Recent communications from the Reserve Bank of Australia (RBA) have shifted the tone of the interest rate outlook, challenging the market’s prior assumption that the tightening cycle had effectively run its course. Minutes from the February policy meeting indicate that inflation outcomes through late 2025 were stronger and more broad-based than expected, suggesting that underlying price pressures remain persistent.

In response, the RBA raised the cash rate by 25 basis points to 3.85%, reinforcing its commitment to returning inflation to target within a reasonable timeframe. Updated forecasts point to a slower disinflation process, with both headline and underlying inflation expected to remain above the 2–3% target band over the near term.

This shift has prompted a recalibration across financial markets. Expectations that had begun to tilt toward eventual rate cuts have been replaced with a more cautious “higher for longer” stance. Bond yields have adjusted, equity market leadership has narrowed, and interest rate-sensitive sectors are once again under pressure. For investors, the change carries immediate implications for asset valuations, sector performance, and portfolio positioning.

Reading Between the Lines of RBA Guidance

While the RBA has stopped short of explicitly signalling an extended hiking cycle, its recent commentary reflects a clear tightening bias. The Board emphasised that inflation remains above target, with risks skewed to the upside amid strong domestic demand and tight labour market conditions.

Economy-wide capacity pressures have increased, suggesting that demand may be running ahead of supply. Both headline and trimmed-mean inflation in the December quarter came in higher than forecast, with the share of CPI items rising above 2.5% increasing sharply by historical standards. Trimmed mean inflation is projected to peak at 3.7% in mid-2026, while headline CPI is expected to reach around 4.2%, partly influenced by the ending of electricity rebates. This dynamic complicates disinflation and increases the likelihood that restrictive policy settings will persist.

The labour market remains central. Low unemployment and resilient wage growth support household incomes but contribute to persistent services inflation. Unit labour costs remain elevated, reflecting tight conditions, while business investment, particularly in data centres, has surged. The RBA faces a delicate balancing act: tightening sufficiently to contain inflation without unnecessarily destabilising growth.

For investors, the hurdle for rate cuts has risen. Policy is now firmly data-dependent, with a bias toward further tightening should inflation fail to moderate. Eased financial conditions, rising housing credit, and strong business debt growth reinforce the Board’s view that policy must remain restrictive. Australia’s domestic inflation challenges diverge from the more accommodative paths signalled by peers such as the US Federal Reserve and the European Central Bank, highlighting the unique domestic context.

How Rising Rates Move Markets

Rate hikes do not affect all assets equally. Understanding how rising rates flow through markets is key for portfolio positioning.

At a fundamental level, higher rates increase the discount rate applied to future cash flows. This reduces the present value of long-duration assets, most acutely impacting growth stocks where expected returns lie several years ahead. Companies projecting earnings five to ten years out are more sensitive than those generating strong cash flows today.

Capital-intensive sectors and companies with high leverage face direct pressure as borrowing costs rise and profit margins tighten. Consumer discretionary businesses are doubly exposed: higher financing costs for operations combine with households contending with rising mortgage repayments and living costs, dampening demand.

Certain sectors historically benefit in a rising-rate environment. Banks and financial institutions often see net interest margin expansion, while energy and resources stocks, less sensitive to domestic rates and more influenced by global commodity prices, can hold up. The RBA noted that global growth, particularly in East Asia and the US, has remained resilient, supporting commodity prices and providing a tailwind for Australian resources.

