Stock Spotlight: CSL Limited (ASX:CSL) | Sharewise

CSL Limited is one of Australia’s most prominent healthcare investments that is a market-leader in the biotech and pharmaceutical industry. With a strong track record in innovation and global expansion, CSL ASX stock is widely considered a defensive, yet high-growth investment on the ASX.

For long-term investors, CSL Limited stock has consistently delivered shareholder returns, supported by steady revenue growth and reinvestment into cutting-edge research and acquisitions. Unlike many biotech firms that struggle with profitability, CSL’s share price has consistently maintained financial stability while expanding its global reach. Its leadership in medical advancements ensures that it remains at the forefront of the industry.

While CSL Limited has established itself as a strong investment, market conditions, valuation trends and portfolio diversification should be considered before making investment decisions. Understanding financial health, long-term growth potential, and how CSL share price on the ASX has performed over time can help investors determine if it aligns with their strategy.

About CSL Limited.

CSL Limited researches, develops, manufactures, markets, and distributes biopharmaceutical and vaccines in Australia, the United States, Germany, the United Kingdom, Switzerland, China, Hong Kong, and internationally. The company operates through CSL Behring, CSL Seqirus, and CSL Vifor segments. The CSL Behring segment offers plasma products, gene therapies, and recombinants. The CSL Seqirus segment provides influenza related products and pandemic services to governments. The CSL Vifor segment offers products in the therapeutic areas of iron deficiency and nephrology. The company also licenses CSL intellectual property. CSL Limited was founded in 1916 and is headquartered in Melbourne, Australia.

Source: Yahoo Finance

What Makes CSL Stocks A Strong Competitor In Biotech?

CSL Limited is a dominant player in the biotech and pharmaceutical industry that specialises in plasma-derived therapies, vaccines and nephrology treatments. With over a century of experience and a global footprint spanning more than 30 countries, CSL benefits from economies of scale, diversified revenue streams and deep expertise in life sciences.

The biotechnology sector is one of the most competitive and capital-intensive industries that requires companies to navigate complex regulatory environments, lengthy approval processes and significant R&D investment. When undertaking a CSL stock analysis, it’s vital to recognise the long-standing expertise and infrastructure that give it a strong advantage over new entrants. Key factors that reinforce its market dominance include:

- High barriers to entry: Decades of research, clinical trials and regulatory approvals make it challenging for competitors to develop similar therapies.

- Established supply chains: CSL has a global network of plasma collection centers and production facilities, ensuring stable product distribution.

- Massive scale and market cap: As one of the largest biotech firms globally, with a market cap consistently exceeding $100 billion, CSL has financial strength that allows for continuous innovation and expansion.

- Defensive investment appeal: The steady demand for healthcare products and institutional investor confidence have historically made CSL stocks more resilient during economic downturns.

CSL stocks maintain strong profit margins and robust cash flow provides it with significant reinvestment capacity. As opposed to many biotech firms that rely on speculative drug approvals, CSL’s well-diversified revenue base ensures long-term financial stability. Key elements of CSL’s financial strength include:

- Heavy reinvestment into R&D: CSL consistently allocates billions annually to research and development, keeping it ahead of competitors.

- Strategic acquisitions: Acquiring Vifor Pharma and other biotech firms has expanded CSL’s market reach and product range.

- Operational expansion: CSL regularly scales production facilities and invests in advanced manufacturing processes to maintain efficiency and meet growing demand.

- Consistent revenue streams: With income from plasma products, vaccines, and nephrology treatments, CSL is less reliant on a single breakthrough product for profitability.

CSL’s competitive edge also stems from its ability to outperform many ASX-listed biotech peers. Companies like Cochlear (ASX:COH) and ResMed (ASX:RMD) are highly specialised, focusing on hearing implants and sleep apnea devices, respectively. While these companies have seen success, CSL’s diverse portfolio of life-saving therapies and global reach reduces its exposure to single-product market risks. Additional factors that strengthen CSL’s stock chart include:

- Global brand recognition: CSL’s reputation in plasma therapy and vaccine development places it among the most trusted names in biotechnology.

