Stock Spotlight: Fisher & Paykel Healthcare (ASX:FPH)

About Fisher & Paykel Healthcare

Fisher & Paykel Healthcare Corporation Limited, together with its subsidiaries, designs, manufactures, markets, and sells medical device products and systems in North America, Europe, the Asia Pacific, and internationally. It provides its products for use in acute and chronic respiratory care, and surgery, as well as the treatment of obstructive sleep apnea (OSA) in the home and hospital. The company also offers adult respiratory products, including airvo system, optiflow nasal high flow therapy, invasive ventilation, and noninvasive ventilation. In addition, it provides infant respiratory products, such as resuscitation, invasive ventilation, continuous positive airway pressure (CPAP) therapy, and nasal high flow therapy products. Further, the company offers hospital products comprising humidification products, breathing circuits, chambers, masks, nasal cannulas, surgical, accessories, and interfaces; and homecare products that include masks, CPAP devices, software and data management products, and humidifiers. Fisher & Paykel Healthcare Corporation Limited was founded in 1934 and is headquartered in Auckland, New Zealand.

Key Stats

Key Stats

Source: Yahoo Finance. Data as of 19/08/25.

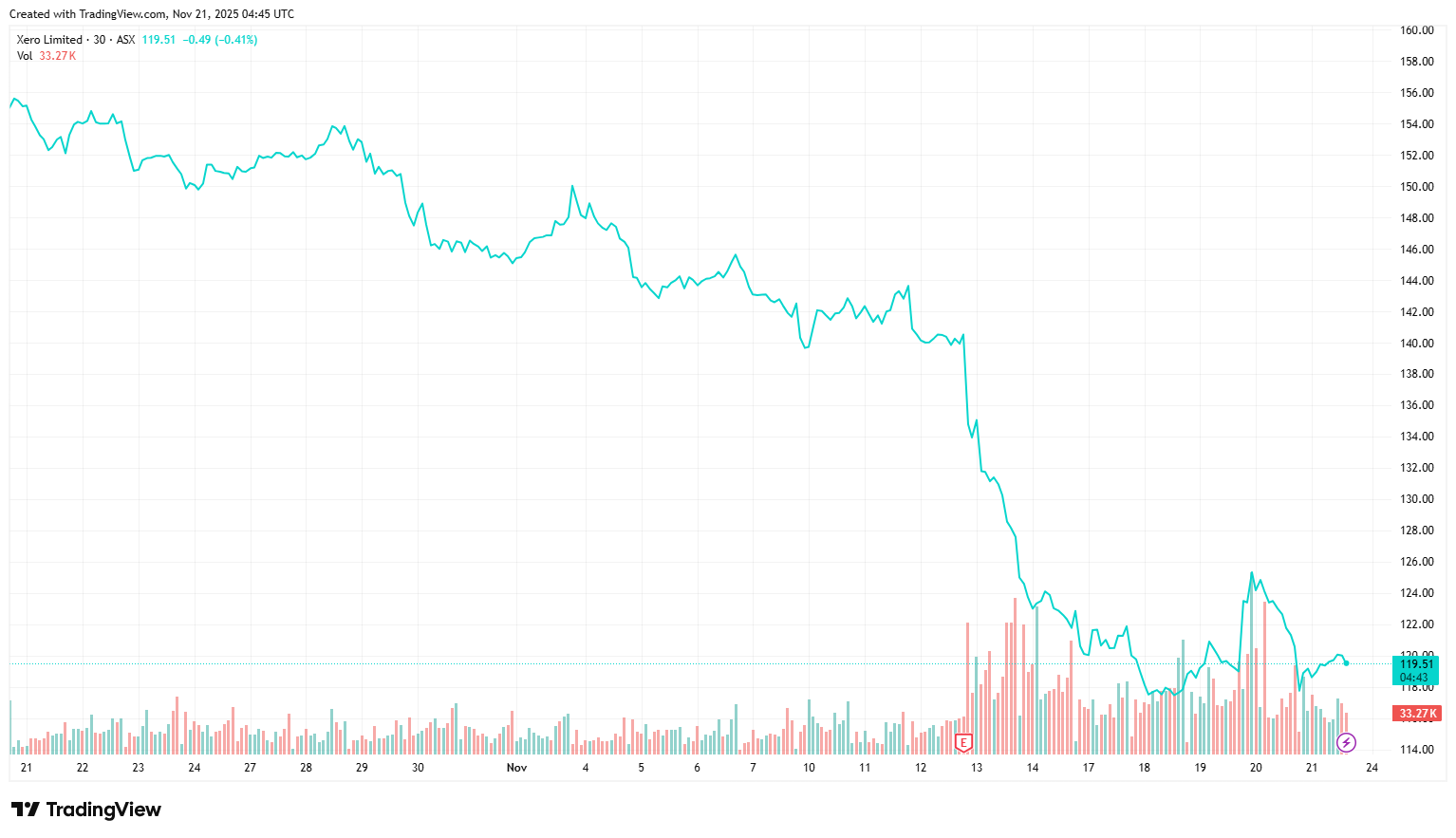

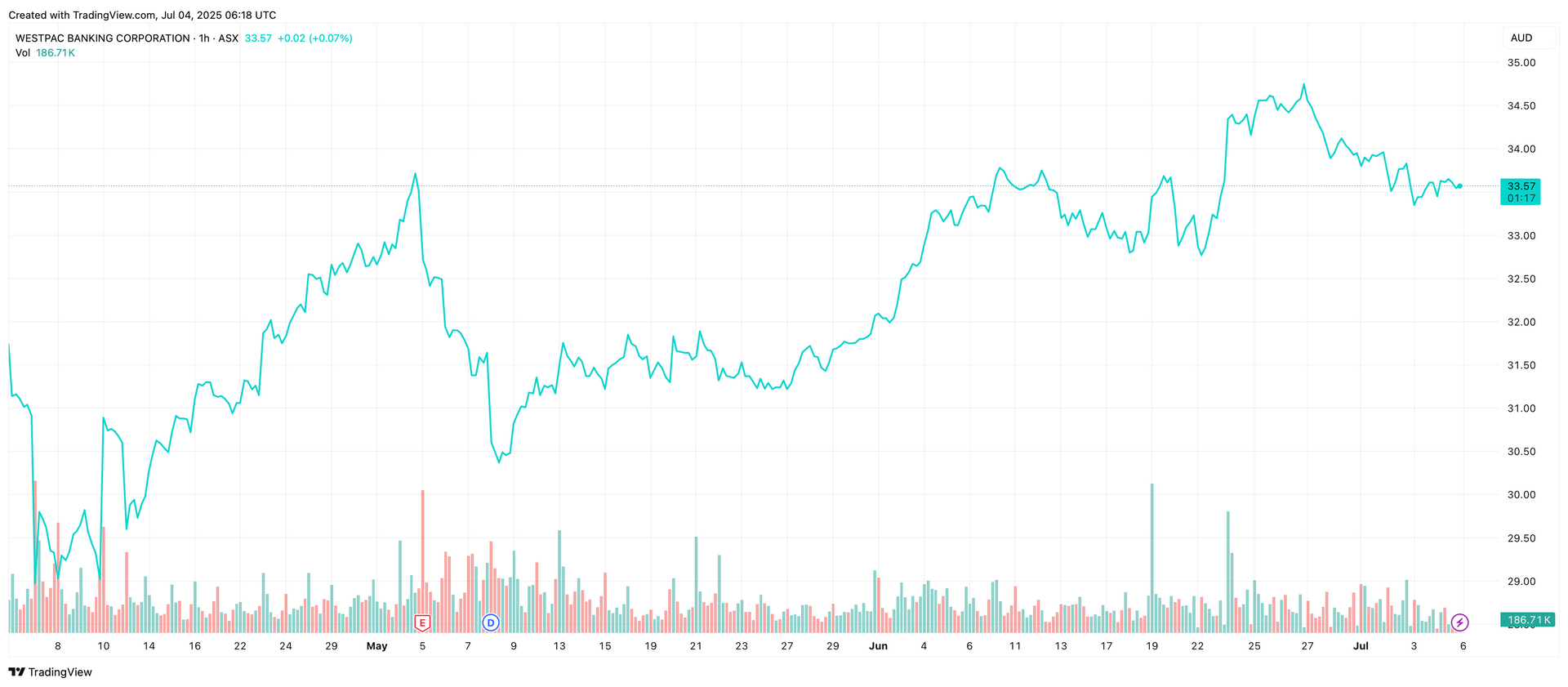

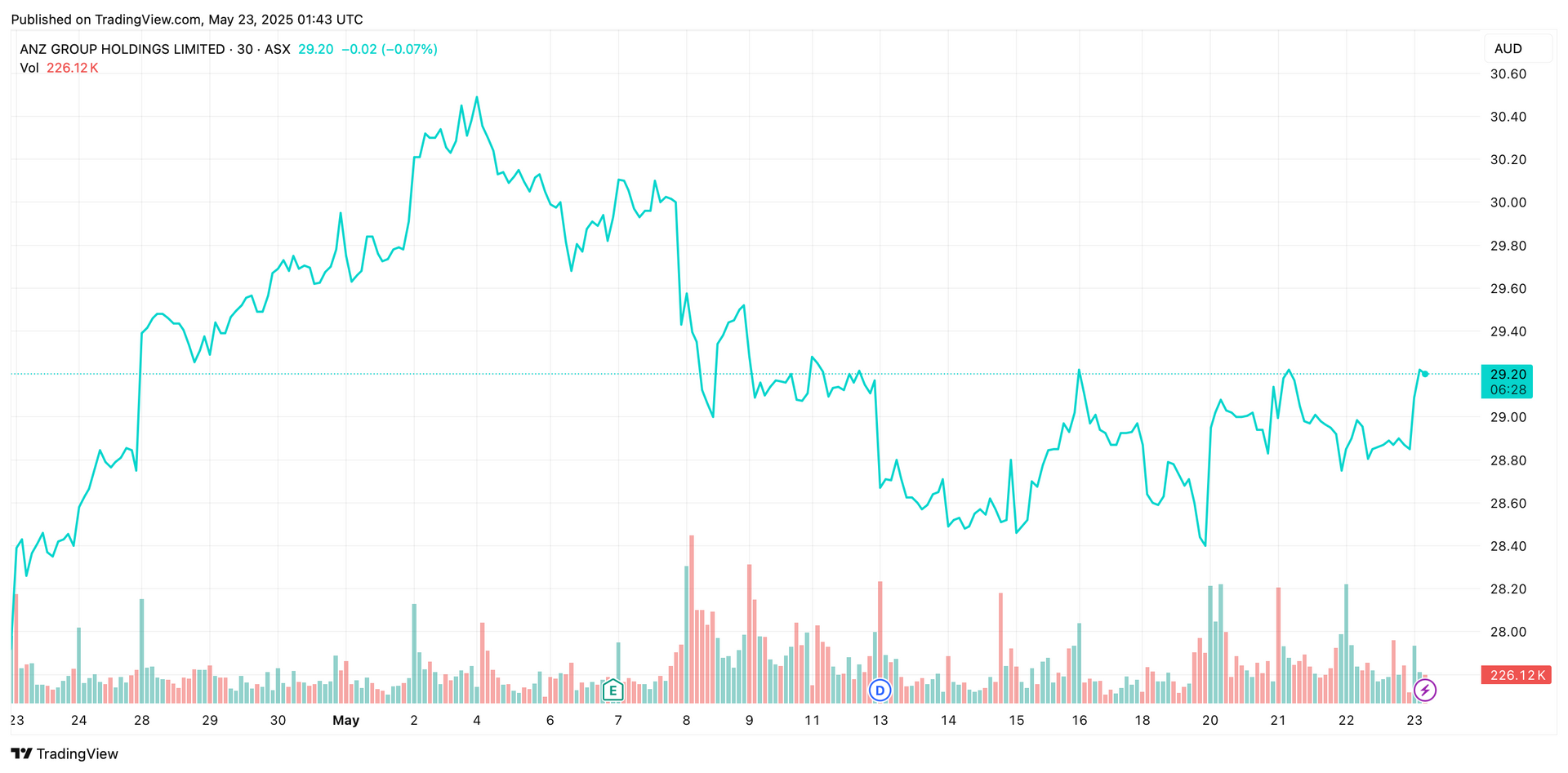

Price Performance

Growth Potential

- Global leader in invasive and non-invasive inhalation, nasal high flow therapy and during surgery.

- Strong global market position in a significantly under-penetrated treatment of sleep apnea market and chronic obstructive pulmonary disease.

- Increasing uptake of Nasal high-flow (NHF) therapy and consumables growth on the back of this.

- High barriers to entry in establishing global distribution channels.

- Strong R&D program ensuring new product releases and FPH remains ahead of competitors.

- Bolt-on acquisitions to supplement organic growth.

Key Risks

- Consolidation / normalization of sales post the COVID-19 driven demand.

- Disruptive technology leading to better patient compliance.

- Product recall leading to reputational damage.

- Competitive threats leading to market share loss.

- Disappointing growth (company and industry specific).

- Adverse currency movements.

- FPH needs to grow to maintain its high PE trading multiple. Therefore, any impact on growth may put pressure on FPH’s valuation.

Subscribe to our newsletter

Disclaimer: This article does not constitute financial advice nor a recommendation to invest in the securities listed. The information presented is intended to be of a factual nature only. Past performance is not a reliable indicator of future performance. As always, do your own research and consider seeking financial, legal and taxation advice before investing.