Stock Spotlight: Commonwealth Bank of Australia (ASX:CBA)

As the current largest company listed on the ASX by market capitalisation, Commonwealth Bank of Australia (ASX:CBA) plays a pivotal role in both the national economy and investor portfolios. With a vast footprint across retail, business and institutional banking, CBA serves millions of customers throughout Australia, New Zealand and select global markets.

For investors, CBA shares may offer a rare combination of stability, long-term income potential and direct exposure to the strength of the Australian banking sector. Whether you’re targeting dividend income, building a defensive portfolio or tracking major banking stocks on the ASX, CBA may be a company worth close attention.

At Sharewise, we deliver expert-level, data-driven insights to help investors make confident decisions. Contact us today to uncover detailed insight about CBA and any other Australian stocks and for support on your financial journey!

About Commonwealth Bank of Australia.

Commonwealth Bank of Australia provides financial services in Australia, New Zealand, and internationally. It operates through Retail Banking Services, Business Banking, Institutional Banking and Markets, and New Zealand segments. The company offers transaction, savings, and foreign currency accounts; term deposits; personal and business loans; overdrafts; equipment finance; credit cards; international payment and trade; and private banking services, as well as home and car loans. It also provides institutional banking services; funds management, superannuation, and share broking products and services; home, car, health, life, income protection, and travel insurance products, as well as retail, premium, business, offshore services. In addition, the company offers advisory services for high-net-worth individuals; equities trading and margin lending services; debt capital, transaction banking, working capital, and risk management services; and international and foreign exchange services. Commonwealth Bank of Australia was founded in 1911 and is based in Sydney, Australia.

Source: Yahoo Finance

What Makes CBA Stocks A Strong Competitor In The Banking Sector?

The CBA share price on the ASX typically draws close attention from investors—and for good reason. With the largest market capitalisation of any Australian bank, Commonwealth Bank of Australia presently holds a dominant position in retail banking, underpinned by industry-leading home lending volumes and a loyal customer base.

Financially, CBA bank shares currently outperforms its ASX banking peers. Its return on equity (ROE) sits at around 13.7%, reflecting strong profit generation relative to shareholder capital—a key metric that highlights CBA’s efficiency and long-term value creation. This level of ROE places CBA at the top of the Big Four and well above the broader sector average.

Its balance sheet also stands out. CBA maintains a strong Common Equity Tier 1 (CET1) ratio, which provides a robust capital buffer and gives the bank flexibility to absorb market shocks, support lending growth and return capital to shareholders. For investors, these financial strengths reinforce CBA’s reputation as a reliable, lower-risk banking stock—especially during periods of economic uncertainty or rising rates.

Compared to Westpac, NAB and ANZ, CBA stocks have consistently led in digital capability, earnings consistency and customer retention. NAB has built strength in business banking and SME lending, but falls short of CBA’s retail reach. ANZ’s international footprint adds growth potential but introduces additional exposure to global volatility, particularly across Asia-Pacific markets.

Westpac continues to recover from prolonged regulatory and compliance challenges. Although it has made progress in recent years, it still trails CBA in critical areas like technology investment and earnings reliability. In contrast, CBA offers a compelling blend of scale, performance and trust—a combination few others in the sector can presently match.

Key Stats

Key Stats

Source: Yahoo Finance, ASX. Data as of 27/08/25.

Price Performance

Growth Potential

- CBA is leading all its competitors on a closely monitored measure of customer satisfaction & engagement – Net Promoter Score (NPS). CBA has held the top position in the consumer category for 26 consecutive months. CBA has also returned to the number one position in business. CBA also holds the number position in MFI share – i.e. number of consumers who consider CBA their main financial institution – with 33.4% share in Retail (vs nearest peer 16.8%) and 27.3% share in Business (vs nearest peer 19.3%).

- Trades at a 3.5x Price to Book, and dividend yield of 3.0% and trades at a premium to its peer group.

- Improving macroeconomic environment which may see favourable higher interest rate hikes.

- Better than expected economic conditions could result in provisions write-backs.

- Potential pressure on net interest margins as competition intensifies with other major banks.

- Sector leading return on tangible equity.

- A well-diversified corporate book.

- Improving CET1 ratio, which may in due course provide opportunity to undertake capital management initiatives.

Upcoming Innovations From Commonwealth Bank Of Australia ASX

Commonwealth Bank is, at present, widely regarded as the most digitally advanced of Australia’s major banks. It continues to make long-term investments in technology, positioning itself to improve customer experience, drive efficiency and stay ahead in an increasingly digital financial sector. For investors tracking Commonwealth Bank ASX, this forward-thinking approach allows them to stay proactive in an ever-evolving financial landscape.

CBA was one of the first banks in Australia to lead in mobile banking, and its digital capabilities remain well ahead of the pack. The CommBank app delivers real-time payments, cardless cash withdrawals, smart alerts and integrated budgeting tools. These features do more than enhance convenience—they reduce reliance on physical branches, cut operational costs and boost customer engagement. As adoption of mobile banking grows, CBA’s ability to scale services efficiently becomes a major competitive advantage.