- Pricing power and industry influence: Its established presence and market leadership allow CSL to set competitive pricing and negotiate strong supplier agreements.

- Greater research scope: CSL’s broad R&D pipeline spans multiple healthcare areas, reducing reliance on any single segment.

- Regulatory expertise: CSL has decades of experience navigating strict pharmaceutical regulations, giving it a compliance advantage over smaller biotech firms.

With a strong balance sheet, continued investment in cutting-edge treatments, and a proven ability to scale globally, the CSL company in Australia remains a compelling choice for investors seeking exposure to healthcare stocks.

Key Stats

Key Stats

Source: Yahoo Finance. Data as of 21/08/25.

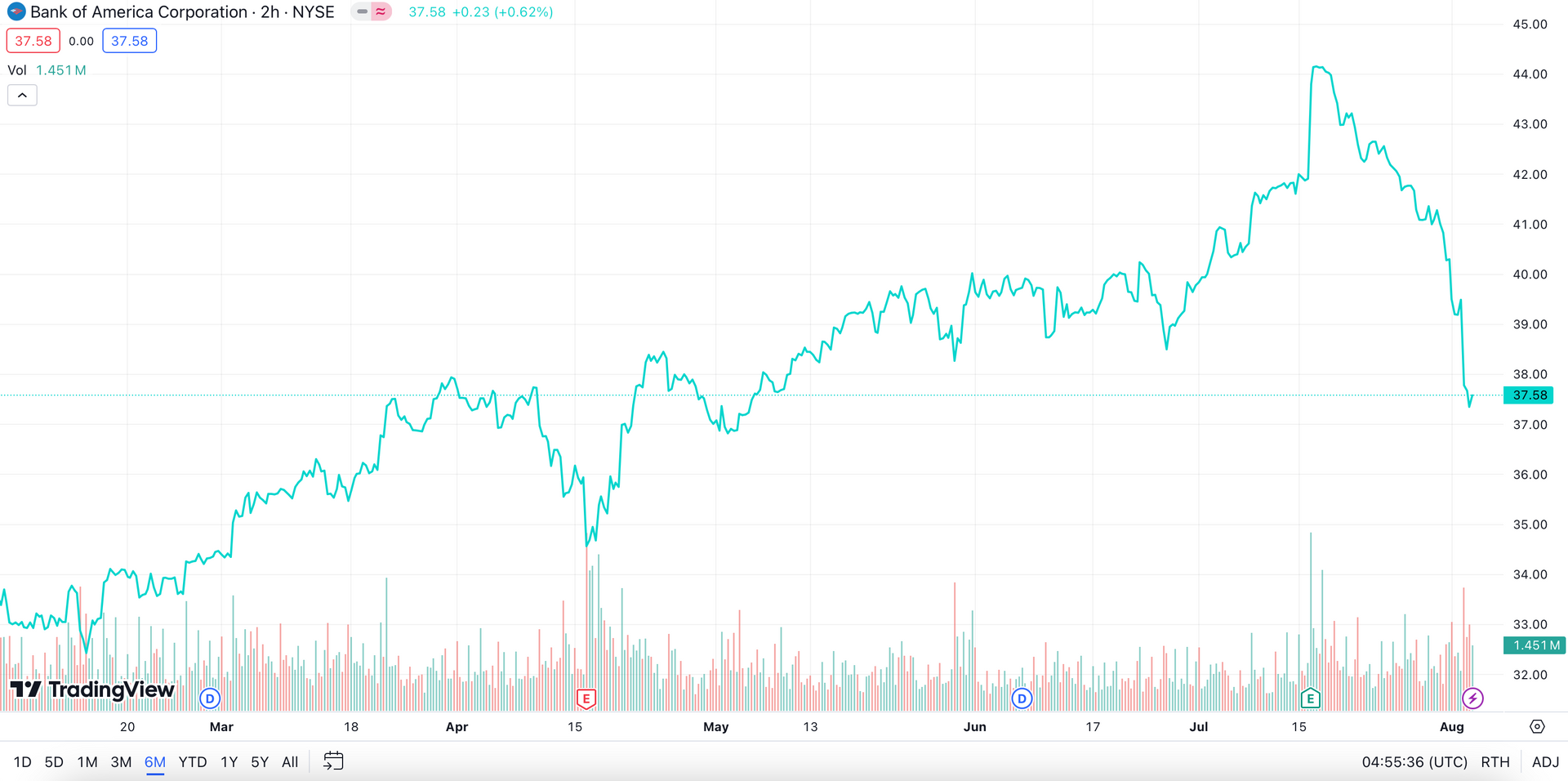

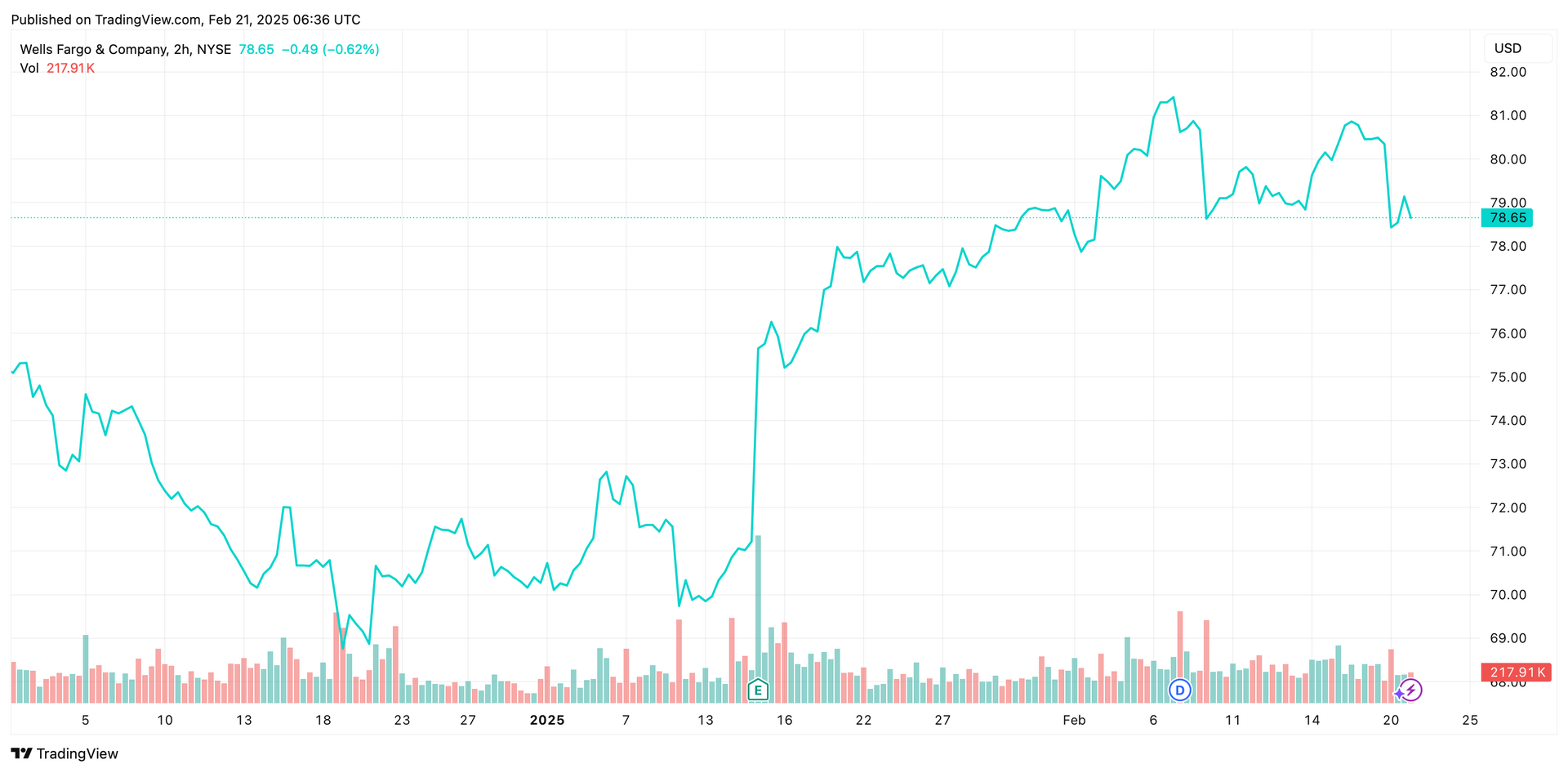

Price Performance

Growth Potential

- Our revised valuation is a blend of our DCF & PE-relative valuations.

