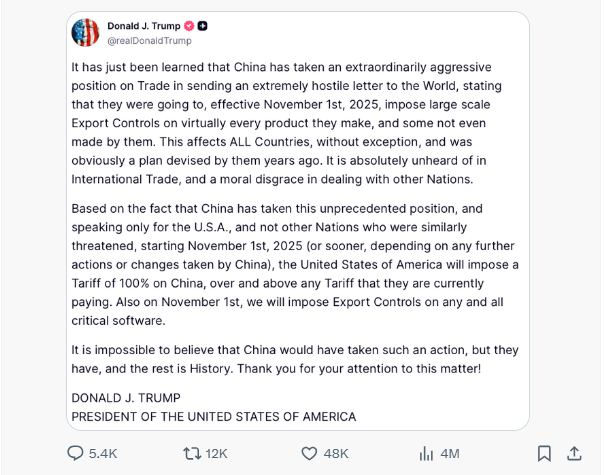

On 10 October, former U.S. President Donald Trump announced via Truth Social his plan to impose a 100% tariff on Chinese imports, effective November 1 or sooner depending on Beijing’s actions. He described it as a direct response to China’s “extraordinarily aggressive” export controls on rare earths and critical materials. The new tariff, he said, would apply “over and above any tariff they are currently paying.”

The announcement triggered a sharp global equity sell-off. U.S. markets reacted immediately, with the S&P 500 falling 2.7% and the Nasdaq Composite dropping 3.6%, their steepest one-day declines since April 2025. The move underscored how sensitive markets remain to abrupt trade policy shifts, particularly those with wide-reaching global implications.

Market Reaction: From Rhetoric to Risk-Off

Investors interpreted Trump’s statement as more than campaign rhetoric, viewing it as a credible policy shift with near-term economic consequences. The timing and breadth of the proposed tariffs reignited fears of a renewed trade war, further eroding sentiment already weakened by slowing growth and persistent inflation concerns.

The market response was swift and broad-based. Global equities shed nearly USD 2 trillion in value as algorithmic systems and hedge funds accelerated selling. Technology, semiconductor, and industrial sectors bore the brunt of the downturn as investors priced in higher production costs, disrupted supply chains, and weaker profit margins. Companies heavily reliant on Chinese manufacturing or export markets were hit hardest.

In contrast, defensive sectors such as utilities and healthcare held up relatively well as investors sought stability. Safe-haven demand strengthened, pushing gold and the U.S. dollar higher, while Treasury yields declined as capital rotated into bonds. Market volatility surged, highlighting uncertainty over how aggressively either side might act in the coming weeks.

For many market participants, the sell-off was less about the tariff measure itself than what it represented: a shift back toward unpredictable trade confrontation. The potential for tit-for-tat retaliation raised renewed concerns over inflation, earnings downgrades, and slowing global growth.

Broader Economic & Policy Implications

The proposed tariffs pose several key risks for both markets and policymakers.

Inflation and cost pass-throughs:

Higher import duties are likely to lift input costs for manufacturers, filtering into consumer prices and complicating the Federal Reserve’s inflation management.

Margin pressure and earnings guidance:

Technology and manufacturing companies dependent on foreign components may face tighter margins and could be forced to revise earnings outlooks or delay capital expenditure.

Trade retaliation:

Beijing has already signalled potential countermeasures, increasing the risk of a broader trade escalation affecting multiple sectors and regions.

Growth effects:

Slowing trade activity, reduced investment confidence, and rising uncertainty could weigh on global GDP growth, particularly across export-driven economies.

China market impact:

Chinese equities also appear vulnerable, with investors expecting profit-taking and capital outflows amid heightened risk aversion.

What Investors Should Consider

Given heightened volatility and policy uncertainty, portfolio positioning requires greater selectivity. Investors may consider focusing on companies with solid balance sheets, resilient cash flows, and minimal exposure to cross-border trade disruptions.

Defensive sectors such as healthcare, consumer staples, and utilities could offer relative stability if global tensions persist. Maintaining liquidity and flexibility remains essential, enabling investors to respond swiftly to policy updates or market corrections.

For long-term investors, the sell-off may also present selective opportunities. Quality companies that have been oversold during the downturn could merit reassessment, provided their underlying fundamentals remain intact. Monitoring leading indicators such as Chinese trade data, tariff announcements, and corporate guidance will be critical to assessing the trajectory of market sentiment.

Outlook

The scale and speed of the recent sell-off demonstrate how geopolitical developments have become a central driver of equity valuations. Trade and policy communication now carry direct market implications, shaping expectations for inflation, earnings, and capital flows.

For investors, the coming weeks will hinge on whether tensions ease or intensify ahead of the 1 November deadline. Until greater clarity emerges, maintaining discipline, diversification, and downside protection will be essential to navigating a market environment increasingly defined by political risk.