaction feel like prudence. When indices swing sharply, headlines turn ominous, and correlations converge, even experienced investors are drawn toward the perceived safety of the sidelines. The instinct is understandable, as capital preservation is a cornerstone of portfolio management. Yet in practice, this reflex often manifests not as discipline, but as delay.

History suggests that the most costly investor behaviour across market cycles is not poor stock selection or imperfect asset allocation. It is the decision to wait for clarity before deploying capital. Markets, by their nature, rarely provide such clarity. They offer prices, often dislocated, occasionally irrational, but frequently compelling. Periods of uncertainty, while uncomfortable, have consistently coincided with some of the most attractive long term entry points. As Warren Buffett aptly observed, “The stock market is a device for transferring money from the impatient to the patient.”

For investors, the implication is clear: the appropriate response to uncertainty is not paralysis, but process. In this context, dollar-cost averaging (DCA) offers a deliberate, rules-based framework for maintaining market participation while reducing the risks associated with imperfect timing. Rather than attempting to predict inflection points, investors can systematically allocate capital across varying market conditions, reinforcing both mathematical resilience and behavioural discipline during periods of elevated volatility.

Dollar-Cost Averaging: A Systematic Approach to Capital Deployment

Dollar-cost averaging is a phased investment strategy in which capital is deployed at regular, predetermined intervals over a defined time horizon, rather than as a single lump-sum allocation. By investing consistent amounts irrespective of prevailing market conditions, investors acquire more units when prices are lower and fewer when prices are higher, resulting in an averaged cost base that reflects a range of market environments.

While conceptually straightforward, the strategic depth of DCA is often underestimated. It is not a passive or simplistic approach, but a deliberate commitment to process over prediction. Once an investment thesis and asset allocation framework have been established, DCA systematises execution, insulating capital deployment from short term market noise and behavioural bias.

From a portfolio construction perspective, this has two important implications. First, it reduces sensitivity to entry point timing, limiting the adverse impact of deploying capital immediately prior to periods of market weakness. Second, it introduces a structured pathway for deploying capital in uncertain or volatile environments, where macroeconomic signals may be mixed and conviction levels uneven.

Importantly, DCA does not eliminate market risk, nor does it replace the need for rigorous asset selection. Rather, it functions as both a risk management tool and a governance mechanism, reinforcing discipline in execution while allowing investors to maintain alignment with their long term strategic objectives.

The Mathematics of Volatility Working in Your Favour

Volatility is often framed as the primary risk in financial markets. Yet for investors deploying capital systematically, it can also become one of the most quietly advantageous forces shaping long-term outcomes.

When a fixed amount of capital is invested at regular intervals, fluctuations in asset prices directly influence the number of units acquired. Declining prices enable investors to accumulate a greater number of shares for the same capital outlay, while rising prices result in fewer shares purchased. Over time, this dynamic produces an average cost base that is typically lower than the simple average of observed prices across the investment period.