- Given the near-term uncertainty, we believe CSL’s share price is likely to be range bound. The market is likely to grapple with what valuation multiples to apply to CSL, in our view.

- The core group earnings driver Behring remains a solid business, and we continue to forecast double digit earnings growth for the group over the medium term. However, this is not completely without risk.

- High barriers to entry in establishing expertise + global channels + operations/facilities/assets.

- Better results from the development & R&D pipeline – new product launches.

- Strong management team and operational capabilities.

- Strong balance sheet which could be used to deploy capital management initiatives.

Upcoming Innovations from CSL Limited

CSL Limited continues to drive innovation in the biotech and pharmaceutical industry by investing heavily in cutting-edge medical advancements across plasma-derived therapies, vaccines and specialty medicines. With a strong R&D focus and strategic acquisitions, CSL remains at the forefront of medical breakthroughs that shape the future of healthcare.

The company’s research and development pipeline targets high-growth therapeutic areas with significant market demand. The key innovation drivers that drive the CSL dividend include:

- CSL Behring: Expanding plasma-based therapies for rare and chronic diseases, reinforcing its leadership in immunoglobulin and hemophilia treatments.

- CSL Seqirus: Advancing next-generation flu vaccines, including mRNA-based solutions to enhance pandemic preparedness and seasonal influenza protection.

- CSL Vifor: Strengthening its iron deficiency and nephrology treatment pipeline, with a focus on addressing chronic kidney disease and associated conditions.

Beyond internal R&D, CSL’s innovation strategy includes strategic acquisitions and partnerships that accelerate the development of breakthrough treatments. The acquisition of the aforementioned Vifor Pharma has expanded CSL’s presence in renal and cardiovascular therapies, increasing its exposure to high-growth therapeutic areas. In addition, CSL has established collaborations with global biotech firms that focus on gene therapy, cell therapy and precision medicine to develop targeted treatments for complex diseases. The company is also investing heavily in next-generation biologics to leverage advanced manufacturing and research capabilities to address high unmet medical needs.

As demand for advanced biologics and immune-based treatments grows, CSL’s commitment to innovation supports long-term revenue growth and sustained competitive positioning. With its focus on biotechnology expansion and global healthcare advancements, CSL on the stock market is well-positioned to deliver cutting-edge medical solutions that drive shareholder value.

CSL Shareholder Returns & Investor Sentiment

CSL Limited has consistently rewarded long-term investors through substantial share price appreciation and regular dividend payments. Over the past two decades, the share price for CSL on ASX has significantly outperformed the broader local healthcare index.

CSL has maintained a strong commitment to shareholder returns through consistent dividend payments. In August 2024, the company announced a final dividend of $1.45 per share, an increase from $1.29 the previous year. This growth underscores CSL’s dedication to providing reliable income to investors while balancing reinvestment in research and acquisitions. While CSL’s dividend yield is relatively low compared to some other ASX stocks, its ability to steadily grow dividends highlights its financial strength and disciplined capital management.

Investor sentiment toward CSL remains strong, driven by its financial performance and strategic market positioning. For the first half of the 2025 fiscal year, CSL reported revenues of $8.48 billion, reflecting a 5% increase year-over-year, and net profit of $2.11 billion, also up 5%. While some divisions faced challenges, including a 9% revenue drop in Seqirus due to lower immunisation rates in the U.S., CSL’s diversified portfolio and strategic acquisitions—such as the Vifor Pharma acquisition—have reinforced its long-term growth potential.

Over the years, CSL’s sustained share price growth, dividend increases and ability to proactively navigate changing market conditions have made it an attractive option for long-term investors. With a track record of financial stability and strategic expansion, CSL stock forecast continues to offer compelling value to both institutional and retail investors.

