Investing in Hong Kong: Risks, Rewards & What Australian Investors Should Know in 2026

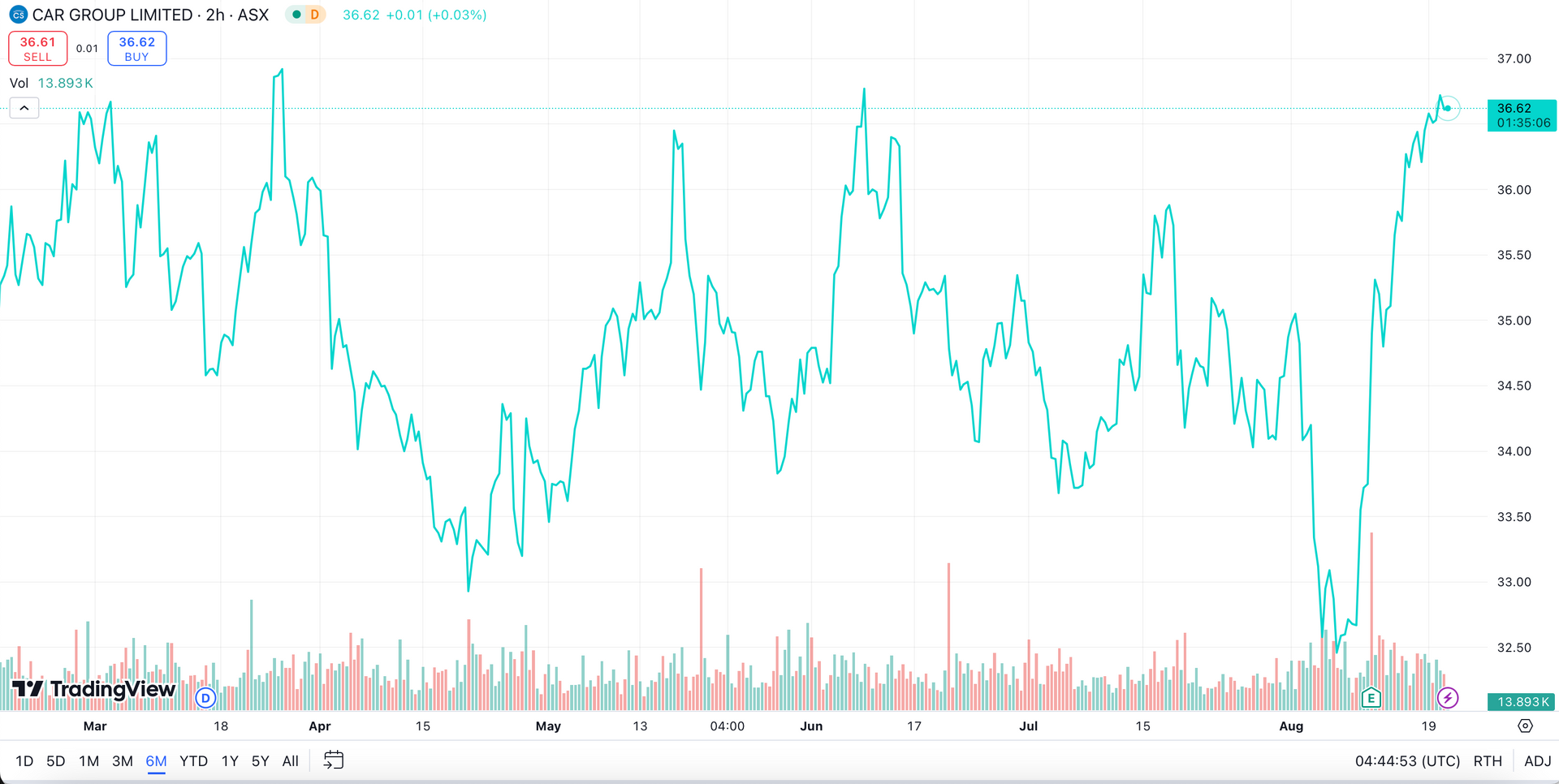

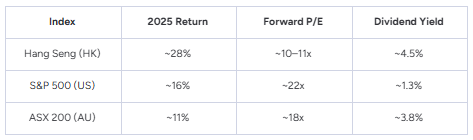

Hong Kong was written off by many just a few years ago, yet the Hang Seng Index surged around 28% in 2025, comfortably outpacing the S&P 500’s 16.3% gain. This dramatic rebound has put Hong Kong back in the spotlight as a leading destination for equity investors, attracting global attention with strong trading activity and a robust IPO pipeline.

