Investing Simplified: The S&P 500

As the world’s financial markets become more interconnected, more Australian investors are looking beyond the ASX to build diversified portfolios that include exposure to major global markets. One of the most popular ways to tap into the growth and resilience of the US economy is through the S&P 500, a leading benchmark of American equities. This article explores the S&P 500, its benefits and risks, and how our US share advisory service at Sharewise can help Australians navigate this essential market.

What is the S&P 500?

The S&P 500, short for Standard & Poor’s 500, is a stock market index that represents the 500 largest publicly traded companies in the United States. Managed by Standard & Poor’s, the index reflects around 80% of the total US stock market capitalisation and covers companies across 11 sectors. The S&P 500 serves as a key barometer of the US economy’s performance, tracking some of the world’s most recognised and innovative companies, such as Apple, Microsoft, Amazon, and Google.

The S&P 500 is a market-capitalisation-weighted index, meaning companies with higher market values have a greater influence on the index’s performance. This structure ensures that the S&P 500 is responsive to the successes of the largest and most impactful companies, while the diverse sector coverage captures a broad view of the US economy’s overall health and trends.

Why Should Australians Invest in the S&P 500?

The S&P 500 has consistently provided strong returns over the long term, often outperforming many other indices around the world. For Australian investors, there are several advantages to considering this index:

- Broadened Diversification: The Australian economy, while strong, represents only a small portion of global economic output. The S&P 500 provides exposure to a diverse group of US-based companies across sectors like technology, healthcare, and consumer goods, helping to broaden an Australian investor's portfolio.

- Access to High-Growth Sectors: The S&P 500 includes globally dominant companies known for their innovation and market strength, especially in technology and healthcare. This index gives Australian investors a chance to participate in high-growth industries that may not be as prominent on the ASX.

- Historically Strong Performance: The S&P 500 has delivered robust returns over the long term, averaging around 10% per year (although past performance is not a guarantee of future returns). This track record has made the S&P 500 a valuable component of many portfolios globally.

- Currency Hedge Potential: Investing in the S&P 500 provides exposure to the US dollar, which can serve as a hedge against AUD fluctuations. If the Australian dollar weakens against the US dollar, the value of your US investments will increase when converted back to AUD, potentially boosting returns.

- Stabilising Impact on Portfolios: The S&P 500’s large, stable companies can offer balance to a portfolio. Since the US and Australian economies don’t always follow the same cycles, investing in the S&P 500 can mitigate risks associated with Australia-specific economic downturns.

Ways to Invest in the S&P 500 from Australia

Australian investors have a variety of options to gain exposure to the S&P 500. Here are some of the most common methods:

- Exchange-Traded Funds (ETFs): ETFs are one of the simplest ways to access the S&P 500. Some ETFs are listed on the ASX, such as iShares Core S&P 500 ETF (IVV), which allows Australians to invest in the S&P 500 in AUD without the need to exchange currency.

- Managed Funds: Managed funds also provide access to the S&P 500, typically at higher fees than ETFs. This option may appeal to those who prefer professional fund management.

- Direct Investment in S&P 500 Companies: Investors looking for more control can directly invest in individual stocks from the S&P 500. This option requires more research and monitoring but allows for targeted investments in specific sectors or companies.

- US Share Advisory Services: At Sharewise, our US share advisory service offers guidance on investing in the S&P 500 and individual US stocks. Our service provides detailed research, stock recommendations, and customised support to help Australian investors optimise their exposure to the US market.

Tax Considerations for Australians Investing in the S&P 500

Understanding tax obligations is crucial for Australian investors in US stocks or funds. Here are some key points to consider:

- Capital Gains Tax (CGT): Profits from the sale of S&P 500 investments are subject to capital gains tax in Australia. If you’ve held these investments for more than a year, you may qualify for a 50% discount on CGT.

- Dividend Withholding Tax: Dividends paid by US companies are subject to a 15% withholding tax for Australians, as outlined in the US-Australia tax treaty. This amount is deducted before dividends are distributed, so it’s important to factor this into your overall returns.

