How to Decide What Shares to Buy?

In the vast and dynamic world of investing, choosing which shares to buy can seem like a daunting task, especially for beginners. With countless options available and the constant ebb and flow of the market, it's easy to feel overwhelmed. However, with a thoughtful approach and the right perspective on how to look at stocks, navigating the stock market can become a rewarding and fulfilling endeavour. In this guide, we'll explore practical steps and strategies to help you make informed decisions when selecting the best shares to buy for your investment portfolio.

1. Clarify Your Investment Goals

Before wondering "what shares should I buy? Take a moment to reflect on your investment objectives. Are you investing for long-term growth, regular income, or a combination of both? Understanding your goals will help shape your investment strategy and influence the best shares to invest for you personally. Consider factors such as your risk tolerance, investment timeline, and financial situation.

- Are you looking to build wealth over time, or are you more interested in generating income from your investments?

- What is your investment horizon? Are you investing for retirement, a major purchase, or other financial goals?

- How much risk are you comfortable taking with your investments? Are you willing to accept volatility in exchange for potentially higher returns, or do you prefer a more conservative approach?

2. Conduct Thorough Research

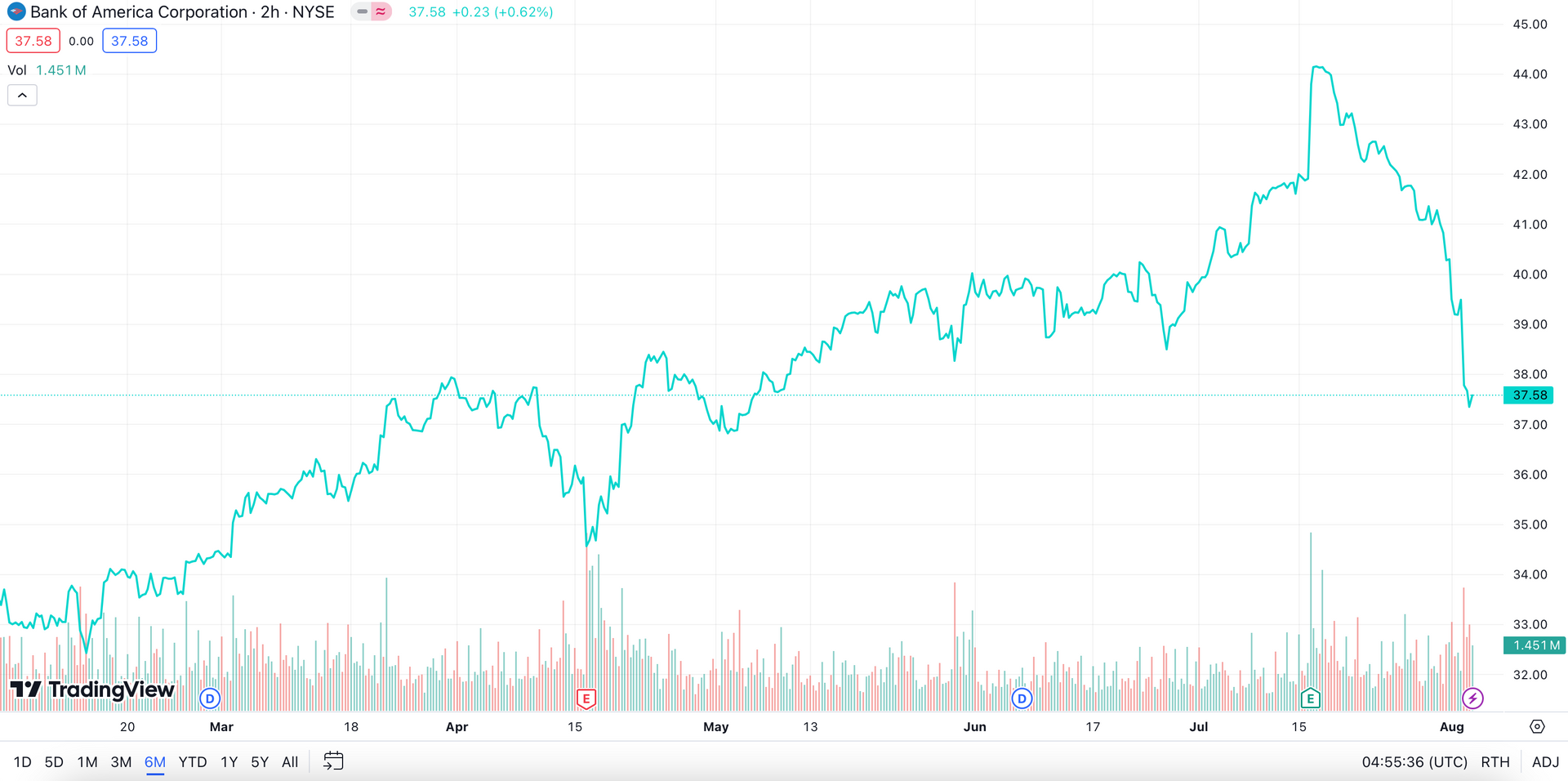

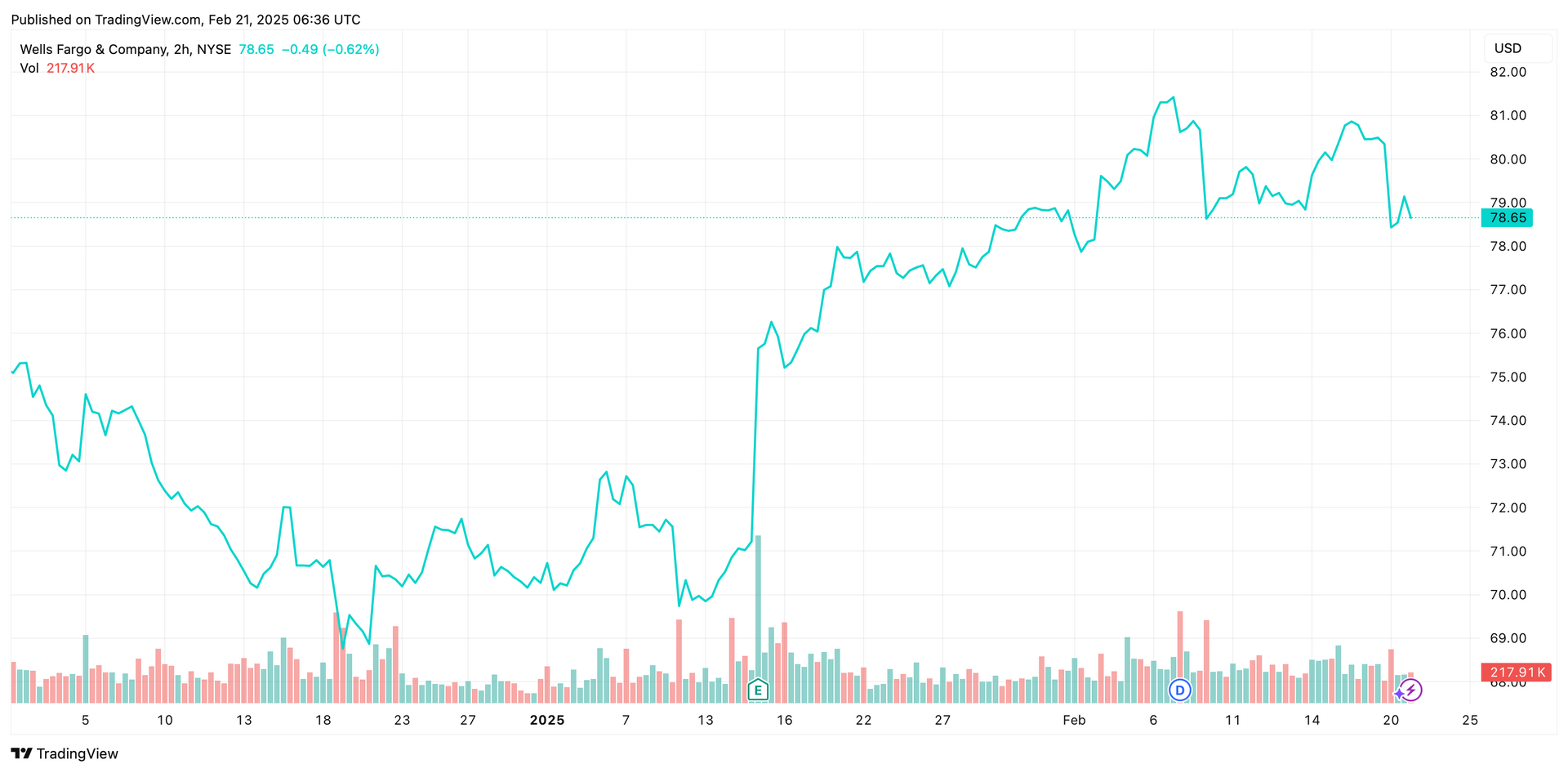

Knowledge is power in the world of investing. To discover the good shares to purchase now, begin by researching different industries, companies, and market trends. Look for companies with strong fundamentals, such as solid revenue and earnings growth, a competitive edge in their industry, and a healthy balance sheet. After all, buying shares in a business means becoming a small owner in the company. Utilise a variety of resources, including financial news websites, investment research reports, and company annual reports, to gather information.

- Dive deep into the industries you're interested in and learn about key drivers of growth, competitive dynamics, and potential risks.

- Explore different investment strategies, such as value investing, growth investing, and income investing, to see which aligns best with your goals and preferences.