For Australian investors, Hong Kong provides a unique combination of opportunities. It offers exposure to high-growth Chinese companies, thematic sectors such as technology and consumer services, and income-generating assets such as REITs, all within a well-established, internationally regulated market. Its proximity and aligned time zones make monitoring and trading more convenient, while its role as a gateway to mainland China gives access to companies and sectors underrepresented on the ASX. Adding Hong Kong equities enhances portfolio diversification, providing exposure to different economic cycles, industries, and regional growth dynamics.

With 2026 shaping up as another active year, understanding key trends, valuation opportunities, risks, and market access will be essential for Australian investors navigating opportunities ahead.

A Market Regaining Momentum

Hong Kong has long served as a bridge between China’s economy and international capital markets. As at the end of January 2026, total market capitalisation stood at HKD 50.8 trillion, up 44% year-on-year. More revealing is the surge in liquidity: average daily turnover in January 2026 reached HKD 227.3 billion, an 89% increase. ETF turnover averaged HKD 35.9 billion, while derivative warrants turnover rose 77%, and activity in callable bull/bear contracts doubled. These gains signal renewed engagement from both institutional and retail investors, supporting the credibility of valuation re-ratings.

Equity capital markets are likewise showing signs of revival. Thirteen companies listed in January 2026, a 63% increase year-on-year, raising HKD 39.3 billion via IPOs and HKD 53.1 billion in total funds. This reopening of the IPO market represents both a psychological and structural inflection point, reflecting growing investor confidence, improved liquidity, and renewed corporate willingness to raise capital.

The Rewards – Investment Opportunities

Valuations and Income Potential

Hong Kong stocks remain genuinely inexpensive compared to US and Australian equities. The Hang Seng trades on a forward P/E of around 10–11x, less than half the S&P 500 (~22x) and below the ASX 200 (~18x). Dividend yields of approximately 4–5% add to the attractiveness for yield-focused Australian investors. HSBC Private Bank has set a Hang Seng target of 31,000 by end-2026, suggesting potential for both income and capital growth.

China Exposure via a Global Financial Hub

Hong Kong remains the primary offshore gateway to China. Its largest listed companies span Chinese banks, insurers, internet platforms, and consumer businesses. For Australian investors, this provides access to different economic drivers than the ASX 200, which is heavily bank- and resource-weighted. Exposure to Hong Kong introduces a different type of economic risk, tied to Asian consumer growth, technology innovation, and mainland financial services, offering genuine diversification benefits.

China’s accelerating commitment to AI adds another layer of opportunity. Government industrial policy prioritises semiconductors, foundries, and AI infrastructure, with private capital following suit. Australian investors who missed the US tech rally can access the AI and infrastructure build-out theme at lower valuation multiples, combining geographic diversification with structural growth exposure.

IPO and New Economy Exposure

The IPO pipeline remains a standout attraction. After leading global IPO fundraising in 2025, estimates for 2026 suggest total proceeds between HKD 320–350 billion. The reopening of capital markets reflects investor confidence, stronger liquidity, and corporate willingness to raise growth capital. Several large-cap and potentially global names are reportedly considering Hong Kong for primary listings, creating access to emerging leaders in technology, consumer goods, biotech, and AI. Participation in this IPO cycle offers exposure to companies shaping Asia’s economic growth at earlier stages than developed markets often allow.

Commercial Real Estate - Discounted Entry

For sophisticated investors, Hong Kong’s commercial property market presents potential opportunities. Recent market corrections have created entry points for patient capital, while mainland Chinese buyers remain active, reflecting confidence in long-term fundamentals. Hong Kong-listed REITs, such as Link REIT, provide a practical way to gain exposure to commercial property income streams without owning physical assets. These vehicles are accessible via most international brokerages and offer dividend income alongside capital appreciation potential.