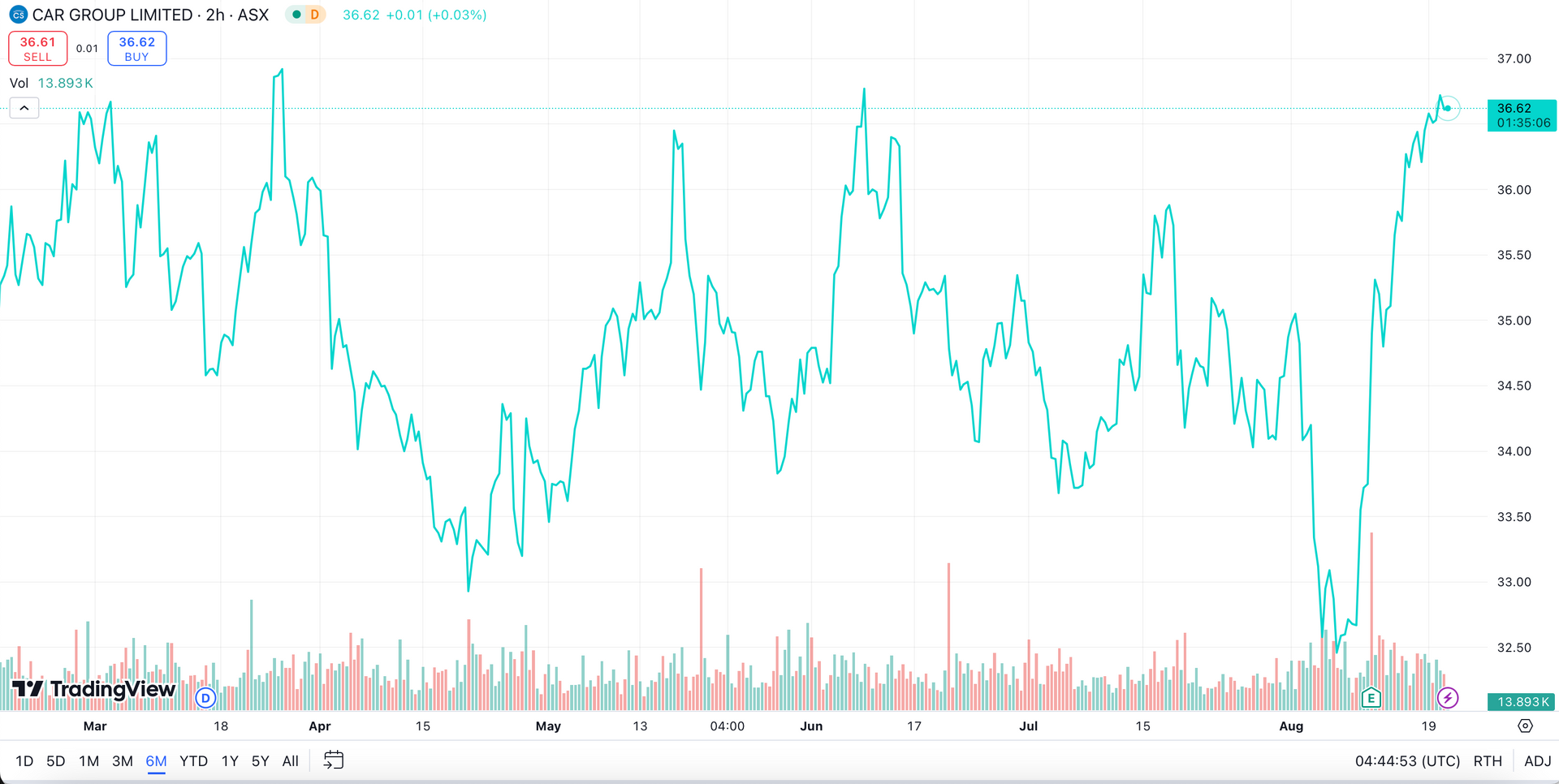

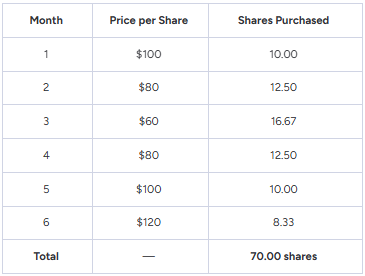

A simplified illustration highlights this effect. Consider an investor allocating $1,000 per month into an equity ETF over a six-month period characterised by price volatility:

Total capital invested amounts to $6,000, resulting in the accumulation of 70 shares at an average cost of approximately $85.71 per share. By comparison, the arithmetic average of the six monthly prices is $90.00. The systematic investment approach therefore results in an entry cost nearly 5% lower, achieved not through timing, but through disciplined capital deployment.

Contrast this with a lump-sum allocation of $6,000 in the first month at $100 per share. In this case, the investor would hold 60 shares at an initial cost of $100 each, materially higher than the average acquisition cost achieved through phased investment before the position has had an opportunity to recover.

The implication is straightforward: volatility does not inherently disadvantage the systematic investor. The wider the price dispersion across the investment horizon, the greater the potential cost advantage from consistent deployment. The same market conditions that often prompt hesitation can, when approached with discipline, enhance long term entry outcomes.

This dynamic is not without limits. In persistently rising markets with minimal pullbacks, lump-sum investing may outperform by maximising early exposure to positive returns. Dollar-cost averaging derives its primary advantage in environments that are volatile, uncertain and sentiment-driven, conditions that have characterised a meaningful portion of most market cycles. For investors able to maintain a defined investment cadence through periods of market stress, volatility is not simply endured. It is converted into a structural cost advantage that can compound over time.