- Currency Exchange: Currency fluctuations impact gains or losses when converting S&P 500 returns from USD to AUD. For example, a strong USD relative to the AUD could enhance returns, while a weaker USD could diminish them when converted back to AUD.

Key Sectors Within the S&P 500

The S&P 500 encompasses a range of sectors, each with unique growth prospects and risk profiles. Here’s a look at some key sectors within the index, highlighting opportunities relevant to Australian investors:

- Technology: Technology companies like Apple, Microsoft, and Meta make up a significant portion of the S&P 500. This sector is known for its rapid growth potential but can be volatile. At Sharewise, we provide analysis on tech stocks within the S&P 500 to help investors identify growth opportunities.

- Healthcare: The US healthcare sector, represented by companies such as Johnson & Johnson, Pfizer, and UnitedHealth, offers resilience and steady growth. With an aging global population and rising healthcare demands, this sector is particularly valuable for long-term investors.

- Consumer Discretionary: This sector includes globally recognised brands like Amazon, McDonald’s, and Nike, providing exposure to the strength of the US consumer market.

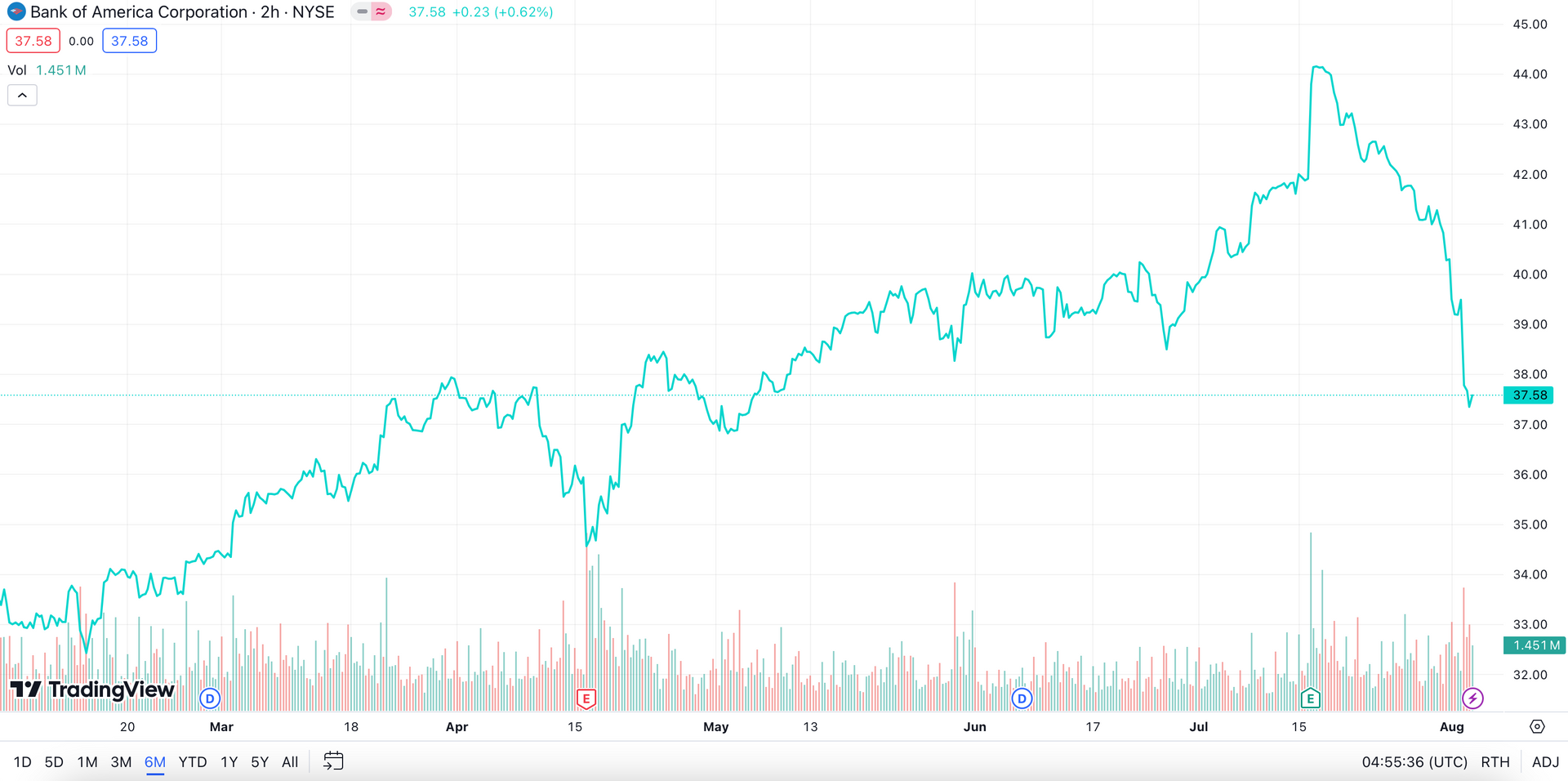

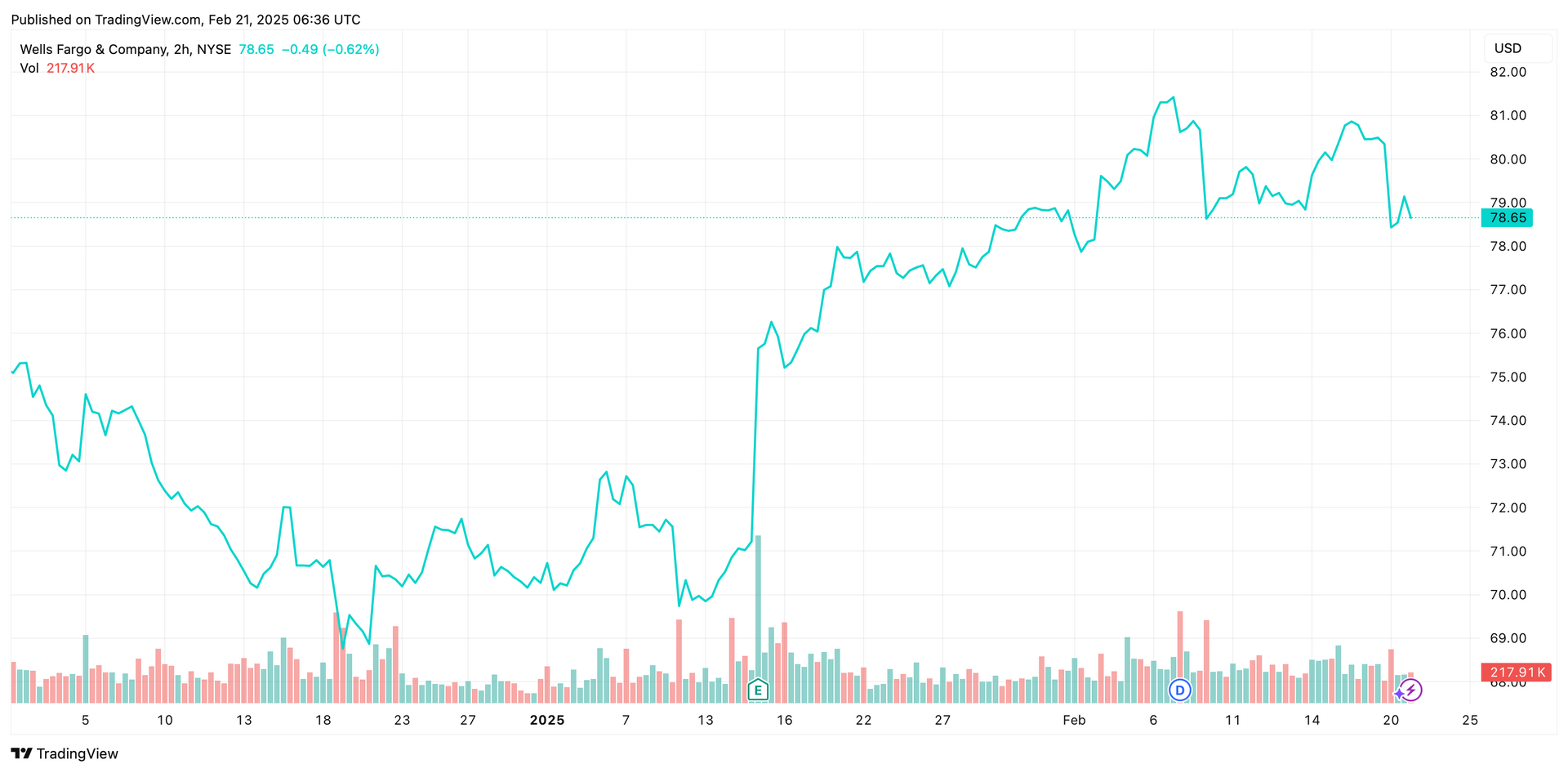

- Financials: Financial institutions such as JPMorgan Chase and Bank of America are part of the S&P 500. This sector can provide stable returns, particularly in periods of rising interest rates.

- Energy and Utilities: Major US energy companies, including ExxonMobil and Chevron, add stability during inflationary periods and offer potential growth as energy demands continue to evolve.

Our Sharewise analysts regularly monitor these sectors to help Australian investors understand trends and identify sectors primed for growth.

