AI Layoffs Accelerate: How Workforce Cuts Are Affecting Markets

Artificial intelligence is reshaping not just technology strategy but labour markets and financial markets. After a prolonged period of rapid hiring to fuel AI development, a wave of workforce reductions is now underway, spreading beyond pure tech into financial services, media and other sectors. This phenomenon reflects more than economic cycles or post-pandemic adjustments. It is part of a structural shift in how firms seek to leverage AI for efficiency, productivity and competitive advantage, prompting investors to reassess earnings, risk and growth assumptions.

From an investment perspective, key questions emerge. Are these layoffs a temporary adjustment or a signal of deeper structural change in labour demand and operating models? How do markets interpret workforce reductions as indicators of profitability and future performance? Understanding the interaction between AI adoption, layoffs and market behaviour is essential for positioning portfolios in the evolving economy.

Mapping the Layoff Wave

The latest wave of reductions affects global markets and a broad range of industries including logistics, manufacturing, financial services and retail. Workforce cuts are increasingly framed as enterprise-wide productivity and automation initiatives rather than cyclical cost control. As of early 2026, Amazon has reduced approximately 16,000 corporate roles, completing plans that could lower headcount by up to 30,000 positions as it streamlines operations and expands AI-enabled tools. UPS plans to eliminate up to 30,000 operational roles in 2026 as it automates facilities and reconfigures its delivery network, following nearly 48,000 cuts in 2025. Chemicals group Dow has outlined roughly 4,500 layoffs linked to productivity improvements. These reductions illustrate a shift toward leaner organisational models across multiple sectors.

This phase of workforce reduction differs meaningfully from earlier cycles. Rather than responding primarily to demand weakness or overcapacity, companies increasingly describe layoffs as part of structural optimisation linked to AI adoption and workflow redesign. Management commentary often emphasises reallocating resources away from routine, process-driven tasks toward higher-value functions, automation and capital discipline. Large platforms such as Microsoft and Meta have reduced headcount in technology and operational roles while positioning these moves as necessary to support long-term efficiency and AI-led transformation.

Geographically, the adjustment remains uneven. The United States is at the centre of large-scale reductions, reflecting higher AI penetration, more flexible labour markets and a corporate culture accustomed to rapid restructuring. In Europe, workforce reductions have been more gradual, constrained by stronger labour protections and regulatory oversight. Asia presents a mixed picture, with automation advancing more quickly in export-oriented and service-intensive economies than in domestic-focused markets. This layoff wave is unfolding against a relatively resilient macro backdrop. Unemployment rates across many developed economies remain low, reducing immediate political pressure and allowing companies greater latitude to recalibrate workforces without triggering broader confidence shocks.

The AI Productivity Thesis: Economics and Market Implications

At the core of the current layoff narrative sits the AI productivity thesis. From a corporate perspective, artificial intelligence is increasingly positioned as a tool to reduce labour intensity, improve throughput and flatten organisational structures. For investors, the appeal is straightforward. Labour remains one of the largest and least flexible cost lines for many companies, particularly in services-heavy sectors.

Markets have historically rewarded cost discipline, and AI-driven layoffs fit neatly within that framework. Workforce reduction announcements are often accompanied by language around redeployment of capital, reinvestment in growth and improved operating margins. In the near term, this can support earnings per share even in the absence of strong top-line growth, particularly where labour costs account for a meaningful share of operating expenses.

The longer-term picture is more complex. While AI can automate repetitive and rules-based tasks efficiently, translating these capabilities into sustained productivity improvements is not guaranteed. Recent examples highlight execution risk. Air Canada faced legal and reputational costs after an AI-powered customer service system provided incorrect guidance, while Klarna later acknowledged that aggressive automation in customer support compromised service quality and required partial reversal. Integration challenges, oversight requirements and organisational change costs can dilute near-term benefits and slow realisation.

Despite these risks, investors have generally been willing to look through uncertainty, particularly in sectors where margins are under pressure and efficiency gains are most valuable. The result has been a tendency to price in productivity improvements early, often ahead of clear evidence in reported financials. This dynamic creates opportunity, but it also increases the risk of disappointment if implementation falls short of expectations.

Sectoral Analysis: Winners, Losers, and the Disrupted Middle

AI layoffs are uneven across sectors. In technology, firms developing AI platforms, infrastructure and tools have maintained resilience, while legacy software and service providers face pressure to restructure.

In financial services, front-office roles benefiting from algorithmic trading, risk analytics and automation see limited reductions, whereas middle and back-office functions such as compliance and reporting are more heavily affected.

Professional services, traditionally labour-intensive, are integrating AI into research, document drafting and regulatory tasks, reducing headcount in routine functions. Media and content industries face generative AI producing articles, imagery and video at scale. Some firms are expanding editorial teams for higher-value content, while others are reducing staff where automation achieves near-human quality.

Manufacturing and logistics are deploying robotics and AI-driven process optimisation, reducing repetitive roles but creating growth in AI maintenance and management. Retail and consumer-facing businesses are using AI for customer service, reducing call centre and frontline positions.

Across these sectors, the most vulnerable roles are routine, manually intensive or rule-based. Less susceptible areas include human leadership, creative strategic work, and highly specialised technical tasks that require contextual judgement.

Market and Valuation Implications

Markets are increasingly pricing in the potential for AI-driven margin expansion. Companies with clear AI strategies and credible efficiency narratives often trade at valuation premiums relative to peers lacking such positioning. This reflects investor expectations that automation can compress operating costs and improve profitability, even in modest growth environments.