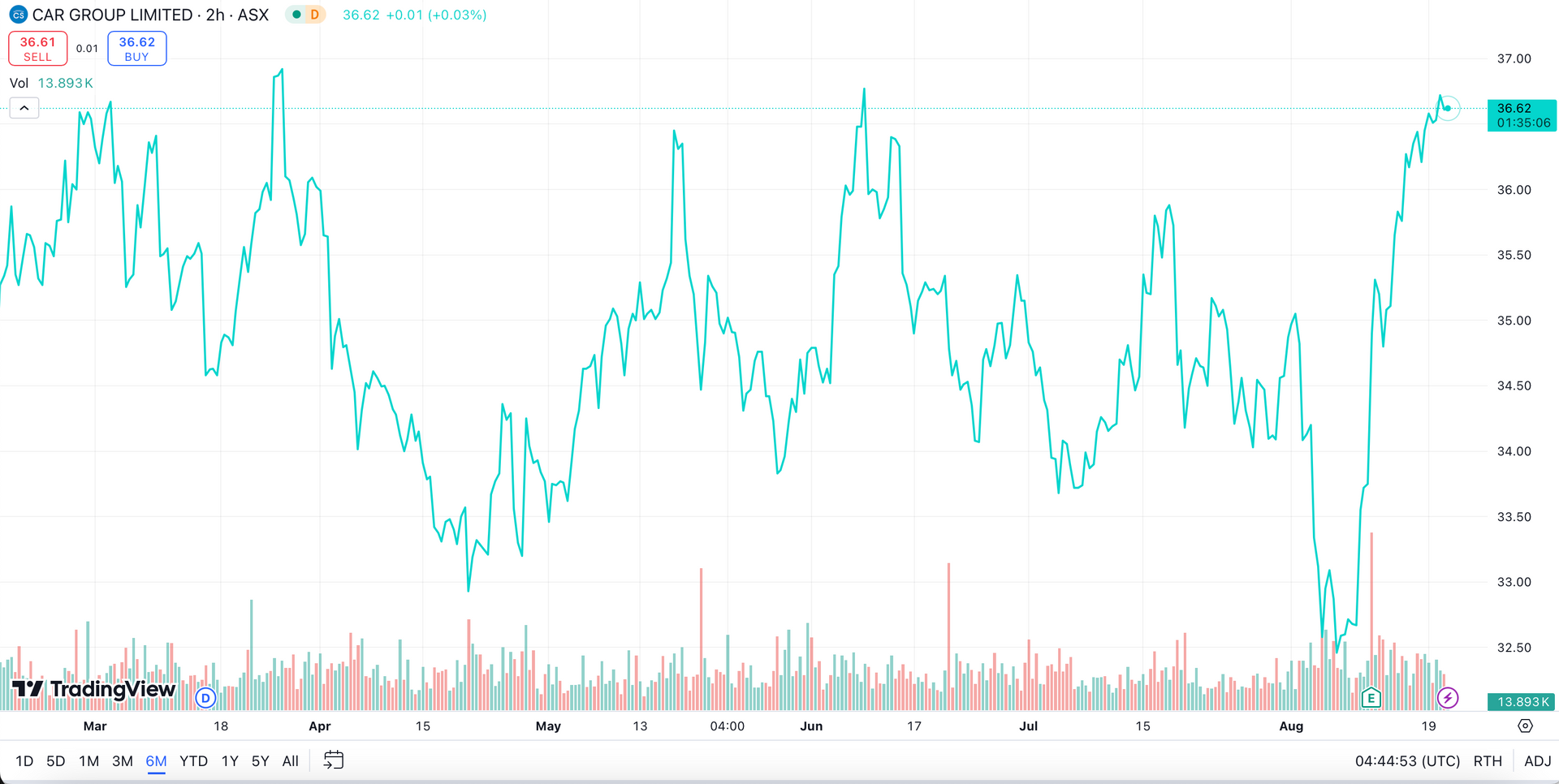

On the ASX, equity prices had already underperformed other major markets before February’s decision, reflecting expectations of rising rates that were progressively priced in. The key uncertainty now is not the recent hike, but how many more may follow and whether the RBA can balance cooling inflation without triggering a material slowdown in growth.

Portfolio Implications

Equities: Earnings Over Expansion

In a higher-rate environment, equity returns are increasingly driven by earnings rather than multiple expansion. Growth stocks with long-duration earnings profiles are particularly sensitive, as higher discount rates reduce the present value of future cash flows. Companies with strong pricing power, consistent cash flow generation, and robust balance sheets are better positioned to navigate elevated costs and softer consumer demand. Defensive sectors such as healthcare, consumer staples, and infrastructure may offer more stable cash flows, while financials could benefit from wider lending margins if credit quality remains resilient.

Fixed Income: Income Re-emerges

Rising yields have restored fixed income as a meaningful source of portfolio income. Government and investment-grade bonds now offer attractive yields, improving the risk-return trade-off. Duration risk remains relevant, with longer-dated bonds facing price volatility if policy tightens further or remains restrictive. Strategies that actively manage duration, incorporate floating-rate notes, or diversify across maturities and credit profiles can help mitigate risk while capturing higher income.

