Stock Spotlight: BHP Group Limited (ASX:BHP)

As the world’s largest diversified mining company and one of the most valuable stocks on the ASX, BHP Group Ltd (ASX: BHP) holds a central place in many Australian portfolios. With operations spanning iron ore, copper, nickel and emerging energy transition minerals, BHP is more than just a mining giant—it’s a long-term engine for dividends, capital growth and global resource exposure.

BHP’s consistent profitability, scale and strong shareholder returns make it a core investment for those seeking stability in a sector often marked by volatility. Its strategic pivot toward future-facing commodities like potash and battery metals also positions BHP to benefit from the world’s push toward decarbonisation and infrastructure renewal.

Use Sharewise to track the latest forecasts, chart trends and expert insights on BHP shares so that you can pounce at the best price!

About BHP Group Ltd.

BHP traces its roots back to 1885, beginning as Broken Hill Proprietary in outback New South Wales. Through strategic mergers, global expansions and efficient acquisitions—including the landmark 2001 merger with UK-based Billiton—BHP has grown into the world’s largest diversified mining company by market capitalisation. Headquartered in Melbourne and unified under a simplified corporate structure, BHP operates across four continents. It emphasises low-cost, high-volume extraction and robust shareholder returns.

Today, BHP’s operations span critical commodities that underpin global industry, including iron ore from its world-class mines in Western Australia’s Pilbara region, copper from the giant Escondida mine in Chile and metallurgical coal operations in Queensland’s Bowen Basin. Beyond these core materials, BHP is actively expanding into future-facing minerals, such as nickel through its Nickel West assets and potash development at Canada’s Jansen mine—commodities essential for electric vehicles, battery technology, sustainable agriculture and renewable infrastructure.

BHP’s global reach and strategically integrated supply chains position the company as an essential player in global resource security. Whether it’s steel production in China, battery manufacturing in Europe or renewable energy technologies in North America, BHP plays a critical role in delivering the materials driving economic growth and global decarbonisation efforts.

With a sharp focus on operational excellence, ambitious decarbonisation targets and ESG transparency, BHP continues to deploy advanced technologies like autonomous haulage, renewable-powered mining facilities and carbon capture solutions. This forward-thinking approach reinforces BHP’s position as both a resilient global resource provider and a consistent performer on the ASX.

What Makes BHP Stocks A Strong Competitor In The Mining Sector?

BHP shares currently stand apart from competitors due to the company’s diversified commodity portfolio. Unlike Rio Tinto who are heavily reliant on iron ore, or Fortescue Metals (FMG) who are a pure-play iron ore miner, BHP balances its exposure across several major commodities. Its diverse operations include iron ore, copper, nickel and metallurgical coal, plus strategic positions in potash and lithium.

This diversified mix enables BHP to effectively buffer against market volatility. Recent downturns in iron ore significantly impacted Rio Tinto and FMG, but BHP’s broader commodity footprint softened volatility, maintaining overall stability. Forward-looking investments in copper, nickel and potash align closely with rising global demand driven by renewable energy, battery manufacturing and electrification.

Operational excellence and disciplined financial management further define BHP’s competitive strength. Its large-scale operations and cost discipline maintain resilient margins even during challenging market conditions. Recent financial results underscore this—BHP recorded a $5.08 billion profit for H1 2025, despite lower commodity prices, demonstrating profitability relative to peers. Maintaining a dividend of $0.50 per share reinforced commitment to returns.

Consistency and stability of BHP dividend payments are why it holds such appeal, particularly for SMSFs and income-focused investors. Reliable yield and disciplined capital management solidify its status, clearly visible through performance trends on the BHP ASX chart. For investors seeking dependability and diverse global resource exposure, stocks BHP represent a core holding.

Key Stats

Key Stats

Source: Yahoo Finance, ASX. Data as of 07/04/25.