Historical Evidence: The Case for Staying Invested

Empirical data consistently reinforces the value of systematic deployment through periods of acute market uncertainty. Across three defining dislocations of the past 25 years, the dot-com bust (2000–2002), the Global Financial Crisis (2008–2009), and the COVID-19 market crash (2020), investors who maintained disciplined, phased investment schedules generally recovered more quickly and, in many cases, achieved higher absolute returns than those who paused or withdrew capital.

One of the most striking illustrations of this principle is the cost of missing the market’s best days. Analysis of the S&P 500 from 2002 to 2022 shows that an investor who missed just the ten strongest trading days over the 20 year period would have experienced more than a 50% reduction in total returns compared with an investor who remained fully invested. Critically, the majority of these best performing days occurred immediately following extreme drawdowns, when investor sentiment was at its most pessimistic.

Historical experience highlights a central insight for investors: timing the market is rarely a reliable path to superior outcomes, while disciplined exposure, even during periods of heightened volatility, systematically captures the most compelling opportunities. By deploying capital incrementally, investors are able to participate in recoveries without needing to predict the exact market trough, converting uncertainty into a practical advantage over time.

Portfolio Construction and Strategic Implementation

The effectiveness of dollar-cost averaging is determined by how it is embedded within a broader portfolio framework. As a tool for disciplined capital deployment, its implementation should be calibrated to the investor’s liquidity profile, investment horizon and scale of capital. Deployment cadence, whether weekly, monthly or quarterly, should align with these factors. For institutional investors, quarterly schedules are often appropriate, reflecting governance cycles and rebalancing processes, while private wealth portfolios may favour more frequent intervals aligned with cash flow dynamics.

DCA is most effective in liquid asset classes such as publicly traded equities and fixed income, where regular deployment can be executed efficiently. In private markets, a similar effect is achieved through vintage year diversification, where commitments are spread across multiple periods to smooth entry points and return outcomes. DCA also integrates naturally with portfolio rebalancing, allowing capital to be systematically directed toward underweight exposures while maintaining strategic allocation discipline.

While DCA enhances execution, it does not replace the need for rigorous investment selection. It determines how capital is deployed, not where it is allocated. When applied within a well-defined investment framework, it ensures that portfolio decisions remain consistent, measured and aligned with long term objectives despite short term market uncertainty.

Limitations and Trade-Offs

While dollar-cost averaging offers clear advantages in managing uncertainty, it is not without limitations. In sustained bull markets, delaying full investment can result in opportunity costs, as a portion of capital remains uninvested during periods of positive returns. The strategy is therefore best understood not as a return maximisation tool in all environments, but as a mechanism for managing entry risk in uncertain or volatile conditions.

More importantly, DCA does not eliminate fundamental investment risk. Systematically deploying capital into an asset that continues to decline due to structural, sectoral or company specific deterioration will still result in losses, albeit at a lower average cost than a poorly timed lump sum entry. As such, DCA should not be viewed as a substitute for asset allocation or rigorous due diligence. Its effectiveness depends on being applied to a well founded, conviction driven investment thesis.

There is also a distinction between maintaining discipline and ignoring changing conditions. A well-structured DCA framework should incorporate periodic review points, whether valuation based, macro driven or time based, allowing investors to reassess the underlying thesis without defaulting to reactive decision making. When applied thoughtfully, DCA enhances execution but does not replace the need for ongoing judgement and portfolio oversight.

Conclusion: Process Over Prediction

Over time, the key differentiator between investors who compound wealth effectively and those who do not is rarely asset selection, but discipline. The ability to maintain a consistent, process-driven approach to capital deployment across varying market conditions is fundamental to long-term outcomes.

Dollar-cost averaging institutionalises this discipline by transforming the intention to remain invested into a structured and repeatable framework. It does not eliminate uncertainty, but provides a pathway to maintain market exposure while reducing the risks associated with imperfect timing.

In uncertain environments, the ability to participate in recovery without relying on precise entry points may prove to be one of the most valuable attributes of a well-constructed investment process.

Subscribe to our newsletter

Disclaimer: This article does not constitute financial advice nor a recommendation to invest in the securities listed. The information presented is intended to be of a factual nature only. Past performance is not a reliable indicator of future performance. As always, do your own research and consider seeking financial, legal and taxation advice before investing.