Labour costs as a percentage of revenue provide a useful lens for assessing exposure. Industries where wages represent a large share of expenses, such as professional services and customer-facing businesses, are more sensitive to automation-led changes. Capital-intensive sectors or those with lower labour intensity face less immediate pressure.

Broader macro dynamics also reflect these shifts. Wage inflation has eased in some markets despite low unemployment, partly due to AI’s impact on demand for less specialised roles. This has implications for bond markets, where expectations for contained wage growth may temper inflation forecasts and influence rate trajectories.

Currency markets may also respond indirectly. Economies that achieve faster productivity gains through AI adoption could see relative currency strength as risk-adjusted returns improve, while labour-intensive economies slower to adapt may face competitiveness pressures.

Second-Order Effects and Risks

Beyond earnings, AI-driven layoffs carry broader risks. Consumer spending remains sensitive to employment conditions, particularly in service-dominated economies. Even if displaced workers eventually find alternative roles, transition periods can weigh on demand and confidence

Political and regulatory responses are likely to intensify as workforce reductions become more visible. Governments are already examining AI governance, workforce protections and retraining obligations. Such measures may slow adoption or raise compliance costs, particularly in regulated sectors.

Skills mismatches represent another constraint. The pace of displacement may exceed the capacity of education and training systems to redeploy labour efficiently, limiting realised productivity gains and increasing friction in labour markets.

Execution risk is also material. Companies that cut too aggressively risk losing institutional knowledge or weakening innovation capacity. The growing prevalence of “AI washing”, where layoffs are attributed to automation without clear operational evidence, further complicates investor assessment of management credibility.

Outlook and Trend Forecast: Will AI Layoffs Accelerate or Stabilise?

AI-driven workforce restructuring is expected to continue through the latter half of the decade, with automation displacing a meaningful share of tasks rather than entire occupations. Research from McKinsey, Goldman Sachs, Gartner, MIT and the Brookings Institution suggests that cumulative effects will become more visible between 2025 and 2030 as AI integration deepens across workflows.

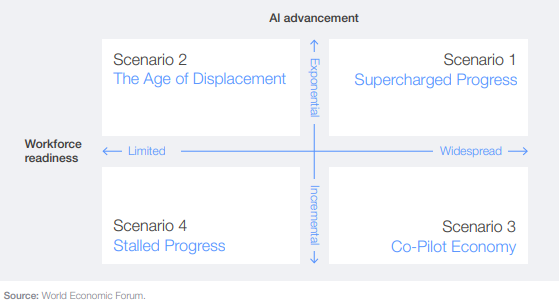

The World Economic Forum identifies four possible futures for jobs by 2030. Supercharged Progress assumes AI and skilled workers drive productivity breakthroughs. The Age of Displacement sees automation outpacing reskilling, raising unemployment risks. Co-Pilot Economy reflects incremental AI integration and human-AI collaboration. Stalled Progress occurs where adoption is limited and skill gaps constrain productivity. Rapid adoption can boost margins but heighten displacement risk, whereas measured integration with reskilling creates new opportunities.

Base-case forecasts anticipate gradual acceleration as AI capabilities improve and corporate confidence grows, offsetting job losses through new role creation. Upside scenarios involve faster breakthroughs and margin expansion. Downside risks include regulatory intervention, slower productivity gains or social resistance. The trajectory will depend on adoption speed, regulatory response and AI capability limits. AI-related layoffs represent a multi-year structural adjustment with implications for earnings quality, labour-sensitive sectors and long-term consumption trends.

Portfolio Positioning and Investment Implications

For investors, navigating AI-driven labour change requires balance. Likely beneficiaries include AI infrastructure and software providers, technology firms with strong R&D pipelines and businesses able to monetise productivity gains. More defensive positioning may favour companies with lower labour intensity or durable intellectual property.

Contrarian opportunities may emerge in labour-intensive businesses where valuations fail to reflect structural resilience or niche advantages. Geographic positioning also matters, with markets leading in AI adoption and workforce readiness likely to outperform those slower to adapt.

From a factor perspective, quality, profitability and low-volatility strategies may outperform pure growth exposures as earnings predictability and cost control gain importance. Active management is well suited to distinguishing durable productivity improvement from short-term cost cutting that may undermine long-term growth.

Navigating the AI Labour Transition

The acceleration of AI-linked layoffs marks a structural shift rather than a temporary adjustment. The investment challenge lies in separating durable productivity improvement from cyclical cost cutting and assessing how labour dynamics feed into long-term earnings power.

This transition will unfold unevenly across sectors and regions, requiring ongoing evaluation rather than static assumptions. As AI reshapes workforces, it will continue to influence margins, valuations and macro outcomes. Investors should reassess exposures with a focus on execution quality, adaptability and resilience, and engage with advisers to ensure portfolios remain aligned with a changing labour and technology environment.

To explore companies leading the AI acceleration and understand how these dynamics are shaping investable opportunities, access our ASX AI stocks report here and our US AI stocks report here.

Subscribe to our newsletter

Disclaimer: This article does not constitute financial advice nor a recommendation to invest in the securities listed. The information presented is intended to be of a factual nature only. Past performance is not a reliable indicator of future performance. As always, do your own research and consider seeking financial, legal and taxation advice before investing.