The Gold Rush of 2025: Why Investors Are Flocking to the Safe Haven

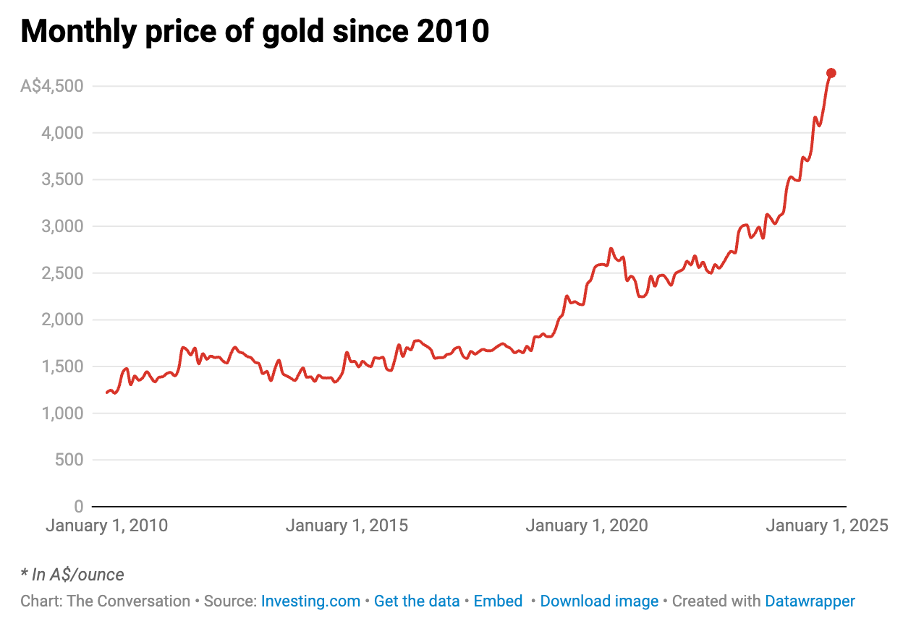

Gold is once again making headlines in 2025 as its value has risen to unprecedented levels since the start of the year. It recently surpassed $3000 USD per ounce as investors flock to its time tested safe-haven appeal. This isn’t just another bull run, a powerful combination of geopolitical shifts, inflation fears, and changing market dynamics is fuelling what could be gold's most significant rally in decades.

1. BRICS Nations Are Reshaping Global Gold Demand

The expanded BRICS alliance now representing over 30% of the world's GDP is accelerating its gold accumulation strategy. Central banks within the bloc, led by China and Russia, have been stockpiling bullion at the fastest pace in over a decade, signalling a deliberate move away from the U.S. dollar.

De-Dollarisation in Action

Countries in the BRICS+ group are increasingly moving away from the U.S. dollar for international trade, with gold re-emerging as a key neutral reserve asset. This shift is particularly driven by countries seeking stability outside of the U.S. dollar’s influence.

A New Gold Standard?

BRICS countries have also shown interest in creating a new currency to challenge the U.S. dollar, with speculation suggesting it could be partially backed by gold. This potential gold-backed BRICS currency could provide an alternative store of value, reducing dependence on fiat currencies and offering stability, which is driving interest in gold and sparking a rally in the precious metal market.

While Russian President Vladimir Putin has suggested backing a new BRICS currency with hard assets like gold or oil, it is more likely that the currency would be supported by a basket of BRICS currencies, with gold potentially included as a stabilising asset. The inclusion of gold could provide a measure of value stability in trade settlements, appealing to countries wary of geopolitical risks tied to the U.S. dollar.

2. Inflation Isn’t Going Away And Neither Is Gold’s Appeal

Despite aggressive central bank policies, inflation expectations remain stubbornly high. The 5-year breakeven rate hovering near 3% suggests markets are bracing for prolonged price pressures.

Gold has historically thrived when real interest rates stagnate or decline. With the Federal Reserve's recent policy adjustments, including the implementation of new tariffs, there's an increased likelihood of rate cuts.Goldman Sachs predicts three interest rate cuts within the next year, potentially reducing the federal funds rate to a range of 3.5% to 3.75%. Such a rate environment diminishes the opportunity cost of holding gold, enhancing its appeal as a non-yielding asset.

In light of persistent inflation and potential economic headwinds, institutional investors, including pension funds, are bolstering their gold allocations. This strategy serves as a hedge against potential stagflation a scenario characterized by sluggish economic growth coupled with high inflation. Notably, 81% of central banks surveyed expect to increase their gold holdings going into 2025, reflecting a broader institutional shift towards gold as a strategic asset.

3. The Gold-Stock Market Paradox: What’s Really Happening?

Gold offers valuable diversification benefits within a portfolio. Unlike most hedging instruments, it exhibits a dual nature. During risk-on environments, gold often moves in tandem with equities as investor sentiment drives broad asset price appreciation. However, in periods of financial stress or heightened uncertainty, gold typically decouples from the stock market and assumes its traditional role as a safe haven, showing negative correlation to equities. This behavioural shift makes gold uniquely adaptive providing upside exposure in optimistic markets while offering downside protection when risk assets falter.

Historically, gold tends to rise when stocks experience downturns, serving as a safe haven during periods of financial stress (e.g., the 2008 financial crisis or the 2020 market crash).

A Cautionary Note: While the simultaneous rise of both gold and equities may seem promising, some analysts warn that this divergence could be a sign of market dislocation. A widespread “buy everything” mentality where investors are piling into both growth stocks and safe-haven assets might be masking underlying systemic risks. These conditions could indicate that market optimism is outpacing economic fundamentals, leaving investors vulnerable to potential corrections in both asset classes.

Where Does Gold Go From Here?

Gold’s rally in 2025 is not just a market trend, but a reflection of broader economic shifts. As BRICS nations expand their influence and central banks continue to accumulate gold, the metal’s status as a safe-haven asset grows stronger. Despite the unusual rise of both gold and equities, this divergence signals deeper market dynamics, with gold providing diversification and protection against uncertainty.

Looking ahead, gold’s appeal is set to remain central in an increasingly volatile world. M banks like Bank of America project prices could reach $3350 USD by 2026 but volatility is guaranteed. Gold continues to serve as a crucial hedge against inflation, geopolitical risk, and market instability. For investors, gold’s role in a diversified portfolio is more critical than ever in navigating a complex global landscape.

What to Watch Next:

- BRICS announcements on gold-backed trade mechanisms

- Fed policy shifts and real yield trajectories

- Whether the gold-stock correlation reverts or evolves further

Subscribe to our newsletter

Disclaimer: This article does not constitute financial advice nor a recommendation to invest in the securities listed. The information presented is intended to be of a factual nature only. Past performance is not a reliable indicator of future performance. As always, do your own research and consider seeking financial, legal and taxation advice before investing.