Property and REITs: A Selective Market

Property remains highly sensitive to rates. Leveraged REITs and property investments face pressure from rising borrowing costs, refinancing challenges, and cap rate expansion. High-quality assets in supply-constrained segments may prove more resilient than secondary or cyclical properties with weaker demand. Investors should prioritise asset quality, tenant stability, and structural market advantages.

Consumer and Cyclical Sectors: Margin Pressures

Elevated interest rates weigh on household budgets, reducing discretionary spending. Companies in consumer discretionary or cyclical sectors may face margin compression if cost increases cannot be passed through. Businesses with pricing power, operational efficiency, or exposure to non-discretionary demand are better positioned to navigate this environment.

Cash and Liquidity: Reconsidered

Cash and term deposits are now a competitive component of a diversified portfolio, offering meaningful yield while preserving capital. Maintaining liquidity provides flexibility to respond to market volatility or opportunistic investments, particularly if rate volatility continues.

Where We See Opportunity

Higher-rate environments are not uniformly hostile to investors; they are hostile to the wrong positioning. That distinction creates opportunities for those willing to be precise.

Within equities, we favour businesses with three core attributes: strong free cash flow, low financial leverage, and demonstrated pricing power. These qualities allow companies to navigate higher costs, service debt without distress, and preserve margins even as consumer budgets tighten. On the ASX, this points us toward quality names in financials, healthcare, infrastructure, and select resources — sectors where earnings are underpinned by structural demand rather than cyclical optimism. Periods of macro-driven volatility can create mispricing, allowing long-term investors to accumulate high-quality assets at attractive entry points.

Fixed income now deserves a genuine allocation. The yields available in shorter-duration, investment-grade bonds provide a meaningful income base that was largely absent two years ago. Inflation-linked securities add further protection in an environment where the RBA’s own forecasts anticipate above-target inflation persisting well into 2027.

Selectivity remains critical. Broad market exposure may be less effective than targeted positioning aligned with prevailing macro conditions. Investors should focus on businesses with resilient earnings, strong balance sheets, and exposure to non-discretionary demand, while diversifying across sectors, geographies, and asset classes to mitigate risk and capture upside.

Key Risks to Monitor

While the RBA remains focused on containing inflation, risks remain on both sides of the policy outlook. Overtightening could slow consumption or employment more sharply than expected, while persistent inflation may require further tightening, increasing the risk of a more pronounced economic slowdown.

External factors such as global growth volatility, particularly in China, or commodity price swings, could influence the domestic outlook. Taken together, the most likely scenario is that interest rates remain elevated for an extended period rather than moving sharply in either direction. Portfolios should therefore be designed to be resilient and flexible across a range of potential outcomes.

Navigating a Higher-for-Longer Environment

Rate uncertainty has reshaped the investment environment. Investors must now contend with the likelihood of persistent restrictive settings. Portfolio construction should prioritise quality, resilience, and diversification across equities, fixed income, property, and cash.

From a valuation perspective, higher rates and persistent inflation alter asset attractiveness. Equities with predictable earnings, strong cash flow, and low leverage are likely to outperform, while long-duration growth stocks remain sensitive to higher discount rates. Fixed income offers meaningful income, particularly via short-duration and inflation-linked instruments. High-quality property and REIT exposures in structurally advantaged segments may also hold value, while excessive leverage or secondary assets remain vulnerable.

Strategically, selectivity and flexibility are paramount. Portfolios should be robust to uncertainty rather than reliant on precise interest rate timing. Maintaining liquidity and monitoring macro signals allows investors to respond to market dislocations and mispricing opportunities. A disciplined, forward-looking approach enables capture of opportunities where valuations reflect fundamentals while managing downside risks.

By integrating these considerations, investors can navigate the current cycle with a balanced approach, aligning portfolio positioning with market realities and maintaining resilience while pursuing selective upside in a prolonged high-rate, high-inflation environment.

Whether you want to review your holdings or receive strategic guidance on navigating a higher-for-longer rate environment, we encourage you to

speak with an adviser. Thoughtful positioning decisions today can have meaningful implications for outcomes over the years ahead.