Managing Risks: Key Considerations for Australian Investors

Like any investment, the S&P 500 carries risk. Here are some tips for Australian investors to help mitigate these risks:

- Stay Diversified: Diversifying across sectors within the S&P 500 can help mitigate the risk of sector-specific downturns. Balancing investments in high-growth areas with more stable sectors like consumer goods or healthcare can reduce overall volatility.

- Consider Currency Movements: Since the S&P 500 is priced in USD, currency fluctuations impact returns. For instance, if the AUD strengthens significantly against the USD, your US investments could be worth less when converted back. At Sharewise, our advisors help you understand and manage currency risks, including strategies for hedging.

- Adopt a Long-Term Perspective: Historically, the S&P 500 has performed well over long periods, despite short-term volatility. By maintaining a long-term investment outlook, you allow your assets time to grow and benefit from compounding returns.

- Seek Expert Guidance: Our

US share advisory service at Sharewise offers up-to-date insights on S&P 500 stocks, sector trends, and macroeconomic events that could impact the market. Our guidance helps Australian investors make well-informed decisions and manage their portfolios effectively.

How Sharewise Can Help You Invest in the S&P 500

Investing in the S&P 500 offers significant potential but also comes with complexities, such as navigating currency movements and tax implications. Here’s how our team at Sharewise can support you:

- Daily Global Market Analysis: Our analysts monitor not only the S&P 500, but also the international economy as a whole, and provide insights into sector trends, growth drivers, and individual stock opportunities.

- Buy/Sell Stock Recommendations: We help you identify individual stock opportunities within the S&P 500, enabling you to build a portfolio that aligns with your risk tolerance.