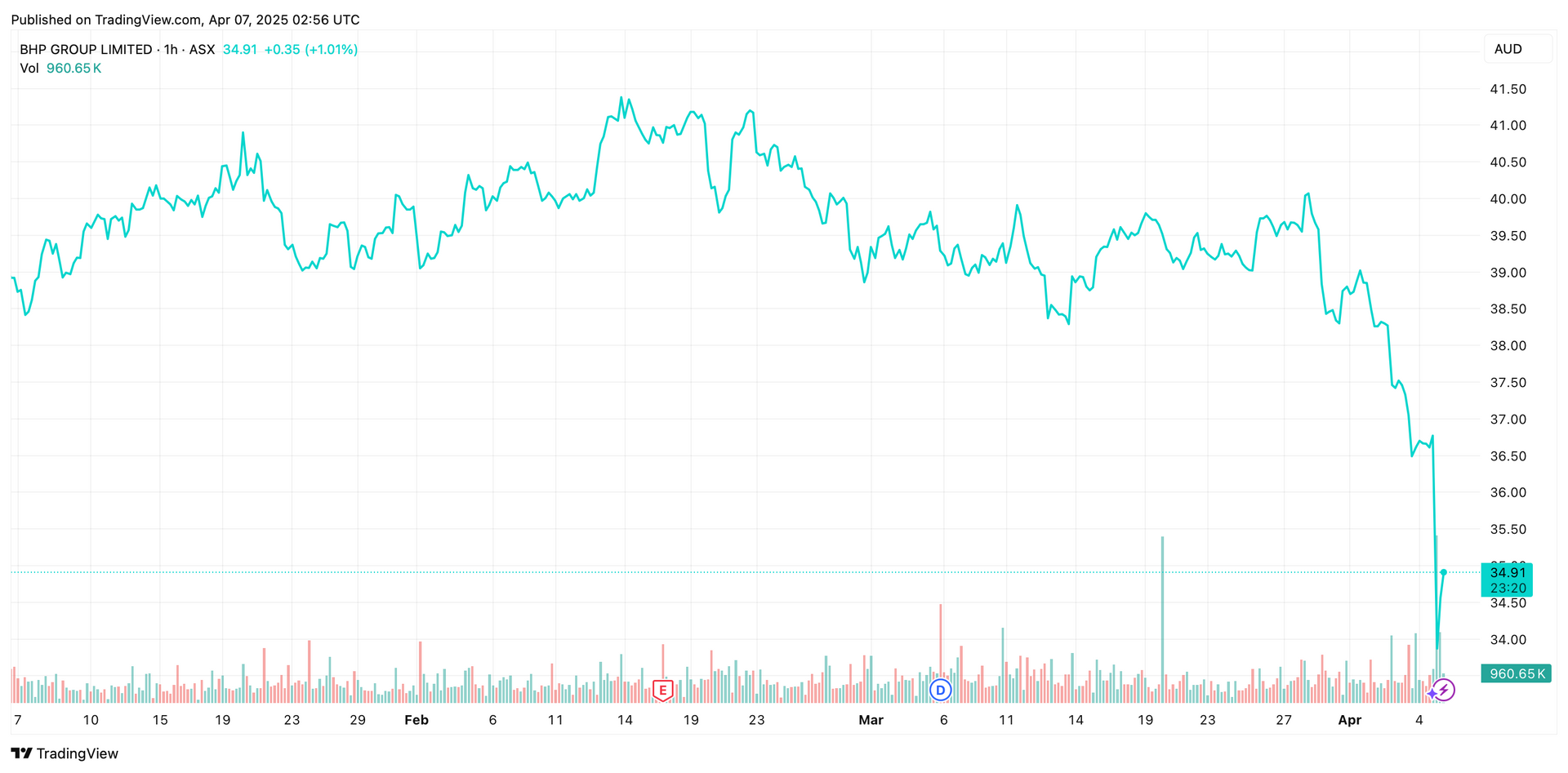

Price Performance

Growth Potential

BHP’s growth centres on commodities positioned for robust demand driven by global decarbonisation and electrification trends. Copper assets at Escondida in Chile and Olympic Dam in Australia underpin BHP’s role as a critical supplier of minerals needed for electric vehicles and renewable infrastructure.

BHP’s Nickel West operations and the development of its Canadian Jansen potash project further align with future-facing commodities essential for sustainable agriculture and battery technology. Demand from China and India supports resilience and upside potential.

This strategic alignment provides optimism for BHP stocks, especially if global commodity prices rebound or the US dollar strengthens, providing tailwinds for the BHP share price on the ASX.

Upcoming Innovations From BHP Group Ltd

BHP is reshaping mining through innovation, automation and sustainability:

Autonomous Operations: BHP uses driverless haul trucks, automated drill rigs and remote-controlled trains, boosting safety, efficiency and lowering operational costs.

Advanced Analytics & AI: Predictive analytics improve ore-body mapping, optimise extraction and accurately predict maintenance needs, reducing downtime.

