Stock Spotlight: Monash IVF Group Limited (ASX:MVF)

This week's Stock Spotlight is ASX-listed Monash IVF Group Limited.

About Monash IVF Group Limited.

Monash IVF Group Limited provides assisted reproductive and specialist women imaging services in Australia and Malaysia. The company offers diagnostic obstetric, gynecological ultrasound, and fertility treatment services. It also provides tertiary level prenatal diagnostic, and IVF treatment services. Monash IVF Group Limited was incorporated in 2014 and is based in Cremorne, Australia.

Key Stats

Key Stats

Source: Yahoo Finance, ASX. Data as of 18/08/25.

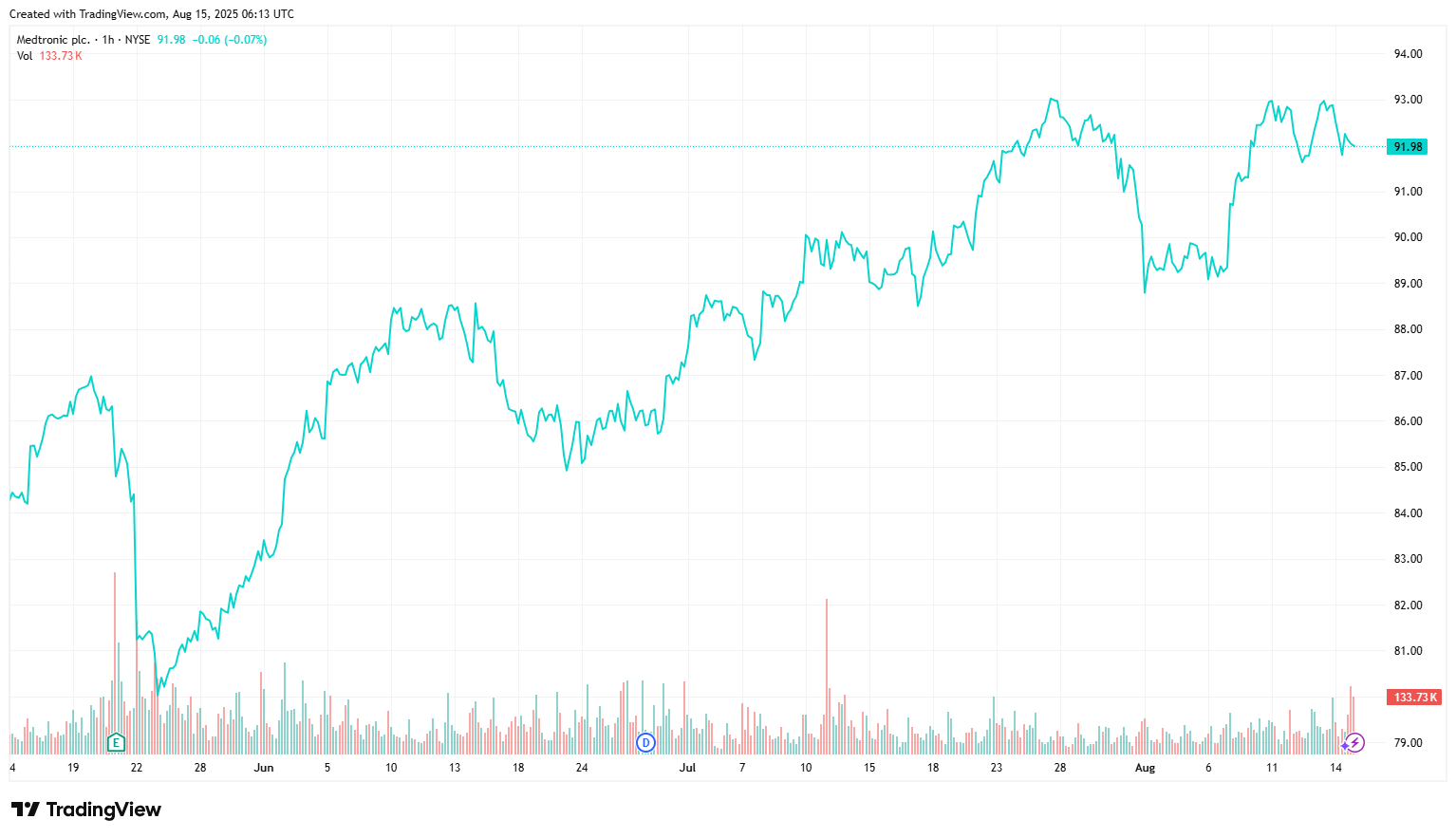

Price Performance

Growth Potential

- Trading below our revised valuation (which forecast little to no growth over the near-term) but given the recent Brisbane incident we believe investors will be cautious jumping back into this name immediately.

- We would argue the current price is already largely factoring in a material structural damage to MVF’s share price.

- High barriers to entry with unique expertise and assets. 40-year heritage of leadership in science and innovation in ARS and women’s imaging, coupled with the depth of experience from the doctors and clinical team which will continue to underpin MVF’s future growth and maintain treatment success rates.

- Aging Australian population and increased age of mothers (especially with the trend of more females choosing career over family until their early thirties) will provide favorable demographic tailwinds.

- Potential earnings diversification and growth via international expansion and increased presence in diagnostics.

- Potential growth from genetic carrier screening.

Key Risks

- Brisbane incident leads to material reputation damage over the long-term leading to lower patient registrations and human capital moving to competitors.

- Regulatory risk as changes in government funding may increase patient’s out-of-pocket expenses and thereby volume demand.

- Fluctuations in the availability and size of Medicare rebates may negatively influence the number of IVF cycles administered and overall industry revenue.

- The Australian market does not rebound following this period of downturn. Population of males and females with fertility problems decline.

- Loss of key specialists.

- Loss of market share especially to low-cost providers, with one already appearing in Victoria.

- Weakening economic activity resulting in increased unemployment leading to less disposable income to be spent in IVF treatment.

- Execution of international forays into Malaysia goes poorly.

Subscribe to our newsletter

Disclaimer: This article does not constitute financial advice nor a recommendation to invest in the securities listed. The information presented is intended to be of a factual nature only. Past performance is not a reliable indicator of future performance. As always, do your own research and consider seeking financial, legal and taxation advice before investing.