Stock Spotlight: PayPal Holdings Inc (NASDAQ:PYPL)

About PayPal Holdings Inc

PayPal Holdings, Inc. operates a technology platform that enables digital payments for merchants and consumers worldwide. It operates a two-sided network at scale that connects merchants and consumers that enables its customers to connect, transact, and send and receive payments through online and in person, as well as transfer and withdraw funds using various funding sources, such as bank accounts, PayPal or Venmo account balance, consumer credit products, credit and debit cards, and cryptocurrencies, as well as other stored value products, including gift cards and eligible rewards. The company provides payment solutions under the PayPal, PayPal Credit, Braintree, Venmo, Xoom, Zettle, Hyperwallet, Honey, and Paidy names. The company was founded in 1998 and is headquartered in San Jose, California.

Key Stats

Key Stats

Source: Yahoo Finance. Data as of 05/09/25.

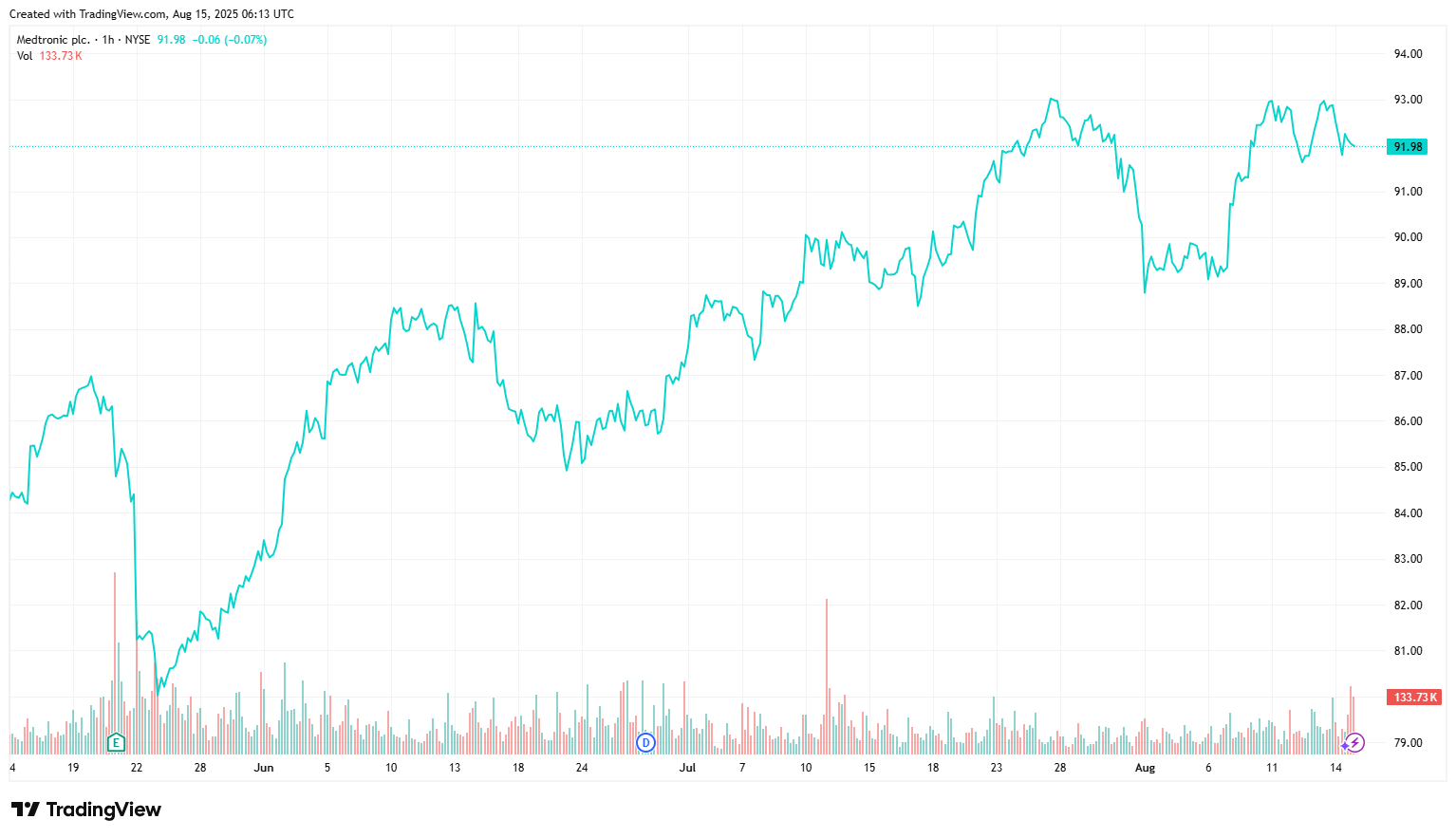

Price Performance

Growth Potential

- Leveraged to the structural growth story of electronics payments and e-commerce.

- Strong scale (438m active accounts) and network effects with the company’s dual-sided network (consumers + merchants) creating stickiness (merchants need PayPal because consumers use it and consumers keep PayPal because merchants accept it).

- Large untapped TAM (<20% penetrated in $125bn online payments revenue, <1% penetrated in $200bn offline payments revenue and <1% penetrated in $800bn ads/commerce/credit revenue).

- Upside from Venmo (>90m users in the U.S. with growing merchant acceptance giving a long runway for monetization with management targeting $2bn in Venmo revenue by FY27, growing at a low-teens CAGR) and Braintree (powers checkout for leading global merchants and though it is lower-margin today, the scale, data and merchant relationships can be leveraged for cross-selling higher-margin VAS).

- Margin expansion potential with New CEO Alex Chriss emphasizing goal to expand operating margin without compromising top-line growth by streamlining operations, trimming non-core initiatives and pushing automation/AI-driven cost reductions.

- Optionality in new growth areas with embedded finance, BNPL, crypto custody/payments and AI-driven fraud prevention potentially opening additional revenue streams.

Key Risks

- Deterioration in global macro conditions (impacting consumer spending/business activity) with geopolitical tensions impeding cross-border e-commerce transactions.

- Margin compression from shift in mix (Braintree growth is lower margin than core PayPal checkout).

- Pricing pressures from intensifying competition with Apple Pay, Google Pay, Block (Square + Cash App), Adyen, Stripe, Shopify Payments all aggressively competing for digital wallet and checkout dominance.

- Adverse FX movements, regulatory changes (governments’ data privacy/protection policies), and security and technology risks (including cyber-attacks).

- Value destructive acquisitions (though management has emphasized M&A as a secondary priority after investing in organic growth with M&A not being a major focus in the near term).

Subscribe to our newsletter

Disclaimer: This article does not constitute financial advice nor a recommendation to invest in the securities listed. The information presented is intended to be of a factual nature only. Past performance is not a reliable indicator of future performance. As always, do your own research and consider seeking financial, legal and taxation advice before investing.