- Ongoing Support: Your dedicated Investment Manager is here to provide you with continuous assistance, equipping you with the latest insights and recommendations for success in the US market.

How to Get Started with Sharewise

Whether you’re new to investing or a seasoned market participant, Sharewise can help you take advantage of the opportunities within the S&P 500. Here’s how to get started:

- Sign Up for Our US Share Advisory Service: View our membership options and join our advisory service, where you’ll find research, stock recommendations, and the latest market insights.

- Build a Diversified Portfolio: Use our insights to create a balanced mix of S&P 500 stocks or ETFs based on your risk tolerance, investment goals, and time horizon.

- Stay Informed with Regular Updates: Sharewise provides ongoing updates on market conditions, political implications, and currency trends so you can adjust your strategy accordingly.

The S&P 500 represents an exciting opportunity for Australian investors to gain exposure to some of the world’s largest and most innovative companies. From technology to healthcare and beyond, the US market provides diversification, growth potential, and stability that complement Australian-focused portfolios.

At Sharewise, we specialise in helping Australian investors optimise their portfolios with a focus on US equities, providing the tools and insights necessary to succeed in the global marketplace.

Subscribe to our newsletter

Disclaimer: This article does not constitute financial advice nor a recommendation to invest in the securities listed. The information presented is intended to be of a factual nature only. Past performance is not a reliable indicator of future performance. As always, do your own research and consider seeking financial, legal and taxation advice before investing.