From Tariffs to Opportunity: How to Invest Strategically in a Shifting Global Trade Landscape

When navigating during uncertain or volatile market conditions, investment portfolios should prioritise caution and flexibility. Holding a healthy cash position is essential as the saying goes ‘cash is king’. Certainly, during frequently shifting market sentiment, facilitating readiness to act when genuine opportunities arise is crucial. For new investments, confirmation of trend reversals or stability before entering positions is a strategy to avoid catching falling knives.

For new investments, waiting for confirmation of trend reversals or market stability before entering positions is a prudent strategy to avoid catching falling knives. Implementing a dollar-cost averaging (DCA) approach enables positions to be built gradually, helping to mitigate the effects of market volatility and emotional decision-making. A balanced investment strategy assists in managing risk while positioning a portfolio to capitalise on potential rebounds.

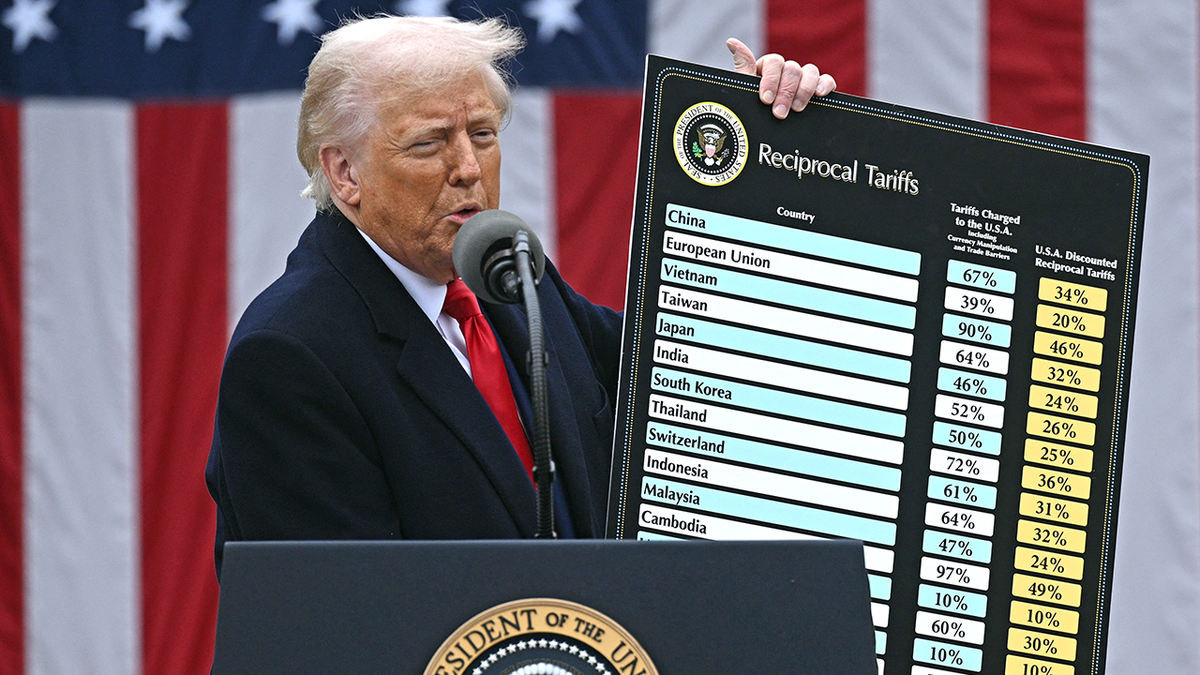

Trump Tariff Policy Outlook

Analysing recent commentary from Trump and his administration regarding tariffs reveals complicated and potentially fluid policy direction. While official statements have maintained a firm stance on the newly imposed tariffs, tariffs are looking more like a negotiation tactic (specifically the U.S. President sharing TikTok videos that suggested that tariffs were part of an intentional negotiation tactic that will not actually go forward with full force). As countries begin negotiating with the U.S. to reduce these tariffs, particularly nations heavily reliant on exports to the U.S. who have strong incentives to push for tariff reductions, a short term rebound from last week’s market fall seems likely. However, it is a matter of when as it is uncertain how long the markets will continue to decline until this happens.