Investment Tips for Buying CSL Limited (ASX:CSL) Stock

CSL Limited is widely regarded as a high-quality, long-term investment, but making informed decisions about when and how to buy is key to maximising returns. Investors should evaluate CSL’s valuation, potential risks and long-term growth prospects to determine the best approach for their portfolio.

CSL has historically traded at a premium valuation, reflecting its market leadership, strong earnings performance and expansive global presence across 30+ countries. Its P/E ratio has consistently remained above the ASX healthcare sector average, often ranging between 30x and 40x, with peaks exceeding 45x during periods of strong earnings growth.

The company’s net profit for FY2024 reached $2.11 billion, marking a 5% year-over-year increase, while its 10-year total return has surpassed 300%, significantly outperforming the broader ASX 200. Analysing historical CSL share price movements can help investors identify potential entry points, particularly during market pullbacks or sector-wide corrections. For long-term investors, dollar-cost averaging remains a practical approach to smooth out price volatility and reduce the impact of short-term fluctuations.

While CSL is a strong investment, there are key risks to consider before buying. Understanding these factors can help investors make more informed decisions and manage potential downside risks:

- Regulatory changes: Global healthcare regulations can affect drug approvals, pricing strategies, and reimbursement models, potentially impacting CSL’s revenue and profitability.

- Foreign exchange fluctuations: With a significant portion of revenue coming from USD and EUR markets, CSL’s earnings can be influenced by currency movements and exchange rate volatility.

- Plasma collection costs: As CSL relies heavily on plasma-derived therapies, rising collection and processing costs or supply constraints could increase operational expenses and impact margins.

For long-term investors, CSL can serve as a core healthcare holding within a diversified portfolio that offers exposure to a stable, high-growth industry. Reinvesting CSL’s consistent but relatively low-yield dividends can further enhance returns through compounding over time. Keeping an eye on R&D developments, regulatory approvals, and new product launches can provide valuable insights into CSL’s future revenue streams and market positioning, helping investors make informed decisions based on long-term potential rather than short-term fluctuations.

Key Risks

- Competitive pressures or growth disappoints (underperform company guidance).

- Product recall / core Behring business disappoints relative to expectations.

- Contract loss (e.g. Kcentra recently lost a substantial U.S. contract).

- Operating costs come in ahead of expectations (incl. elevated costs to support product launches). Further, cost out program fails to yield material benefits given the savings had to be reinvested back into the business.

- Adverse currency movements (AUD, EUR, USD).

Frequently Asked Questions.

What does CSL Limited do?

CSL Limited is a global biotech company specialising in plasma-based therapies, vaccines, and specialty medicines. It operates through three divisions: CSL Behring (plasma therapies for rare and chronic diseases), CSL Seqirus (influenza vaccines), and CSL Vifor (treatments for iron deficiency and nephrology).

Is CSL Limited a good long-term investment?

CSL has historically been a high-performing stock, consistently delivering strong shareholder returns through earnings growth and reinvestment into R&D. With a dominant market position, steady demand for healthcare products, and ongoing innovation, CSL remains a popular choice for long-term investors.

Does CSL Limited pay dividends?

Yes, but the CSL dividend yield is relatively low compared to other ASX-listed companies. The company prioritises reinvestment into research and acquisitions to drive long-term growth while still providing shareholders with stable, growing dividend payments.

What are the risks of investing in CSL stock?

Like any investment, CSL comes with risks. Key concerns include regulatory changes in healthcare markets, foreign exchange fluctuations, and rising plasma collection costs. Investors should also consider CSL’s premium valuation and potential market volatility before making investment decisions.

How can I buy CSL Limited (ASX:CSL) stock?

CSL stocks are listed on the Australian Securities Exchange (ASX) under the ticker ASX:CSL. Investors can purchase shares through an online brokerage platform, financial advisor, or full-service stockbroker.

Subscribe to our newsletter

Disclaimer: This article does not constitute financial advice nor a recommendation to invest in the securities listed. The information presented is intended to be of a factual nature only. Past performance is not a reliable indicator of future performance. As always, do your own research and consider seeking financial, legal and taxation advice before investing.