- Use screening tools and financial databases to filter stocks based on criteria such as market capitalisation, valuation metrics, dividend yield, and financial ratios.

3. Assess Your Risk Tolerance

Every investment carries some level of risk, and it's essential to understand your own risk tolerance before buying shares. Consider factors such as your age, investment timeline, and financial situation. The best company to buy shares in might not be the same for everyone, as personal circumstances can strongly dictate what might be suitable for you personally. If you're comfortable with taking on more risk for potentially higher returns, you may opt for growth-oriented stocks. However, if you prefer a more conservative approach, you may lean towards stable, dividend-paying companies.

- Take a quiz or use a risk tolerance questionnaire to assess your comfort level with different types of investments and market fluctuations.

- Consider your investment horizon and financial goals when evaluating risk. Short-term investors may have a lower tolerance for volatility compared to long-term investors.

- Keep in mind that risk tolerance is not static and may change over time. Regularly reassess your risk tolerance as your financial situation and investment objectives evolve.

4. Diversify Your Portfolio

Diversification is a fundamental risk management strategy in investing. Instead of putting all your money into one or a few stocks, spread your investments across different asset classes, industries, and geographic regions. This helps reduce the impact of any single investment's poor performance on your overall portfolio. Aim for a balanced mix of stocks, bonds, and other asset classes to mitigate risk.

Allocate your investment capital across different sectors and industries to avoid overexposure to any single sector.- Consider investing in index funds or exchange-traded funds (ETFs) to gain exposure to broad market segments with a single investment.

- Rebalance your portfolio periodically to maintain your desired asset allocation and risk profile. Sell winners and buy losers to bring your portfolio back in line with your target allocations.

5. Consider Dividend Stocks

Dividend-paying stocks can provide a steady stream of income, making them an attractive option for income-focused investors. Look for companies with a history of consistent dividend payments and a sustainable payout ratio. Reinvesting dividends can also help compound your returns over time. Additionally, consider the company's dividend growth rate and its ability to sustain dividends during economic downturns.

- Evaluate the sustainability of a company's dividend payments by analysing its free cash flow, earnings growth, and dividend payout ratio

- Look for companies with a track record of increasing dividends over time, as this indicates financial strength and management confidence in the business.

- Consider dividend yield as part of your investment decision, but avoid chasing high yields without assessing the underlying fundamentals of the company.

6. Evaluate Valuation

Assessing a company's valuation is crucial in determining whether its shares are attractively priced. Popular valuation metrics include the price-to-earnings (P/E) ratio, price-to-book (P/B) ratio, and dividend yield. Compare these metrics with industry averages and historical data to gauge whether a stock is overvalued, undervalued, or fairly priced. Keep in mind that a low valuation does not always indicate a good investment opportunity, as there may be underlying risks or challenges facing the company.

- Use valuation multiples to compare a company's stock price to its fundamentals and determine whether it is trading at a discount or premium relative to its peers.

7. Stay Informed and Adapt

The stock market is constantly evolving, so it's important to stay informed about market trends, economic developments, and company news. Keep abreast of changes in the industries you're interested in and be prepared to adapt your investment strategy accordingly. Consider setting up alerts for news related to your investments and regularly review your portfolio's performance. Stay disciplined and avoid making impulsive decisions based on short-term market fluctuations. By staying informed and adaptable, you can navigate market volatility more effectively and make informed investment decisions.

8. Seek Professional Advice if Needed

If you're unsure about where to start or feeling overwhelmed by the best company to buy shares in, don't hesitate to seek professional advice. Financial advisors can provide personalised guidance based on your individual circumstances, risk tolerance, and investment goals. They can also help you navigate market volatility and make informed decisions that align with your long-term objectives.

In conclusion, deciding what shares to invest in requires careful consideration, research, and an understanding of your investment goals and risk tolerance. By following these steps and strategies, you can build a well-diversified portfolio of quality companies that align with your financial objectives. Remember, investing is a journey, not a destination, so stay patient, stay disciplined, and stay focused on your goals.

What shares to buy now in Australia?

If you need further assistance buying shares in Australia and wondering "what ASX shares should I buy" consider reaching out to Sharewise, a comprehensive platform offering low-cost trading, institutional-grade research, expert financial advisory services, and portfolio management. With Sharewise by your side, you can embark on your investing journey and begin to buy shares in Australia with confidence and peace of mind. Happy investing!

Disclaimer: This article does not constitute financial advice nor a recommendation to invest in the securities listed. The information presented is intended to be of a factual nature only. Past performance is not a reliable indicator of future performance. As always, do your own research and consider seeking financial, legal and taxation advice before investing.

Subscribe to our newsletter

Disclaimer: This article does not constitute financial advice nor a recommendation to invest in the securities listed. The information presented is intended to be of a factual nature only. Past performance is not a reliable indicator of future performance. As always, do your own research and consider seeking financial, legal and taxation advice before investing.