Water & Emissions Management: Sophisticated recycling and renewable energy installations support ambitious carbon reduction targets toward net-zero by 2050.

Future-Facing Minerals: Investments in nickel, copper and potash position

BHP limited shares as crucial to global energy transition and sustainable agriculture, capturing long-term value.

BHP Shareholder Returns & Investor Sentiment

BHP’s reliable dividends underpin investor confidence. The BHP dividend yield currently around 4.5%, fully franked, maintains attractiveness amid commodity volatility. Despite market fluctuations, dividends remain consistent due to disciplined financial management.

Investor sentiment varies short-term but remains bullish long-term. Retail investors on platforms like HotCopper view dips as buying opportunities due to diversified operations and stable dividend streams.

Historically, combining BHP dividend shares ASX with capital appreciation yields impressive returns, reinforcing its cornerstone role in SMSFs and income portfolios. Investors tracking BHP share price ASX value its reliable income and growth potential.

Investment Tips For Buying BHP Group Ltd (ASX: BHP) Stocks

To successfully invest in stocks BHP, consider macroeconomic signals, commodity market trends and key indicators:

- Macro trends: Monitor China’s demand, interest rates and FX fluctuations—these often impact BHP share price ASX.

- Commodity signals: Rising iron ore and copper futures typically precede profitability gains in BHP shares price.

- Long-term perspective: Dividend Reinvestment Plans compound returns effectively, particularly during downturns.

- Yield-based strategies: Buying when yields approach 6% has historically provided good entry points.

- Sharewise tools: Leverage charting, valuation and analyst consensus tools for smarter entry/exit decisions.

Key Risks

Investors in BHP shares should be mindful of specific risks inherent in the mining sector. Understanding and actively tracking these risks helps balance potential returns with realistic expectations:

- Commodity Price Volatility: Iron ore, copper, and nickel prices can significantly fluctuate, directly impacting earnings and the BHP share price ASX.

- China Policy and Demand: Changes in China’s infrastructure spending or environmental regulations can swiftly alter commodity demand, affecting BHP’s export volumes.

- ESG and Licensing Risks: Growing environmental, social and governance standards may introduce stricter regulations, licensing complexities or higher compliance costs.

- Cost Inflation: Rising labour and energy expenses, especially during inflationary periods, could pressure BHP’s profitability and margins.

- Currency Risk (USD:AUD): Movements in the Australian dollar versus the US dollar affect revenue and profitability, influencing dividends and returns from BHP dividend shares ASX.

- Political and Geographic Risk: Operations in regions like Chile (copper royalties) and Western Australia (iron ore royalties) expose BHP to political, regulatory or tax-related uncertainties.

Frequently Asked Questions.

How has BHP share price ASX historically responded to global commodity cycles & market downturns?

Historically, BHP share price ASX closely tracks global commodity cycles, declining during downturns but typically rebounding quickly when demand recovers—particularly from China.

What are the key factors driving fluctuations in BHP shares price & how can investors anticipate trends?

Fluctuations in BHP shares price are mainly driven by commodity prices, Chinese demand, currency movements, and global economic sentiment. Investors can anticipate trends by monitoring iron ore futures, copper prices, and AUD/USD exchange rates.

What insights can be drawn from the BHP ASX chart when analysing stock performance over the last decade?

The BHP ASX chart shows consistent price support around $35–$40 and resistance near $50, guiding investors on optimal buying and selling points.

What role does BHP play in the transition to renewable energy & how could it impact BHP stocks?

BHP’s investments in copper, nickel, and potash position it strongly in the renewable energy transition, potentially boosting demand for BHP stocks as global electrification accelerates.

What impact have recent mergers, acquisitions, or asset sales had on BHP Limited shares?

Recent transactions like the Woodside demerger and OZ Minerals acquisition have streamlined operations, refocusing BHP Limited shares towards growth in future-facing minerals and reducing overall volatility.

What are the key signals investors should watch for before deciding to buy or sell BHP shares?

Key signals include commodity price movements, quarterly earnings reports, dividend yield (around 6% historically signals attractive entry), and currency fluctuations, particularly AUD/USD.

Subscribe to our newsletter

Disclaimer: This article does not constitute financial advice nor a recommendation to invest in the securities listed. The information presented is intended to be of a factual nature only. Past performance is not a reliable indicator of future performance. As always, do your own research and consider seeking financial, legal and taxation advice before investing.