In 2025, the bank opened a technology hub in Seattle to deepen its focus on generative AI and intelligent automation. More than 200 employees are being upskilled to develop AI-driven solutions that improve productivity and enhance digital customer experiences—such as predictive virtual assistants and automated service workflows. It’s a strategic move that positions CBA to respond faster and operate leaner than most competitors.

CBA is also exploring blockchain technologies, including smart contracts, real-time cross-border transactions and more secure compliance processes. At the same time, it’s investing in digital identity tools designed to reduce fraud and streamline customer onboarding—a critical innovation in a highly regulated sector.

For shareholders, these initiatives are part of a long-term strategy to protect margins, drive growth and future-proof operations. Among the Big Four, CBA shares on ASX continue to set the pace—and its innovation agenda plays a big role in maintaining that lead. Investors watching the CBA ASX chart can take confidence in a bank that isn’t just reacting to the future, but actively building it.

CBA Shareholder Returns & Investor Sentiment

CBA’s focus on innovation and efficiency continues to reward shareholders with consistent income and strong capital growth. Among its local banking rivals, it currently offers one of the most reliable dividend streams—a key reason why many income-focused investors turn to Commonwealth Bank dividends ASX as part of their long-term strategy. In February 2025, CBA paid a fully franked interim dividend of $2.25 per share, marking a 5% increase year on year. With a current yield of around 3.6–3.7%, the bank continues to meet expectations for stable, growing returns backed by a resilient balance sheet.

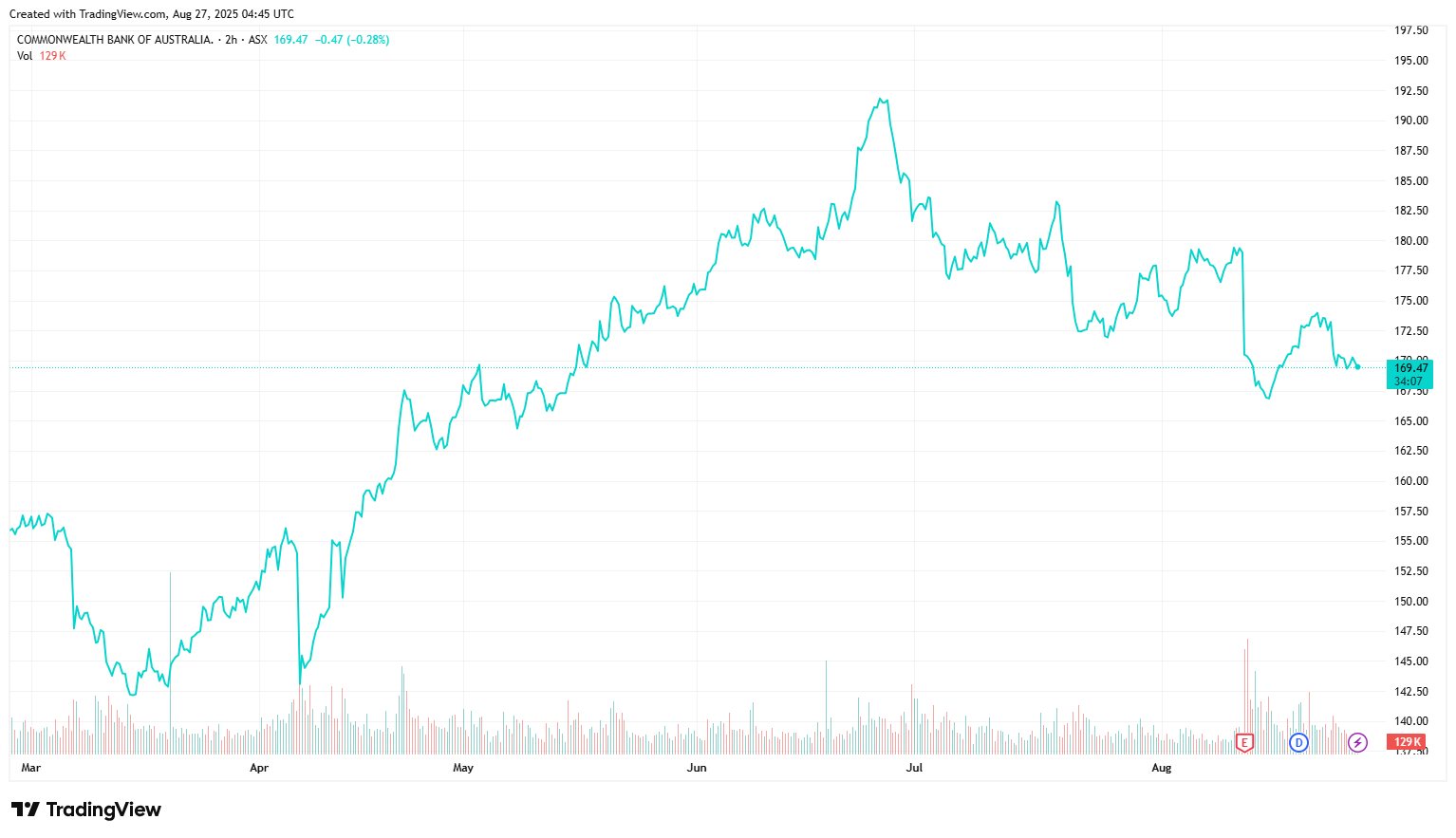

Over the past 12 months, CBA has delivered a total return of +25.36%, significantly outperforming most ASX-listed financial stocks. The CBA stock price ASX reached a record high of $167.61 in February 2025, driven by investor demand for defensive stocks with high-quality earnings. While the share price has since levelled off, its performance reflects the market’s long-standing confidence in CBA’s ability to generate reliable returns—both through dividends and capital appreciation.