The Risks - What to Watch

While the performance backdrop and structural drivers are compelling, Hong Kong investing is not without its risks.

Geopolitical Uncertainty

US–China strategic tensions remain an ongoing overhang for the region. Export controls, technology restrictions and broader trade frictions introduce policy unpredictability and can affect capital flows, particularly in sensitive sectors such as semiconductors and advanced technology. For investors, geopolitical risk justifies a persistent valuation discount, even during recovery phases. Any escalation in tensions could quickly weigh on sentiment and trigger renewed volatility.

Valuation Considerations

The rebound in Hong Kong markets has lifted valuations on several indices and individual stocks. In some segments, prices now sit above historical averages, particularly in tech and high‑growth segments. While not necessarily a warning of an imminent downturn, elevated valuations can compress future returns if growth expectations are not met or if external conditions sour.

Market Concentration

Despite broader participation, a relatively small number of large companies dominate trading volumes on the Hong Kong exchange. This concentration can make headline indices more sensitive to large‑cap performance swings, potentially obscuring market breadth or smaller‑cap opportunities.

Currency Considerations for Australians

The Hong Kong dollar is pegged to the US dollar, which means Australian investors are indirectly exposed to movements in the AUD/USD exchange rate. A stronger Australian dollar can dilute offshore returns when translated back into local currency, while a weaker dollar can enhance them. Currency exposure therefore forms part of the overall risk profile and can either amplify or offset underlying equity performance. Investors should consider whether to remain unhedged or seek hedged exposure depending on their broader portfolio positioning.

How Can Australians Actually Invest?

Australian investors have multiple avenues to gain exposure to Hong Kong’s markets, each with its own trade-offs in terms of diversification, risk, and access:

- Direct HK-Listed Stocks: Full exposure to local pricing and dividends via brokers with HKEX access.

- ETFs: Diversification across sectors and companies, including A+H share exposure.

- Dual-Listed Companies: Access Hong Kong equities via ASX or US listings, avoiding direct FX conversion.

- Managed Funds: Professional selection and currency management for a hands-off approach.

- Structured Products / Derivatives: For sophisticated investors to hedge or leverage sector/market exposure.

- REITs: Listed REITs provide access to commercial property income without physical ownership.

By choosing the right combination of instruments, Australians can align Hong Kong exposure with their risk appetite, income objectives, and thematic interests, from IPO participation and tech growth to commercial real estate and dividend income.

Final Thoughts: A Tactical Diversifier

Hong Kong offers a compelling blend of opportunity and nuance. Its gateway role to mainland China, combined with diverse sectors, IPOs, AI/tech exposure, and income-generating REITs, provides access to growth stories and cash flow streams largely absent from domestic markets. Valuations remain attractive relative to the US and Australia, particularly when factoring in dividend yields and potential for re-rating.

At the same time, investors should approach Hong Kong with discipline. Market concentration, geopolitical and regulatory uncertainties, and global macro sensitivity require careful allocation. Balancing direct equities, ETFs, dual-listed companies, and REITs can manage risk while capturing upside. Monitoring IPO activity, capital flows, and policy developments is essential.

Ultimately, Hong Kong should be considered a strategic complement to an Australian portfolio rather than a short-term trade. When approached with awareness of its structural characteristics and cyclical drivers, it offers both income and growth, enhancing diversification beyond domestic concentrations while participating selectively in high-potential sectors like technology, AI, and commercial real estate.

For strategic guidance on incorporating Hong Kong exposure into your portfolio, click here to speak to an adviser. Alternatively, click here to access our Hong Kong Stocks Report for free recommended stocks and market insights.

Subscribe to our newsletter

Disclaimer: This article does not constitute financial advice nor a recommendation to invest in the securities listed. The information presented is intended to be of a factual nature only. Past performance is not a reliable indicator of future performance. As always, do your own research and consider seeking financial, legal and taxation advice before investing.