Speculatively, if Trump does roll back tariffs possibly in response to domestic pushback over rising consumer prices, there could be significant investment opportunities. Tech and other sectors that were previously hit hard by the tariffs may be poised for a sharp recovery, driven by renewed investor confidence and improved global trade sentiment. Capitalising on these sectors while they remain undervalued could offer high upside potential, especially in the early stages of a reversal.

Shorting the market (early panic stage)

In the early stages of market panic, shorting the market can be a tactical move for investors anticipating further turbulence. Given the current climate of uncertainty fuelled by ongoing announcements from Trump’s administration, volatility is expected to remain elevated. One way to capitalise on this is through volatility-focused or inverse exchange-traded funds (ETFs). These instruments are designed to move in the opposite direction of market indices, offering downside exposure without directly shorting individual stocks. For example, SQQQ is an inverse ETF that provides 3x daily short leverage to the NASDAQ-100 Index, allowing investors to potentially profit from continued market declines. While powerful, these tools carry higher risk and are best used with strict risk management and short-term horizons.

Gradual Accumulation of Reliable Securities

During periods of heightened volatility and market downturns, a prudent strategy is to slowly accumulate high-quality securities as their prices dip. A focus on oversold blue-chip stocks with strong balance sheets and solid fundamentals, as these companies are more likely to weather economic shocks and rebound over time. Additionally, beaten-down sector leaders in industries such as big tech, industrials, and banking are areas of interest, as they often experience sharp recoveries once market sentiment improves. For long-term growth potential, thematic ETFs in areas like artificial intelligence, green energy, and cybersecurity can offer exposure to future-focused sectors currently trading at discounted levels. A disciplined, dollar-cost averaging approach can help manage risk while building long-term value.

Historical trends during financial crises and economic recession

Looking at former worldwide financial market crises like the global financial crisis (GFC) and COVID can inform effective strategies to navigate the current global trade crisis. By analysing a combination of factors from both events, parallels can be drawn to better understand how investors, markets, and governments are likely to respond to economic shocks.

The GFC serves as a reference point for understanding typical investor behaviour and policy responses following a major financial collapse. It highlights patterns in how market confidence is gradually restored and capital is reallocated across sectors, as well as which industries tend to suffer most and which are more resilient during recovery.

In contrast, the COVID-19 crisis represented a different kind of disruption, stemming from widespread shutdowns, supply chain breakdowns, and sudden changes in consumer and business behaviour. This crisis highlighted the adaptability and resilience of sectors linked to technology and innovation. Notably, technology and growth stocks often heavily oversold during steep downturns, rebounded rapidly as investor sentiment recovered. For instance, the Nasdaq index surged after both the GFC and the COVID-19 crash, with tech stocks leading the recovery just months after the March 2020 bottom.

Today’s global trade crisis can be viewed as a policy-induced shock, driven by escalating tariffs and trade tensions, rather than systemic financial failure or a public health emergency. While the GFC was rooted in internal economic flaws and COVID-19 stemmed from external disruption, the current crisis involves deliberate changes to international trade frameworks with broad economic consequences. In this context, the COVID-19 recovery may offer a more relevant comparison, particularly in terms of supply chain challenges, inflationary pressures, and shifts in market dynamics.

Supply chain disruptions have been a common recurring theme across these crises. During COVID-19, lockdowns and restrictions led to significant bottlenecks, highlighting vulnerabilities in global supply networks. Similarly, the current trade tensions have exacerbated supply chain challenges, with tariffs increasing costs and prompting companies to reevaluate sourcing strategies. These disruptions underscore the importance for investors to consider companies with robust, adaptable supply chains and to be cautious of those heavily reliant on geopolitically sensitive regions.

Subscribe to our newsletter

Disclaimer: This article does not constitute financial advice nor a recommendation to invest in the securities listed. The information presented is intended to be of a factual nature only. Past performance is not a reliable indicator of future performance. As always, do your own research and consider seeking financial, legal and taxation advice before investing.