Overall, investor sentiment around valuation is increasingly cautious. CBA is currently trading at a price-to-earnings (P/E) ratio of around 27x, which is a premium to both its historical average and the broader banking sector. Some analysts estimate fair value in the range of $107 to $120. However, despite these warnings, few investors are willing to bet against the stock. CBA remains a fixture in SMSF and long-term portfolios, valued for its low volatility and strong fundamentals. For prospective investors looking to buy CBA shares, many are watching for pullbacks rather than buying at peak levels.

Investment Tips For Buying Commonwealth Bank Of Australia (ASX: CBA) Stocks

For investors considering CBA shares, timing and portfolio role are just as important as the stock itself. CBA is better viewed as a reliable building block that offers consistency rather than rapid growth. This makes it especially appealing to long-term investors and SMSF holders seeking income and low-volatility exposure to the financial sector.

When the CBA ASX graph peaked at $167.61 in early 2025, many experienced investors avoided entering at the top—they waited patiently. Much like buying a quality home in a good suburb, the goal isn’t to find the absolute bottom, but to secure a stable asset at a reasonable price. For example, when CBA’s yield rises above 4% during a temporary dip, that moment often draws interest from income-focused investors looking to improve their return on entry.

It also helps to define what role CBA stocks should play in your broader portfolio. For many, it acts as a defensive anchor that counterbalances more volatile sectors like tech, mining or small caps. Strategies like reinvesting dividends through a Dividend Reinvestment Plan (DRP) can compound returns without increasing exposure to timing risk. In 2024, nearly 30% of eligible shareholders opted into CBA’s DRP, highlighting its popularity among long-term investors.

Reviewing the CBA share price on the ASX across multi-year periods can provide valuable insight into price behaviour during interest rate changes, dividend announcements or broader market corrections. Notably, CBA has historically bounced around the $135–$145 range before climbing to new highs that some chart watchers use to gauge entry points.

While past performance is never guaranteed, CBA’s consistency, earnings diversity and trusted brand—including asx:cba subsidiaries like CommSec and Bankwest—continue to support its role as a foundational holding in many Australian portfolios.

Key Risks

- Intense competition for loans, as overall market growth rate moderates. Management in particular called out the increasing competitive pressure from Macquarie Bank (MQG).

- Trades at a premium to peer group, with high competition potentially eroding its ROE.

- Major banks, including CBA, are growing below system growth (i.e. losing market share).

- Increase in bad and doubtful debts or increase in provisioning.

- Funding pressure for deposits and wholesale funding (increased funding costs).

- Regulatory and compliance risk

- Australian housing property crash.

Frequently Asked Questions.

What key financial ratios should investors analyse before buying CBA shares?

The most relevant ratios include the price-to-earnings (P/E), currently around 27x, and the price-to-book (P/B), which highlights valuation relative to assets. Return on equity (ROE), at approximately 13.7%, reflects profitability, while the CET1 ratio offers insight into capital strength and resilience. Together, these metrics help assess whether CBA shares offer strong value and financial stability.

How does Commonwealth Bank Of Australia maintain profitability during interest rate fluctuations?

CBA uses flexible loan pricing, diversified lending and disciplined cost control to manage interest rate pressure. It also applies hedging strategies and invests in technology to boost efficiency, helping preserve margins across different rate cycles.

How does the CBA ASX chart indicate potential resistance & support levels for traders?

The CBA ASX chart shows recurring resistance around $167 and support between $135–$145—key zones where price movements have historically reversed. Chart analysts often use these levels to guide decisions on entry points, stop losses or profit-taking.

What role do CBA shares play in income-focused portfolios?

CBA stocks are a mainstay in many SMSFs and income-driven portfolios due to their consistent, fully franked dividends. With a yield near 3.6–3.7%, they offer stable income and relatively low volatility—making them a strong candidate for long-term, passive investing strategies.

What are the long-term implications of CBA’s investments in AI & digital banking?

CBA’s focus on AI, blockchain and mobile platforms aims to reduce costs, enhance customer experience and improve risk controls. For long-term investors in ASX:CBA, these innovations may support stronger margins, higher retention and future-proofed operations in a tech-driven market.

Subscribe to our newsletter

Disclaimer: This article does not constitute financial advice nor a recommendation to invest in the securities listed. The information presented is intended to be of a factual nature only. Past performance is not a reliable indicator of future performance. As always, do your own research and consider seeking financial, legal and taxation advice before investing.